Editor's note: This article is part of Morningstar's ETF week.

Exchange-traded funds that employ strategic-beta indexes are a small but rapidly growing portion of the Canadian equity market, according to a recently released global research paper by Morningstar.

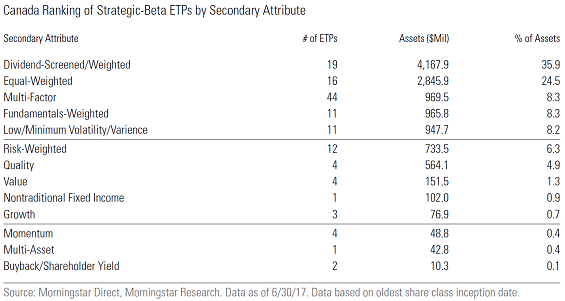

As measured by assets, the most popular types of strategic-beta ETFs in Canada are those that screen or weight equities according to their dividend payouts. The next largest sub-group are equal-weighted strategies. As measured by new launches, multi-factor strategies were the most numerous during the 12-month period studied.

Released in September, the research paper -- A Global Guide to Strategic-Beta Exchange-Traded Products -- reported that as of June 30 of this year, there were 1,320 strategic-beta exchange-traded products worldwide, with collective assets under management of approximately US$707 billion. (All figures cited in this article from the Morningstar study are as of June 30, with dollar amounts expressed in U.S. currency.)

The paper reports that the pace of new strategic-beta fund launches in Canada picked up over the 12 months ended June 30. Thirty-six new ETFs hit the market, just under one-third of the Canadian industry total of 110 new launches, up sharply from 13 during the previous 12-month period. In the first half of 2017, 19 new strategic-beta funds were launched, compared with 25 for the full 2016 calendar year. That brought this year's mid-year total of Canadian-listed strategic-beta funds to 132. Assets invested in these funds grew to US$11.6 billion at June 30, up from US$9 billion a year earlier, a 30% increase. All but six of them are focused exclusively on equities.

At the end of June 2017, strategic-beta funds accounted for 11.5% of all Canadian ETF assets, up from only 2.7% a decade earlier. They also represent a higher portion of the number of ETFs, since the typical strategic-beta fund is smaller than the average one in the Canadian universe.

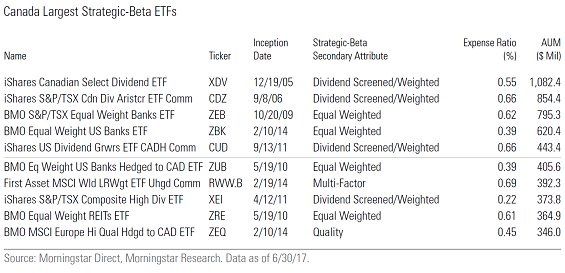

The research paper identified dividend-focused ETFs as being the largest subgroup of Canadian strategic-beta funds, representing nearly 36% of the group's total assets at mid-year. Investors poured an additional US$413 million into dividend-focused strategic-beta funds over the 12 months ended in June 2017. The two largest of this genre, and the largest among all strategic-beta funds, are iShares Canadian Select Dividend (XDV) and iShares S&P/TSX Canadian Dividend Aristocrats (CDZ).

Equal-weighted strategies, the second-largest subgroup, is dominated by BMO ETFs. "Many of these are individual sector funds, where equal-weighting may be an appealing way to improve diversification across individual stocks." As of June 30, the two largest of this kind were BMO S&P/TSX Equal Weight Banks (ZEB) and BMO Equal Weight US Banks (ZBK).

Though a distant third in strategic-beta assets in Canada, multi-factor strategies were the most numerous, with 44 such funds at the end of June. "This subgroup encompasses an eclectic mix of funds ranging from complex strategies, like iShares Edge MSCI Multifactor USA (XFS), which resemble active quant funds, to simpler strategies that focus on two factors, like PowerShares S&P 500 High Dividend Low Volatility Index (UHD.U)," the research paper said.

In attracting new money, the most popular strategic-beta fund over the past 12 months was First Asset MSCI World Risk Weighted (Unhedged) (RWW.B), which attracted US$363 million in net inflows. "This fund offers broad exposure to large- and mid-cap stocks listed in developed markets, but gives larger weightings to stocks with lower volatility," the paper said. "As such, it should appeal to more risk-averse investors."

