This week's expected data deluge was a bust because many key reports were moved a week later, perhaps because of the Veterans Day holiday in the U.S. Markets in general were up as Fed speakers and Fed chair nominee Janet Yellen's confirmation testimony seemed to suggest that no one was in a great rush to taper bond purchases.

The inverse correlation between tapering prospects and stock market performance continues. Unless the U.S. economy falls apart, I strongly believe that tapering will begin sometime in the next seven months. However, the resulting increase in long-term interest rates is likely to be relatively small compared with the current 2.71% rate on the 10-year Treasury bond. That is especially true as inflation remains remarkably subdued and is pushing uncomfortably close to deflation. As highlighted later in this report, year-over-year inflation dipped to 0.7% in the eurozone for the month of October. The U.S. CPI report is due next week and that is expected to show no change month to month, and even the year-over-year data point looks like inflation will be up only 1.0%. Interest rates are usually a function of inflation plus a spread, and now the base rate seems to be lower than we all imagined just a few months ago.

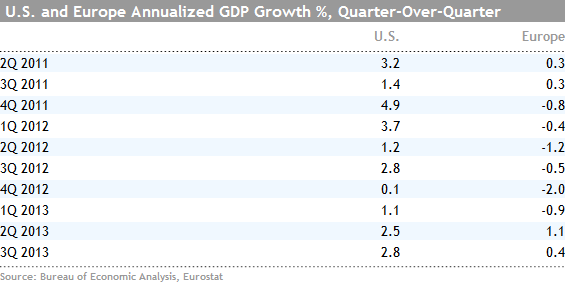

Other overseas news was not so good this week. Besides the scary-low inflation rate in Europe, GDP growth for the eurozone came in at just 0.4% quarter to quarter, annualized, which is how the U.S. data is reported. This compares to the 2.8% rate reported for the United States for the September quarter. Though this represents the second quarter of sequential improvement for Europe, the pitiful growth rate decelerated instead of accelerated from quarter to quarter.

Earnings news was nothing special, either. Overall S&P earnings growth for the third quarter is unlikely to better the 3% growth rate anticipated at the very end of the quarter, with most of the third-quarter data now in hand. Unfortunately, earnings season didn't approach the finish line on a high note. The weekly lowlights included poor reports in the retail sector, including ![]() Wal-Mart WMT,

Wal-Mart WMT, ![]() Kohl's KSS, and Nordstrom. On the other hand, Macy's numbers looked good, and even at the underachievers, trends were beginning to look a little better in October compared with a very slow summer and early fall. And then there was the

Kohl's KSS, and Nordstrom. On the other hand, Macy's numbers looked good, and even at the underachievers, trends were beginning to look a little better in October compared with a very slow summer and early fall. And then there was the ![]() Cisco CSCO, miss that caught everyone by surprise. Many companies, including Cisco, have been reporting softer sales in China, which also suggests that things are not perfect in that market.

Cisco CSCO, miss that caught everyone by surprise. Many companies, including Cisco, have been reporting softer sales in China, which also suggests that things are not perfect in that market.

U.S. economic data this week didn't tell us much that we didn't already know. The trade deficit turned out to be just a little higher than expected, as iPhone imports and softer exports of mining equipment caused a small miss. The only practical effect of the lower number is that the GDP report for the second quarter is likely to be revised down from 2.8% to 2.5%. On the upside, manufacturing industrial production continued to take small baby steps forward in the month of October, increasing 0.3%, driven by furniture, chemicals, printing, and paper.

Turning to the all-important consumer, weekly shopping centre data continues to show little to no improvement with growth rates stuck just above 2%. My guess is that all the uncertainty and health insurance cancellations resulting from the Affordable Care Act are weighing hard on consumer and small-business confidence and spending habits. Past government circus-like behaviour went largely ignored by consumers. However, health insurance cancellation notices and new network restrictions hit much closer to home. Finally, initial unemployment claims failed to make much progress.

European recovery slows, deflation now a real concern

The news out of Europe this week was not good, the eurozone showed quarter-to-quarter GDP growth of just 0.1% -- the way U.S. GDP is reported makes that number equivalent to 0.4% annualized. That is down over 1% from the annualized quarter-to-quarter growth in the June quarter.

The slowing seems to be due to weaker performance in Germany, which was previously doing well, and France, which hasn't been doing well. Some economies continued to show outright declines, including Greece and Italy. Even before these subpar results, the IMF was projecting growth of just 1% for all of 2014. It now looks probable that the growth rate might be cut to 0.50%-0.75% in future forecasts. I certainly don't believe that the improvement in 2014 will do much to move world growth rates or to aid U.S. growth; slower growth and low inflation won't do much to get Europe out of its ongoing debt issues, either.

The poor results have again brought cries for Germany to focus more on stimulating internal demand and less on exports. The German economy continues to run a huge trade surplus with $61 billion in the second quarter, or about 6% of GDP, while internal demand remains relatively weak. Many of those exports are going to other European countries that are currently struggling. Meanwhile, Germany isn't doing much to stimulate internal demand. The European Commission will probably open an investigation into Germany's surplus in the near future, according to several news reports this week, joining calls from the United States and the IMF to take some action, which is theoretically barred by the EU. The European Commission is also expected to put some pressure on France to reduce tax rates, which have hit that economy hard.

Eurozone inflation rates are nearing deflationary levels

The GDP news out of Europe prompted me to take a closer look at Europe's inflation rate. The news there is not good for debtors. Inflation increased a measly 0.7% for October. The trend has been down for some time, as shown in the table below.

