The pace of new special purpose acquisition company (SPAC) deals may seemed to have slowed in the second quarter of 2021, but we believe SPACs are here to stay.

Pitchbook data has seen 13 SPACs tracked so far closing between April 1 – April 15, 2021, as against 316 for Q1 2021.

For a larger image of the table, click here.

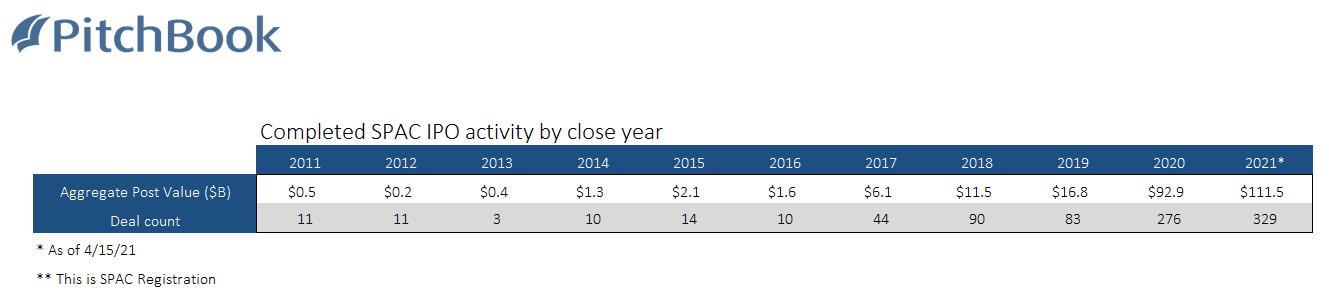

“The unprecedented uptick in SPAC IPO volume in 2020 and the first quarter of 2021 has created a dedicated pool of more than $200 billion to invest in privately-owned companies—and that figure does not even include the private investments in public equity (PIPEs) that accompany many of these acquisitions. While we saw a few indicators of waning enthusiasm for SPACs near the end of 2020 with a handful of downsized SPAC IPOs, this development looks to be just a blip. SPAC IPO activity exploded in 2021, with aggregate capital raised already surpassing the total in 2020 by 19.8% in just over one quarter,” said a recent Pitchbook report. Pitchbook is a Morningstar company.

Pitchbook finds that since the beginning of 2020, 118 SPACs have closed on an acquisition, representing over $120 billion of value that is now public. And there are signs of more deals are on the way. “Even with this explosion in activity, these ‘de-SPAC’ deals still lag the pace of new SPAC IPOs, confirming that there remains a multitude of SPACs still actively looking for a target,” the report notes. The de-SPAC process is similar to a public company merger. The transaction involves the merging of the private target company with the publicly listed SPAC.

For a larger image of the table, click here.

The report finds that SPACs are becoming more aggressive in finding deals quickly, with the median time between SPAC IPO and completion of reverse merger for SPACs raised in 2020 falling significantly to 0.64 of a year (or around 7.5 months).

“The multitude of SPACs will also start to have some side effects,” the report notes, “Competition for attractive targets will only intensify over the next few quarters as multiple SPACs compete for a deal but also butt heads with private investors that are looking to invest in late-stage growth rounds or middle-market buyouts. We see SPACs as a financing tool, similar to an IPO, which means it has the ability to fuel bubbles but is not itself a bubble.”

Slowdown in Q2

Though there may be a lot of sponsor interest in creating and listing new SPACs, there needs to be matching public market investor demand. Recent developments regarding the SEC’s treatment of SPACs seem to have already strangled new SPAC IPOs over the first few weeks of April, which may possibly hamstring the market in the near future.

“This seems to be a response to SEC guidance given to accounting firms about the treatment of warrants, specifically classifying them as a liability rather than equity on the SPAC’s financial statements. The main issue seems to be that the changes in the warrants’ fair market value would now flow through as accounting earnings for the SPAC, complicating the once-simple SPAC financial statements. However, without a concrete rule, it is tough to tell if this revision will apply to all SPAC warrants or if there will continue to be ways to maintain the status quo,” says Pitchbook analyst Cameron Stanfill.

