See more Stock of the Week episodes here

American cannabis pure-play, Green Thumb Industries (GTII) is riding the wave of state legalizations with faster top-line and profit growth than we expected. Let’s see how it’s doing it and what to look forward to.

Similar to fellow U.S. cannabis giant, Curaleaf (CURA), fourth-quarter results were a little weaker than the 3rd quarter’s sequential growth. But investors would be mistaken to see this as weakness. The company was still up 13% sequentially and it increased its EBITDA by 23%. We’ve increased our fair value estimates to $62 per share, up from $40 per share. We still expect continued, massive growth in Illinois, and we think Green Thumb is positioned well for potential legalization in Connecticut, New York and Pennsylvania after New Jersey’s decision to legalize.

Pay-to-Play or Plain Lobbying?

The speedy growth and state licenses that Green Thumb is gathering have garnered attention from investors – and, according to the Chicago Tribune, federal investigators for possible pay-to-play violations. With little detail and no official confirmations, it’s difficult to make an assessment, but there are some doubts.

“It’s particularly hard to believe it would be pay-to-play as the issuances of licenses are a competitive process run by commissions, not politicians,” says sector director Kristoffer Inton, adding that he can’t really see how lobbying for legalization would be pay-to-play, as it opens the door for everybody, including the competition.

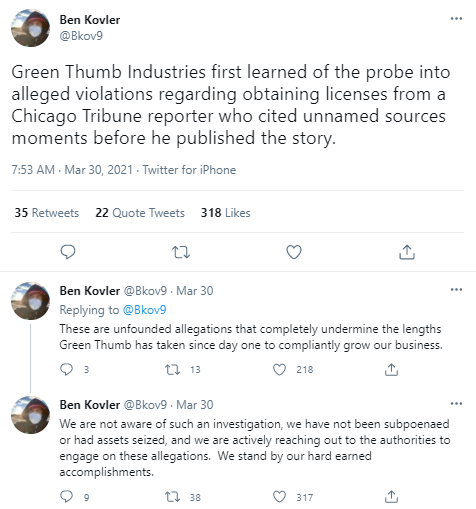

The CEO of Green Thumb, Ben Kovler seemed surprised by the allegations:

Kovler refers to today’s cannabis industry as the end of Prohibition 2.0, says Inton. He also notes that Kovler has a 26% economic stake in the firm and holds nearly 59% of the voting power. “As a large shareholder, he is incentivized to maximize long-term company performance.”

Until we know whether this is lobbying and political donations as usual, or something else, we’re focused on the fundamental facts that remain highly compelling: 12 states, 13 production facilities, 51 stores, 97 retail licenses, and six brands. And a lot of strategy.

How Does the Green Thumb Grow?

Green Thumb has a clever way of picking states to enter. “Its growth strategy focuses on states with large populations and limited licenses, including Illinois, Massachusetts, New York, Florida, and Ohio,” says Inton. “It strategically operates in states with robust medical cannabis markets with momentum around future recreational legalization. Two of its large markets, Illinois and Massachusetts, have already legalized recreational use,” he adds.

“In states with more mature cannabis markets, such as Colorado and California, Green Thumb believes there are enough cultivators available and purchases cannabis from third parties,” says Inton. “This helps reduce capital intensity for expansion without sacrificing exposure to widening legalization.”

Green Thumb’s state-picking prowess helps make up for the disadvantage of not operating internationally. “We think it would need to open cultivation internationally if it wants to compete in the global medical cannabis market - an unlikely event until federal laws are changed,” says Inton.

Lots of U.S. Upside Left

For the missed international opportunities, the U.S. still has the highest potential and offers the fastest growth of any market.

“Eventually, we expect federal law will be changed to allow states to choose the legality of cannabis within their borders,” says Inton forecasting nearly 25% average annual growth for the U.S. recreational market and more than 10% for the medical market through 2030.

Want to invest in Cannabis 2.0?

Learn about the companies most ready to grow in our latest Observer here