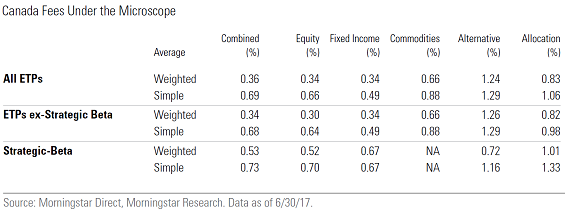

As for fees, Morningstar researchers found that, on average, strategic-beta funds were slightly more expensive than the broader universe, "but they were within striking distance." The paper cautioned that the management fees of some strategic-beta funds "have crept up near the bottom end of the range where many active managers sit -- a difficult place for an index fund to be."

The simple averages are distorted by higher-cost advisor-class shares, which tack on to the management fee an additional fee as an ongoing sales commission paid to brokers, the paper said. Excluding these share classes, management-expense ratios averaged 0.64% on an equal-weighted basis. "This figure matches the equal-weighted MERs of non-strategic-beta offerings."

However, Canadian investors can build diversified equity portfolios of conventional market-weighted index ETFs whose management fees are much lower than average. These include U.S. equity ETFs with management fees of 0.10%, and Canadian equity ones whose fees are half that or even lower. In his 2016 article, Strategic-beta ETFs: Wisdom or madness?, Morningstar Canada's research director Paul Kaplan concluded: "An investment in any strategic beta ETF is a bet that the strategy will outperform the market portfolio by at least the difference in the expense ratios of the ETF in question and that of a low-cost market-index ETF."

Some Canadian ETF providers are able to achieve cost savings by copying strategies launched in the U.S. by parent or affiliated companies. As examples, the Morningstar paper cites PowerShares FTSE RAFI US Fundamental (PXU.F), WisdomTree U.S. Quality Dividend Growth (DGR) and iShares Edge MSCI Minimum Volatility Global (XMW). "But there are some distinctive local strategies, such as Mackenzie Maximum Diversification Canada Index (MKC)," the paper adds. "This fund attempts to construct the best-diversified portfolio of Canadian stocks under a set of constraints to improve risk-adjusted performance."

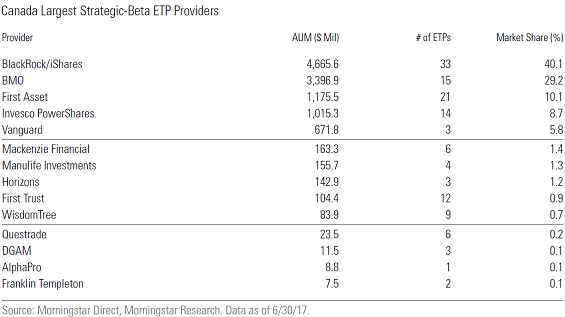

On the basis of Morningstar's definition, iShares sponsor BlackRock Asset Management Canada Ltd. (40.1% market share) and BMO Asset Management Inc. (29.2%) were by far the biggest strategic-beta ETP providers at June 30. Next were by First Asset Investment Management Inc. (10.1%) and PowerShares sponsor Invesco Canada Ltd. 8.7%). The remaining 10 providers of strategic-beta funds combined for only a 12% market share.

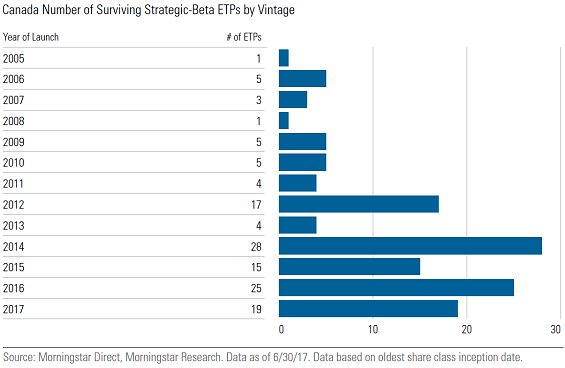

Though the world's first ETF was launched in Canada on the Toronto Stock Exchange in April 1990, more than a quarter of a century go, strategic-beta ETFs are historically a more recent development. Most have short performance histories, the Morningstar paper said. It noted that of the 132 Canadian strategic-beta funds on the market at the end of June, 87 were launched after 2013. The first in Canada was iShares Canadian Select Dividend, launched in December 2005. By 2011, not counting funds that were launched but did not survive, there were still only four.

If anything, the Morningstar paper understates the current appetite among Canadian investors for quantitatively driven strategies that seek to outperform conventional indexes whose constituent holdings are weighted according to market capitalization.

The paper notes that its tally excludes funds that do not meet Morningstar's definition of strategic beta. Prominent exclusions include BMO's low-volatility and dividend strategies, and RBC's quantitative ETFs. "While these are rules-based strategies, they do not track an index, so Morningstar considers them to be actively managed," the paper says. If included, these ETFs would have added another US$4.4 billion to BMO's asset count and US$460 million to RBC's.