After launching a raft of strategic-beta ETFs in recent years, Canadian asset managers slowed the pace over the 12 months to the end of September 2016. The number of such offerings rose by seven to 96 (excluding multiple share classes of a single ETF).

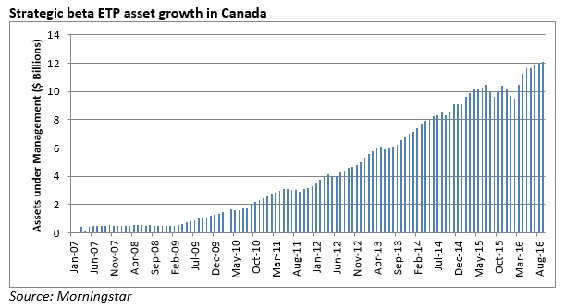

Assets rose at a brisk pace, increasing 26% from $9.6 billion to $12.1 billion, compared with 15% over the prior 12-month period. Weak stock market performance, especially in Canada, meant inflows drove growth. Indeed, approximately $1.5 billion flowed into strategic-beta ETFs over the period. Overall, strategic-beta ETFs' share of the nearly $107 billion ETF market held steady at 11%.

While strategic-beta's share of the overall market changed little over the past year, it's up from 7.5% five years ago thanks to strong investor interest. Over the period, these assets rose $9 billion, $5.7 billion of which stemmed from inflows. In all, strategic-beta assets rose 31% annually over the period, modestly higher than the 21% growth rate for ETFs overall.

These numbers likely understate Canadian adoption of strategic-beta ETFs. With some strategic-beta flavours (such as non-traditional fixed-income and commodities) being nonexistent or in short supply at home, Canadian investors can turn to U.S.-listed ETFs to gain access to these strategies. We don't know the exact dollar value, though, or the extent to which Canadians choose strategic-beta strategies listed south of the border.

A flight to dividend income, safety

ETFs that use dividends in their screening or weighting process remain the largest subcategory of the Canadian strategic-beta universe at more than 39% of the assets. Thirsty for yield, investors have piled into ETFs with methodologies geared toward high dividend yields, with Vanguard FTSE Canadian High Dividend Yield (VDY) and iShares Core S&P/TSX High Dividend Yield (XEI) growing at healthy clips. Assets at iShares S&P/TSX Canadian Dividend Aristocrats (CDZ), which targets firms with histories of dividend growth, remained flat, but strong performance helped push up its U.S.-focused counterpart, iShares U.S. Dividend Growers (CAD-Hedged) (CUD). In the three months following its April 2016 inception, new offering Horizons Canadian High Dividend (HXH) took in $100 million -- more than any fund in its strategic-beta subgroup over the previous year.

Canadian investors have been seeking not just income but also relative safety. Low/minimum volatility ETFs brought in slightly larger sums ($382 million) than their dividend- screened/weighted counterparts. Overall, this subgroup's share of strategic-beta assets rose to 10.3% in September 2016, up from 5.7% a year earlier. PowerShares S&P/TSX Composite Low Volatility (TLV) and Powershares S&P 500 Low Volatility (CAD-Hedged) Index (ULV) were investors' low-volatility favourites. The suite of iShares EDGE offerings soaked up what PowerShares did not, as investors used funds like iShares EDGE MSCI Min Vol EAFE Index (XMI) for foreign-equity exposure.

As investors turned toward strong-performing low-volatility strategies, they moved away from fundamentally weighted ETFs, whose value-oriented strategies have struggled in recent years. The subgroup's share of strategic-beta assets declined to 10.2% in September 2016 from 16% a year earlier.

Multifactor funds enjoyed the biggest market share gain. The subcategory barely registered in June 2015, with a 0.3% market share. A year later, it stands at more than 9%. Echoing investors' embrace of risk-conscious volatility strategies, nearly half of the $219 million in new money that flowed into multifactor funds went into First Asset's suite of risk-weighted ETFs. (These ETFs screen for both size and volatility.) Another $109 million flowed into iShares EDGE multifactor ETFs, which look to home in on the value, momentum, quality and size factors.

The market share of equal-weighted ETFs, the second-largest strategic-beta subcategory, held steady. This group is dominated by BMO sector funds such as BMO S&P/TSX Equal Weight Banks (ZEB) and BMO Equal Weight U.S. Banks (ZBK), which have had tepid growth.

| Strategic beta ETFs by screening/weighting strategy | |||||

| # of ETFs | Assets ($ million) |

% of assets | |||

|

|||||

|

|||||

| Dividend Screened/Weighted | 14 | 4732.3 | 39.1 | ||

| Equal Weighted | 16 | 2852.2 | 23.6 | ||

| Low/Minimum Volatility/Variance | 11 | 1250.3 | 10.3 | ||

| Fundamental | 11 | 1232.1 | 10.2 | ||

| Multi-Factor | 26 | 1100.2 | 9.1 | ||

| Quality | 4 | 467.3 | 3.9 | ||

| Non-Traditional Fixed Income | 1 | 149.5 | 1.2 | ||

| Value | 4 | 118.8 | 1.0 | ||

| Growth | 3 | 92.6 | 0.8 | ||

| Momentum | 4 | 52.9 | 0.4 | ||

| Multi-Asset | 1 | 50.3 | 0.4 | ||

| Risk-Weighted | 1 | 14.0 | 0.1 | ||

|

|||||

| Source: Morningstar | |||||

|

|||||

iShares holds steady; BMO, Invesco, Vanguard gain ground

Six of eight Canadian providers of strategic-beta ETFs enjoyed asset growth in the 12-month period. While competition has eroded iShares' one-time dominance, the firm remains the biggest strategic-beta player, with a 47% market share. Rival BMO is still a distant second, though it gained the largest slice of inflows over the 12-month period. BMO's strength partly owes to one of its biggest customers: itself. BMO MSCI Europe High Quality (Hedged to CAD) (ZEQ) saw its assets rise on the back of investments from in-house funds of funds like BMO Tactical Global Growth.

Despite Invesco PowerShares' struggling fundamental-index offerings, investors' embrace of low-volatility ETFs boosted the PowerShares unit to 10% from 8% of strategic-beta assets. Vanguard continued to make inroads in the strategic-beta arena; its three Canada-domiciled dividend-screened strategies helped raise its market share to over 5% of strategic-beta assets, up from 3% the year before.

| Largest strategic beta ETF providers | |||||

| Provider | # of ETFs | Assets ($Million) |

Market share (%) |

||

|

|||||

|

|||||

| iShares | 28 | 5,731.24 | 47.3 | ||

| BMO | 13 | 3,277.86 | 27.1 | ||

| Invesco | 12 | 1,165.42 | 9.6 | ||

| First Asset | 18 | 1,057.94 | 8.7 | ||

| Vanguard | 3 | 618.85 | 5.1 | ||

| Horizons | 4 | 134.96 | 1.1 | ||

| First Trust | 12 | 109.06 | 0.9 | ||

| Questrade | 6 | 17.08 | 0.1 | ||

|

|||||

| Source: Morningstar | |||||

|

|||||

It is worth noting our tally doesn't include BMO's low-volatility and dividend strategies as well as RBC's quantitative ETFs, most of which focus on dividends. These funds follow rules-based strategies, but because they do not track published public benchmarks, Morningstar considers those ETFs actively managed. If included, they would add another $3.1 billion to BMO's strategic-beta asset pile and $1.1 billion to RBC's.