Note: This article is part of Morningstar's January 2016 Five keys to retirement investing special report.

In building a portfolio that's right for your needs and circumstances, picking which asset classes and how much to invest in each of them is an important step that you need to take before selecting specific funds or securities.

However, asset allocation is not something that you do only once. You need to review your asset mix regularly and make adjustments, especially in light of your future retirement, no matter how distant in the future that might be.

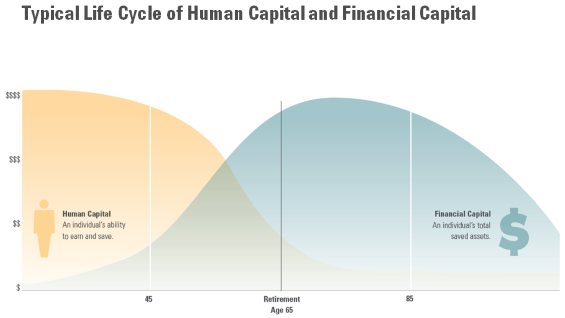

The primary reason for this is that your total wealth consists of more than just the money that you are investing. That money is sometimes called your financial capital. The other major component of your total wealth is what is known as your human capital, which is the present value of all of your future income from your work and all of the income that you will receive after you retire, such as payments from defined benefit plans and government plans like the Canada Pension Plan and Old Age Security.

As the chart below shows, both your human capital and financial capital change dramatically over the course of your life. When you enter the work force, you may have very little financial capital but a very large amount of human capital, since you have many years ahead of you in which you will be earning income. As time passes, future earnings decline, and so does your human capital. But if you save regularly, you are building up your financial capital as your human capital declines. Eventually, you will retire and start spending your financial capital, thus running it down. (You still have some human capital after you retire in the form of guaranteed lifetime benefits.)

© 2016 Morningstar, Inc.

This pattern of falling human capital and increasing financial capital before retirement should have a large impact on your asset-allocation decision for your financial capital over this period of your life. The main considerations should be:

- The size of your financial capital relative to your human capital;

- The riskiness of your human capital;

- Your risk tolerance.

The size of your financial capital relative to your human capital is important because the larger it is, the greater the impact your asset-allocation decisions will have on the amount and variability of your total wealth. Also, for most people, as financial capital grows, your capacity for risk declines. This is because for most people, future earnings are fairly predictable, thus making human capital bond-like. So at the beginning of your career, when financial capital is very low relative to human capital, your capacity for risk is higher. Consequently you can have a high allocation to stocks.

But as your human capital declines and your financial capital increases, your capacity for risk declines. To maintain a consistent level of risk on your total wealth, you need to gradually reallocate your financial portfolio from stocks to bonds. This pattern of declining equity allocation before retirement is known as a glide path.

A glide path makes sense if human capital is largely bond-like. However, the human capital of some people is more stock-like. For example, while a tenured university professor's human capital is like a bond, an entrepreneur whose earnings fluctuate with the health of the economy has stock-like human capital. So while the professor has a very high capacity for stock-market risk, the entrepreneur should probably invest more heavily in bonds.

However, for the last several years, bond yields have been at historical lows. From a total-wealth perspective, this means that human capital is greater than it would be under normal conditions. This is because human capital is the present value of future income. So when interest rates are low, the appropriate discount rates for calculating present values are low, leading to higher present values.

To the extent that your human capital is bond-like, it will be higher under today's low interest rates than in past years. This means that you have greater risk capacity and thus can invest more in equities than you would have been able to under normal interest rates. But keep in mind that an increase in interest rates will lower your human capital and reduce your risk capacity.

Low interest rates make all bonds less attractive, but especially longer-term bonds, since they are more interest-rate sensitive. This means that, to the extent that you invest in bonds, you may want to emphasize shorter maturities.

Finally, you need to consider your risk tolerance, and apply it your total-wealth portfolio. The reason that we hold risky portfolios is that if we keep them sufficiently diversified, we expect to be rewarded with higher long-term returns. Based on your risk tolerance, you should strike a balance between risk and expected return. In doing so, however, you should take into account the riskiness of your human capital.

Forming a glide path

There are various approaches you can take to forming a glide path, some of which make more sense than others. One of the oldest guidelines is the 100-minus-age rule. Under this rule, you invest 100 minus your age in stocks. So if you are 40 years old, you invest 60% of your financial capital in stocks. If you have a higher risk tolerance than what is implied by this rule, just increase the number that you subtract from, to say 110.

The Canadian fund industry, through target-date funds [link to article], offers investors a packaged approach to reducing equity exposure over time. These funds contain the target year of retirement in their names, such as 2020, 2025, 2030, etc. Today, the funds that go the furthest out into the future have a target retirement year of 2055.

The advantage of target-date funds is that they follow their glide paths automatically. The disadvantage is that, since they are one-size-fits-all solutions; the specific characteristics of your human capital and your personal risk tolerance are not taken into account. Furthermore, the glide paths of the various target-date fund families differ from each other quite a bit, so you need to take a look at them to decide which one might work well for you.

In principle, the best glide path involves taking into account your personal preferences and needs each year, both before and after your retirement. In this way, your glide path is not only customized, but also is not predetermined. You won't need to commit to a particular glide path ahead of time. Instead, if you have bond-like human capital, you will naturally shift to more conservative asset allocations as you approach retirement.

.jpg)