The rate is well below the 2.0% target set by the ECB and certainly supports the ECB's recent decision to cut rates. Such low inflation rates are raising alarm bells around the world, especially seeing what happened to the Japanese economy once they tipped into deflation; Japan had almost no growth for a couple of decades. Though some might think lower prices are a good thing, they often cause consumers to postpone purchases in anticipation of even lower prices, slowing economic and employment growth. These are two things that Europe can ill afford at this time, with unemployment already at record highs, even in a supposed recovery. In addition, prices might go down but wages, not so much. Unfortunately that will mean even less willingness to hire workers, so less income and less spending. Not a pretty picture.

Export data a little soft

As I suspected last week, the trade deficit was wider than expected with an overall traded deficit of US$41.8 billion, compared with US$38.7 billion in the previous month. I wouldn't worry too much about the number, though, because it is very near the year-to-date average of US$40 billion, which is well below the 2012 YTD figure of US$45 billion. However, the data was far enough off of the government's estimate used in the GDP calculation that, with no other changes, the reported GDP figure for the third quarter will need to be revised down from 2.8% to 2.5%. I cautioned last week that both the GDP report, and the trade deficit portion in particular, were too good to be true.

Imports were a little higher than expected, driven largely by a huge jump in the cellular phone category that was probably due to the new iPhone 5c. Exports were softer than expected, mainly due to autos and capital goods and only partially offset by higher farm exports. Soybeans had a banner month, jumping more than a billion dollars from the previous month.

Looking at inflation-adjusted data, oil exports were way up and oil imports down meaningfully. That is all relatively old news now. Excluding petroleum prices, both import and export growth was well below long-term averages. The news was slightly better for countries exporting to the U.S., as imports continued to pick up from exceptionally weak levels this spring. On the other hand, export growth--ex-petroleum--remains very low and shows no clear trend.

News on exports to China are discouraging

The trade deficit with China continued to increase, moving to $30.6 billion for September from $29.5 billion the previous month. Perhaps further reports that China was beginning to favour local suppliers in many electronics categories, hurting U.S. and multinational suppliers, were more troubling than the raw numbers.

Our technology team at Morningstar has been talking about weak and worsening sales to China for a while. One of our software analysts, Norman Young, has been harping on this point for several months, even as public data seemed to be indicating improvements in China. Then yesterday, Cisco blamed a large portion of its sales and earnings shortfall on China. Some of that is indeed because growth in China is not as strong as many believe. However, apparently a portion of the weakness is due to China beginning to favor local suppliers over non-Chinese manufacturers. This is not a favourable trend and could end badly for us all. Let's hope that this issue doesn't get any worse.

Manufacturing industrial production figures continue to improve, but only modestly

Despite, the headline growth rate of negative 0.1% in overall industrial production, I was pleased with the industrial production report. The headline number was down, but largely due to a big fall in utility demand, which was more from weather than manufacturing activity. The manufacturing-only component of the report showed a healthy 0.3% monthly growth rate, and the year-over-year averaged manufacturing figure showed continued improvement and pushed over 3% for the first time since January. Although certainly not as strong as the purchasing manager's data suggested, manufacturing seems to be turning the corner yet again.

The improvement was notable because the normally strong auto sector was actually down 1.3% for the month of October. Aerospace was also soft. Though not included in manufacturing, mining also showed a relatively large decline as lower prices and more supply weighed on this heretofore strong sector. Our industrials team believes that at least some of the mining weakness was due to hurricane-related rig shutdowns, which should mean at least a small rebound next month.

Some housing-related categories, including furniture and appliances as well as wood, remained strong and did not falter. Normal laggards including paper, printing, and finally chemicals, all managed to show growth after months of declines. I was particularly glad that chemicals showed signs of life. I am surprised that it has taken this long for an improving economy and the lower cost of natural gas and oil to help this category, which is just about the largest one at 11%-plus of total industrial production. It is nice to see a changing of the guard, but I do worry about the normally strong categories losing some steam, which could show up in a bigger way in 2014.

Retail sales, housing, and inflation lead next week's parade of data

Some of the economic data I had expected this week got shifted to next week, putting a glut of data on tap. Retail sales, which I had expected this week, is the most important of the indicators and is now expected next week, although the analysis will not be clear-cut. We already know the auto component will be down, and gasoline stations are likely to be a detractor, too. Headline retail sales are expected to show no growth in October, and even excluding autos, expectations are for a meager 0.1% growth rate. I will be looking more closely at electronics (iPhones), furniture (summer homebuyers stocking their new homes), and restaurants (very short-term confidence indicator).

Deflation watch

Consensus estimates are calling for no increase in general prices as measured by the Consumer Price Index for October, driven at least partially by falling gasoline prices. Even X-ing out food and energy, prices are expected to be up just 0.2%. Besides the usual suspects, I will be taking a very close look at health-care expenses, which have been unusually tame over the past year.

Builder sentiment and existing home sales could shed light on housing market

We are now experiencing radio silence in the new-home construction market, as data collectors at the U.S. Census Bureau decided to combine the September and October data for new home sales and housing starts, leaving a huge stretch of time with no data at all.

The one reading we will have on the new home side is the Homebuilder Sentiment Index. This report is due on Monday, and the consensus is expecting little change from September's reading of 55. Homebuilders have been overly optimistic lately, but any weakness in the index, to be announced Monday, could spell real trouble for the housing market.

Turning to existing-home sales, economists continue to anticipate deterioration as the summer rush to beat higher mortgage rates ends. Collapsing pending-home sales data suggest a pretty nasty report. Consensus estimates expect existing-home sales to fall from 5.3 million annualized units to 5.1 million units. Even this could prove to be a little optimistic.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)