“We think retaining warrants in the SPAC structure will likely just require wording changes on the warrant agreements,” the report says, “The regulator is reportedly working to understand the product better and slowing down new issuance until it comes to a final decision. Outside the immediacy of the warrants, there is also existing demand from investors for growth opportunities amid the low-interest rate environment, which SPACs have been able to satisfy. We believe this incentive is particularly relevant to retail investor interest in the space, as this group is mainly shut out of the private markets and even IPO allocations, especially for the most in-demand deals.”

Rumours of SPAC Demise Greatly Exaggerated

Stanfill does not think that this is the end of SPACs. “As it stands now, we believe SPACs still fill a gap in the market, will adapt to any changes, and remain a primary option for companies looking to go public. In our past research, we have analyzed individual SPACs and more qualitative market dynamics underlying the popularization of the strategy,” Stanfill says.

He expects sponsors to adjust as necessary and for new SPACs to continue to list with warrants. “However, given the pure number of SPACs in the market, we believe new SPAC IPO issuance will likely cool off over the next few months, as sponsors turn to completing deals with their active SPACs rather than raising new pools of capital until more clarity is available,” he notes.

SPACs will Come Back

Pitchbook believes that for now, SPAC sponsors still have an incentive to raise more SPACs while the market is receptive and hungry for growth given the clear economic benefits to these sponsors. However, given the pure number of SPACs in the market, we believe new SPAC IPO issuance will likely cool off over the next few months, as sponsors turn to completing deals with their active SPACs rather than raising new pools of capital until more clarity is available.

Stanfill feels there are still multitudes of capable firms or individuals that have not yet raised a SPAC, which may support some sustained new activity.

“From the public investor side, we do not anticipate a drop in demand unless there is an external shock to the system such as broader public equity weakness, rising interest rates, or a change in SEC treatment of SPACs that materially distorts the incentives, “ says the report, “If SPACs run out of fitting targets for the strategy, we might see more SPACs dissolve and return capital to shareholders, which may also cool demand for new SPAC IPOs, but the only losers in that situation would be a handful of SPAC sponsors.”

The $200 billion-plus raised by SPACs in the past 15 months and the 24-month clock on these vehicles may make SPACs more likely to cause sharp expansion of valuation multiples in specific markets that fit the SPAC model, such as those we have witnessed with select businesses in the electric vehicle space, the report says, “SPACs are highly incentivized to find an acquisition, but shareholders can accept and validate these deals by utilizing their redemption rights, thereby creating a system of checks and balances. While there may be some valuation dislocations as this amount of capital flows through the market, we expect that SPACs will remain a liquidity option for many private companies given they fill a current gap in the landscape created by the arduous traditional IPO process.”

The SPAC process is not perfect and comes with trade-offs for businesses pursuing this route to the public markets and for investors trying to gain access to exciting opportunities. One thing is certain: This vehicle represents innovation in the IPO process, which we are always enthusiastic to witness.

Four Reasons to Be Careful

We’re happy to see more options and better access for investors, but that doesn’t mean it’s time to dive in. As always, we guide caution.

First, you do not know in advance the acquisition target. You’re taking a bet on the founder of the SPAC. Retail investors rarely have insight into the minds of the founders, and can only make bets based on public perception. This is a risk.

Second, even if the founder has a target in mind, the SPAC might not be able to close the deal. If this is the case, and you get your money back a few years after the initial investment, that is an opportunity cost. An opportunity cost is what you lose in gains you could have potentially made, had you not invested in the SPAC.

Third, as Stanfill’s note on fees to investment banks shows, there’s a lot of people making a lot of money from SPACs – and those people don't seem to be retail investors.

Fourth, the success of the SPAC depends on the success of the company it acquires. The research, due diligence and checks behind these acquisitions may not be as stringent as a traditional IPO, or public company acquisition. It again seems like the investor is the loser.

Before you invest in a SPAC, ask yourself who is making the money, on what, and if you have alternatives you could consider. And as always, invest based on your financial goals, risk appetite and time horizon. When in doubt, seek a financial advisor.

Passionate about Investing in New Ideas?

Explore the latest Global Thematic Fund Landscape report here