Bond yield panic, lingering lockdowns, tech sector valuation fear, uncertainty and doubt have caused tectonic shifts in stock prices since the beginning of the year, leaving an interesting assortment of expensive stocks Canada. The 5 most expensive feature an oil and gas company, the maker of Ski-Doos, and our favourite printed t-shirt company joining perennially expensive Shopify. And then there’s BlackBerry and the whole GameStop saga.

Here’s the list:

|

Name |

Price/Fair Value |

Moat Rating |

|

Tourmaline Oil Corp (TOU) |

1.76 |

None |

|

BRP Inc (DOO) |

1.71 |

Narrow |

|

Shopify Inc A (SHOP) |

1.66 |

Narrow |

|

BlackBerry Ltd (BB) |

1.57 |

None |

|

Gildan Activewear Inc (GIL) |

1.53 |

None |

Source: Morningstar Direct, as of March 24, 2021

The Most Expensive

“No-moat Tourmaline Oil’s fourth-quarter results fell short of our expectations,” says senior equity analyst Joe Gemino on Tourmaline Oil Corp (TOU) after recent results that don’t compel a raise in fair value that currently sits 76% below the current market rate for the stock. “Despite the sequential improvement, cash flow missed our expectations as a result of lower-than-expected gas pricing, higher operating and transportation expenses, and higher-than-expected capital expenditures,” added Gemino.

We see Tourmaline with enough resources to support around 15 years of production, and the company’s been able to replace production with additional resources, but it might not be enough. “Tourmaline will need to increase its resource base to supplant its production levels, resulting in an unfavourable economic structure,” adds Gemino.

The Great Outdoors

With more people working from home, time outdoors has become an increasingly important source of recreation and escape from reality. And investors have recognized a reputable recreational equipment provider – a bit too much. From the depths of the crisis last March, BRP’s stock price (DOO) soared nearly 400% - and today lands around 70% above our fair value.

BRP is one of only two stocks on the list with an economic moat thanks to its brand. But this brand needs to face off against bigger brands like Polaris and Honda in the snowmobile and ATV space, and they have deeper pockets for advertising and promotional spending, notes senior equity analyst Jaime M. Katz. She adds, however, that the company has the right priorities to help take on the competition, including a focus on market share growth, lean operations and cultivating an engaged workforce.

UPDATE: On March 30, 2021, we raised our fair value estimate for BRP to CAD 84 from CAD 59 after adjusting our outlook for the business. The stock still sits in two-star territory.

Online Shop’s Too Hot

Shopify (SHOP)’s been one of Canada’s most expensive stocks for a while – but it’s come down the price list a bit with a slow start to the year. The company’s year-to-date performance is flat after a rough tech-sector sell-off.

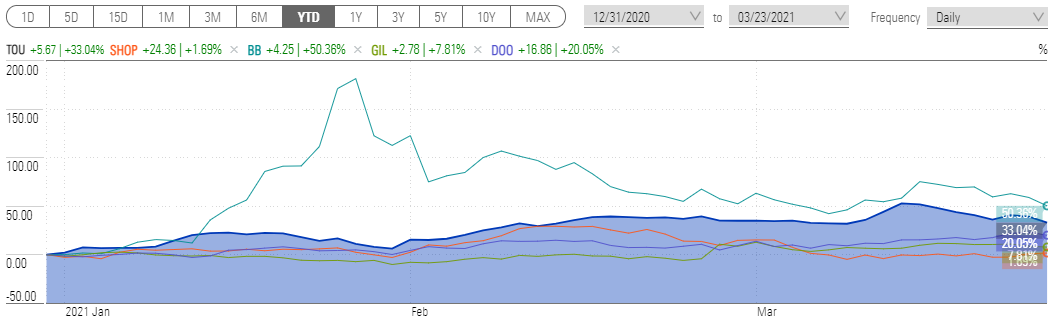

2021 Year-to-Date Performance - Canada’s 5 Most Expensive Stocks

Source: Morningstar Direct, as of March 24, 2021

After recent red days, we still see shares of Shopify as overvalued – by about 66% - but we see why investors are excited. “Gross merchandise volume, is surging, and upsells into merchant solutions, particularly payments, continue to drive results,” says equity analyst Dan Romanoff, “Shopify continues to benefit (way more than the Street anticipated) from lockdowns that have forced consumers online, which we see as an acceleration of a secular trend.”

We recently raised our fair value estimates for Shopify to $880 from $657/share, but there’s a lot of optimism around growth embedded in the current market rate.

BlackBerry or BlockBuster?

After rising from the ashes with security solutions that focus on the company’s forte in areas like data encryption, shares of BlackBerry (BB) went stratospheric with the help of nostalgic Redditors - and prices haven’t fully come down yet.

We see shares overvalued by about 57% as we still need the reinvented company to prove it can grow organically as a software company. “BlackBerry faces risk from being a relatively small and unproven new entrant into its key markets. Customers that are highly risk-averse might opt to go with a more established competitor for an end-to-end solution, especially when money is tight,” says analyst William Kerwin.

BlackBerry is still involved in smartphones through licensing agreements that allow the use of the name and brand, but Kerwin notes that the company’s reputation is a double-edged sword. “While in periods of economic growth, its name recognition might help to attract customers, in downturns, customers might steer clear of a name they associate with a sharp drop-off from a leadership position in the smartphone market in the early 2010s.”

T-Shirt King – De-Throned?

Gildan is the ubiquitous brand for printed t-shirts with an 80% share in the printwear basics market. But the market is temporarily impacted by the pandemic right now and underwear is where it’s at – and Hanesbrand and Fruit of the Loom have taken the lead. Gildan began a private-label brand with Wal-Mart in 2019 but it’s been so successful that it largely replaced its Gildan-branded underwear sales. “We believe Gildan has suffered market share losses to private-label brands, especially in socks, as its annual hosiery and underwear sales have declined by over $200 million over the past three years,” says equity analyst David Swartz.

We think Gildan benefits from a strong supply chain that includes company-owned factories abroad and unlike rivals, hundreds of millions invested in yarn-spinning factories in the U.S. that reduce costs. With the stock trading at a 53% premium to our fair value, we remind investors to consider whether these processes can be replicated by competitors and how cost savings are often lost to lower prices.

Are You Getting The Right Returns?

Get our free equity indexes to benchmark your portfolio here