For investors, there are fewer more nerve-wracking moments than deciding how to invest a big cash windfall, the kind that might come from the sale of a business, an inheritance, or a hefty bonus. The instinct among many individual investors is often to gravitate toward dollar-cost averaging, or DCA.

Investing a little at a time has become conventional wisdom, thanks in part to confusing the process of investing through defined contribution plans, such as pension plans in the US, with dollar-cost averaging. (Defined contribution plans actually do not involve dollar-cost average because they fully invest funds as soon as they become available from a person’s pay).

It has also been pounded into investors’ heads that it is folly to try to pick a bottom or top to markets – so why make a big bet on the market by putting all that money into the market at once? Isn’t it smarter to invest it all gradually? What investors don’t realise is that they are, in fact, making a market call by not making a lump sum investment. They’re betting that the stock market will go down for a while, and then come back up later. In the process, they’re adding more uncertainty to their portfolio planning.

In their paper, “Dollar-Cost Averaging: Truth and Fiction,” Morningstar’s Maciej Kowara and Paul Kaplan tackle the myths around lump sum investing, or LSI, versus DCA.

They show that historically, DCA has produced lower long-term returns than LSI. At the same time, the returns from DCA are more uncertain than the results from LSI – when it comes to meeting an investment goal, this could mean greater risk.

Does DCA make you wealthier?

Deciding to invest a lump sum into the markets is easily accompanied by a parallel fear: “What if the market crashes tomorrow?” Or next week? Or even next year? The reality is that nobody knows what the market will do tomorrow, next week, or next year.

The expectation that the market could crash next week is no more based on evidence than the idea that stocks could rally 10 per cent next week. What’s more important is to look at the maths of DCA versus LSI. On average, DCA does not make you wealthier.

When the market’s expected return is positive, delaying parts of your assets' entry into the market means giving up the gains (on average) that could have been gotten with the money that was sitting on the sidelines. This point is illustrated by the record of the US large-cap market with data going back to 1926.

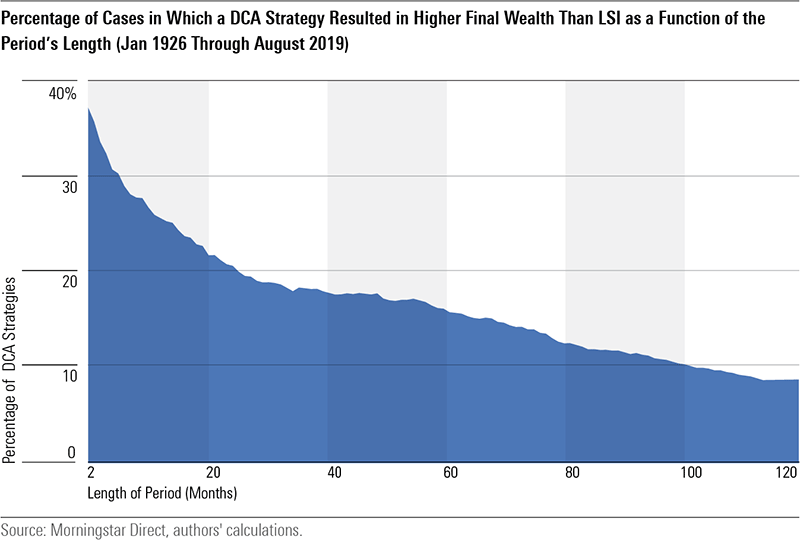

Kowara and Kaplan calculated the results of LSI over all two-, three-, four-, up to 120- month periods and compare them against the final wealth achieved by spreading out the total investment into monthly segments over those periods. They then calculated the percentage of cases in which DCA resulted in more wealth than LSI for each time span.

The results: When you look over the average 10-year time frame, nine out of 10 times, an investor who dribbled money into the market would have ended up with less money than if they had simply put all their money into the markets at the beginning.

