Editor's note: Read the latest on how the coronavirus is rattling the markets and what you can do to navigate it.

The effects of the COVID-19 pandemic on consumers are so wide-reaching that one way to describe the resulting post-pandemic marketplace at this point could be: money problems, and a new obsession with tech.

“Covid-19 is one of those rare events in history – like the Great Depression and fall of the Berlin Wall that will completely reshape geopolitics, societies, and markets,” read a recent Bank of America Global Research piece, discussing “tectonic” economic shifts, social unrest and a war over data.

For all investors, there are new risks to navigate. Let’s start with the big picture.

Pandemic puzzle makes money problems

Broadly speaking, the dominant risk for the economy is a potentially long wait for consumers to perform purchases. Today they’re navigating a maze of protective measures, starting with testing. “Considering the utter importance of diagnostic testing to help the U.S. begin resuming economic activity in a manner that minimizes the prospect of increases in infection, we remain concerned about national testing capacity meeting necessary levels both in terms of volume and accuracy,” says healthcare sector strategist, Karen Andersen, CFA, projecting consumer visits to nonessential businesses will still be down by around 30% at the end of the year.

Vaccine progress is still preliminary. And on treatments, Gilead’s remdesivir is promising but as Next Edge Bio-Tech Plus Fund’s Eden Rahim notes, it only addresses one stage of many that comprise the virus’s attack. We need different drugs to target different phases of the infection cycle.

Until the entire pandemic puzzle is solved, regulators are tending to economies on pause. And there’s a possibility that by holding back the financial floodgates in the way they have, a vastly new economic landscape will emerge.

Potential path to universal income?

“In Canada, we’ve never seen this amount of public involvement,” says CIBC’s Deputy Chief Economist, Benjamin Tal. “These huge programs normally take three to five years – this time it was like five minutes,” he adds, referring to major stimulus initiatives such as the Canada Emergency Response Benefit (CERB).

Tal says these programs have the potential to stick. “They’ll be difficult to remove and could form possible fundamentals for U.B.I. [universal basic income].” What happens then could look similar to the way it did around the time of the Spanish Flu. “There was a narrowing of the income gap, and the government taxed capital. It’s not unthinkable,” he added.

Whether Canadian investors will see a rise in capital gains taxes will also depend on how they handle their debt levels. “Elevated levels of debt carried by Canadian households will work to amplify the negative shock to incomes seen from job losses,” reads a CIBC report written by Benjamin Tal and Katherine Judge this month.

Housing, energy, both in pain

Another Canadian economic weakspot is the housing market. We’ve been waiting on a clear signal since the crisis began. The deep freeze in the market suggests that on the supply side we also have slowing housing starts in the coming quarters, which usually have held up in past recessions, Tal and Judge noted. Real estate investors on this ride to the new equilibrium will also want to watch out for a possible trend of cancellations from developers anticipating discounts or opportunities elsewhere post-pandemic.

And then there’s the energy sector. We’ve got multi-year pain in energy that hinges on a cure, says Kurt Reiman, Chief Canadian Investment Strategist at BlackRock. “In the near term, people will be avoiding public transit, which could be a positive for oil prices [as investors take more private alternatives]. In the longer term, however, there will be more remote working.”

“Every crisis is a trend accelerator,” Tal says. And for the changes happening locally, there are international trends such as ‘decentralization’, particularly in the technology sector that we have been watching balloon in Canada these past few months.

Tech to the rescue

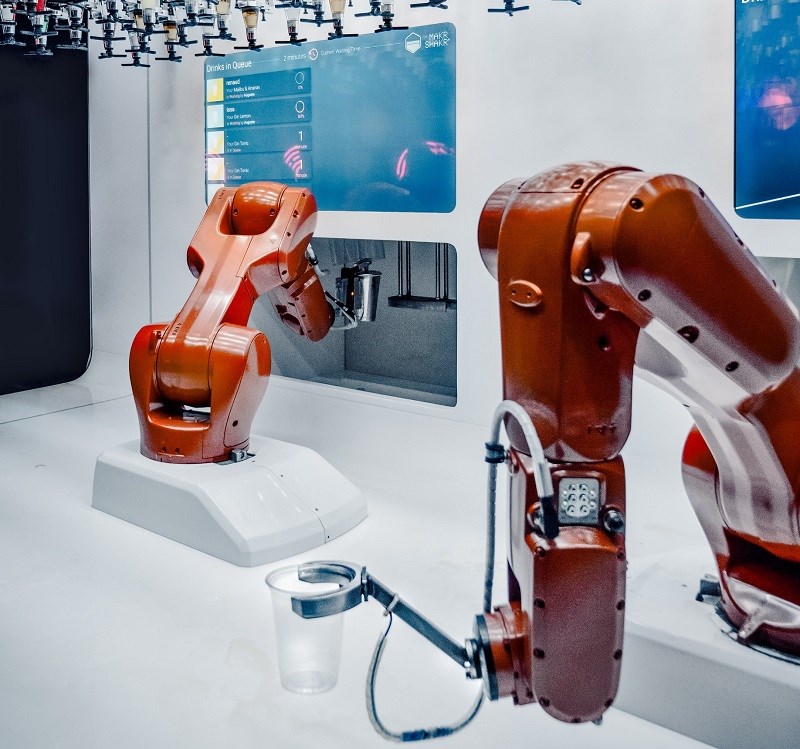

“The pandemic has been a trend accelerant to themes in both negative and positive,” says Kurt Reiman, Chief Canadian Investment Strategist at BlackRock. “It’s been an odd time. We’re stuck at home baking bread and on Zoom calls. Our relationship with technology has changed.”

It’s been reflected in the markets with select stocks experiencing exponential growth and the sector as a whole ballooning. As of May 21st, the S&P 500 is back to October 2019 levels. For the Nasdaq, it’s like the crisis never happened.

“Semi-conductors, cloud names, I just opened up a stamps.com account – but not all of it has been permanently accelerated. When growth is scarce, people gravitate towards winners,” Reiman says, cautioning that some of the pharma names are experiencing short-term benefits from vaccines which are essentially their lifeline.

But overall Reiman isn’t seeing the unrealistic valuations in the tech sector that he used to. “What’s the saying, ‘what you know that just ain’t so will hurt you’ – like growth without earnings. Today I don’t see it,” says Reiman, adding that for some names there are “no obvious wrong assumptions.” It’s the value sector that is going through a tough time and reevaluations he adds.

There wasn’t the same kind of government relief in the tech sector, there’s been consistency, and there’s been dividend growth which is useful in a low interest rate environment, adds Reiman, “Technology may no longer be a nice-to-have, but instead a must-have.”

Still be selective

Investors should consider how the benefits to tech from the coronavirus were distributed. “With accelerants around search engines, social media, e-commerce and biotech, the TSX didn’t come up with much.”

“Shopify briefly dethroned RBC to become the largest publicly traded Canadian company, making up 5.5% of the total S&P/TSX Composite Index (TSX) market cap and over 60% of the tech sector,” says Reiman, noting that while the U.S. is also susceptible to a handful of names taking up large concentrations, he sees the wider sector as a source of quality and good management.

Lastly, tech will also have its own woes to watch out for. On Amazon (AMZN), strategist R.J. Hottovy says “we also expect coronavirus-related changes in consumer behaviour will have a lasting impact on the industry and drive near-term operating volatility,” citing regulatory, postal service and strong competition among many risks that could crop up in the post-pandemic world.

Capture new opportunities in technology

Learn about the Morningstar Exponential Technologies Index here

.jpg)