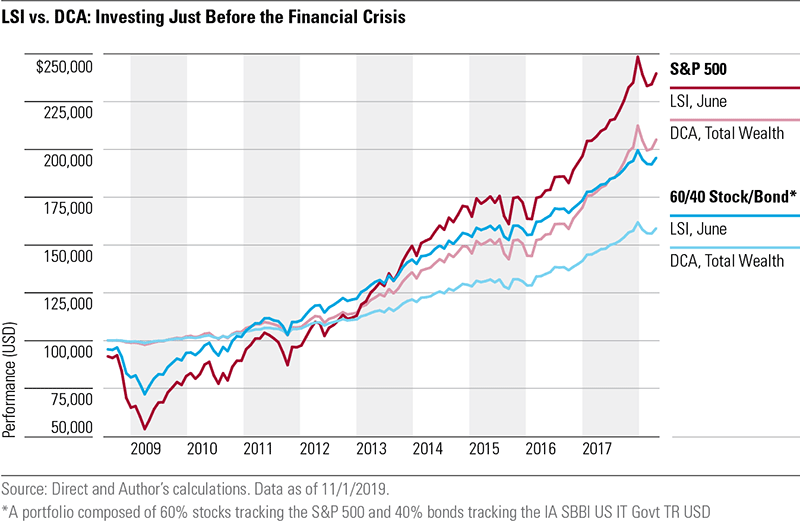

Although this may run counter to the conventional wisdom about DCA, the logic is easy to find: in a market that goes up, as US large-cap stocks have done over the past 100 or so years, the longer you delay your dollars’ entry into the market, the more likely you are to miss the gains that could have been gotten. Of course, long-term averages hide the bumps. What if an investor were handed a $100,000 check in June 2008, just as the global financial crisis was about to break out? Wouldn’t it be better to have done DCA then, and captured the lower prices? Even in 2008, LSI would have been the better choice.

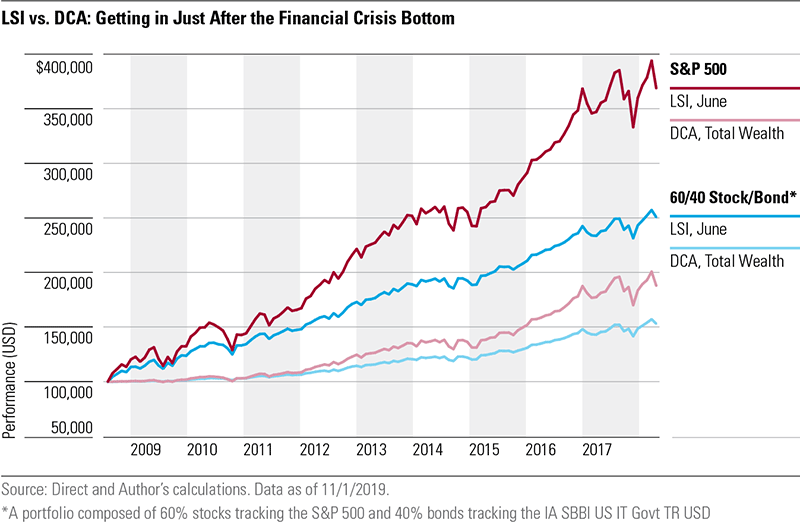

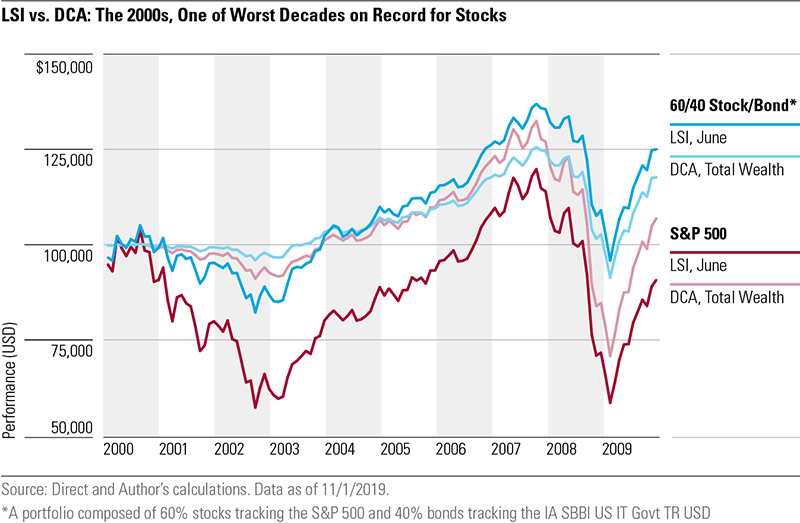

In the following illustrations, Kowara and Kaplan show both the results from a stocks-only portfolio and from a 60/40 balanced portfolio of the S&P 500 and bonds, as represented by the intermediate term US government index from the Ibbotson Stock, Bonds, Bills, and Inflation series.

Despite the massive haircut taken to the investment in 2008, it isn’t hard to understand the reason for the outperformance of the LSI approach: since hitting bottom in early 2009, the US stock market has been in in an uninterrupted bull market ever since.

And because the bear market happened early in the time frame, that investor had more time to recover and had more money in the market at the bottom than the DCA investor. What about investors who got a windfall in June 2009, but – shell-shocked from the financial crisis meltdown – dribbled in their money, instead of putting it to work all at once? They would have been left far behind by the bull market in stocks.

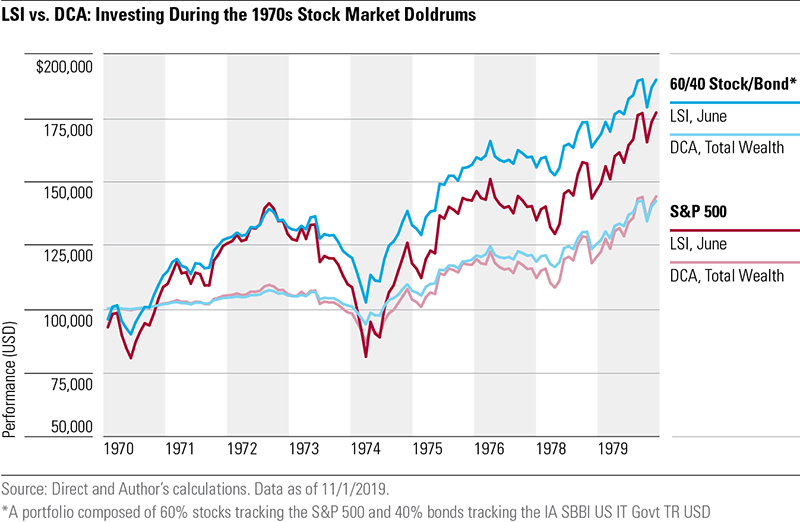

Of course, the stock market doesn’t always rebound strongly from a sell-off. What if stocks bounce back and forth, but over a long period of time, essentially go nowhere? Here things get a little less clear-cut. Perhaps the most famous example of a stock market going nowhere was the 1970s. In a US economy beset by “stagflation” (slow growth, high unemployment) and high interest rates, equities struggled throughout the decade. Still, in this case, there was enough upward movement that a fully invested portfolio, whether stock-only or 60/40, outperformed the DCA strategy (by 23 per cent in the case of the stock-only portfolio, and by 33 per cent in the case of the 60/40 portfolio).

However, it was a different story in the decade of the 2000s. With two bear markets in a 10-year stretch, the S&P 500 was down on an annual basis during this decade. In this environment, DCA would have won out for the stocks-only portfolio, essentially because the stock market was down over that long-term time frame, an unusual occurrence. However, the 60/40 portfolio still benefited from the LSI strategy, outperforming the DCA approach by 6 per cent.

Does DCA reduce risk?

This question of whether DCA reduces risk is harder to answer because it calls for comparing the riskiness of a strategy that is fully invested from the get-go, against a strategy that gradually builds up its exposure to the market.

Intuitively, it may seem that putting all of an investment into the market once is riskier than doing so gradually. But when it comes to the variability of investor outcomes, it is actually LSI that presents a lower risk profile.

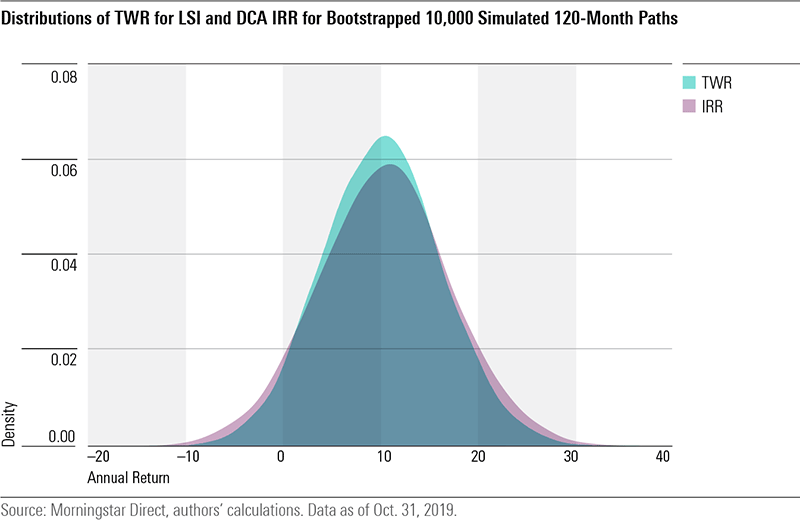

To arrive at this result, Kowara and Kaplan use the portfolios’ internal rate of return, or IRR, as the calculation for measuring performance. The IRR considers both the timing and magnitude of the flows involved.

The IRR can thus be meaningfully compared with the more-familiar performance measure of time-weighted return, or TWR, which is another name for total return.

On average, the IRRs and TWRs between DCA and LSI for the stock portfolio turn out to be nearly equal. But IRRs show a greater level of variability, as seen in the above exhibit, which shows that the distribution of IRR spreads out further than it does for TWR. Viewed in the way that Kowara and Kaplan have presented it, with the uncertainty of IRRs as the metric by which to gauge the riskiness of a DCA program, DCA appears inherently riskier than LSI. One can easily earn an IRR that exceeds TWR. One can just as easily underperform. In addition, the variation of IRRs is higher than the variation of TWRs.

To put it in plain English: with DCA, it's more uncertain how good or bad an investment will turn out to be.

Conclusion

The fundamental problem with DCA is that it is a market-timing strategy. Holding money back and then investing it later only makes sense if investors believe that the prices of the securities they are planning to buy will fall for a while and then eventually rise.

As it is unlikely that many investors are making such forecasts, most investors should not be following a DCA strategy.