Nick Thomas, partner and international equities specialist at Baillie Gifford & Co. Ltd. of Edinburgh, Scotland, subadvisor to the gold medalist Desjardins Overseas Equity Growth Fund, likes to visualize the future of companies as far as a decade ahead for a long rewarding ride.

The team seeks companies that could double revenue during the next five years. Potentially, companies could experience even greater growth rates and become several times bigger after 10 years. They prefer a low-turnover approach to bottom-up stock picking., and the goal is to hang on to superior companies for a long, rewarding ride.

“We consider whether a company might be five times bigger in 10 years, and what are the chances of that happening,” says Thomas. “If possible, that has a lot of value. We look at potential outcomes rather than short-term earnings prospects.”

Volatility Doesn’t Vex Much

Little attention is paid to economic and interest rate forecasts, as the best companies can perform well through various cycles, says Thomas. Investors’ moods typically shift every few months, he says, and that is why the long term is more relevant.

“Last year, due to COVID, investors’ focus was on companies benefitting from the digital lifestyle, and more recently there’s been a shift to companies that will recover most quickly as COVID fears recede and global economies improve,” Thomas says. “With some people expecting a return of inflation and rising interest rates, growth stocks have recently been under pressure, but we regard that as a short-term and transitional stage as things get back to normal. We don’t take our eye off the longer term.”

The team has identified two ‘big picture’ themes that appear to have staying power. They include the continuing disruption caused by technology in various industries as well as the rise of China as an economic superpower.

“We look for companies that stand to benefit by change and disruption, that will not be swept away and overtaken by change,” Thomas says.

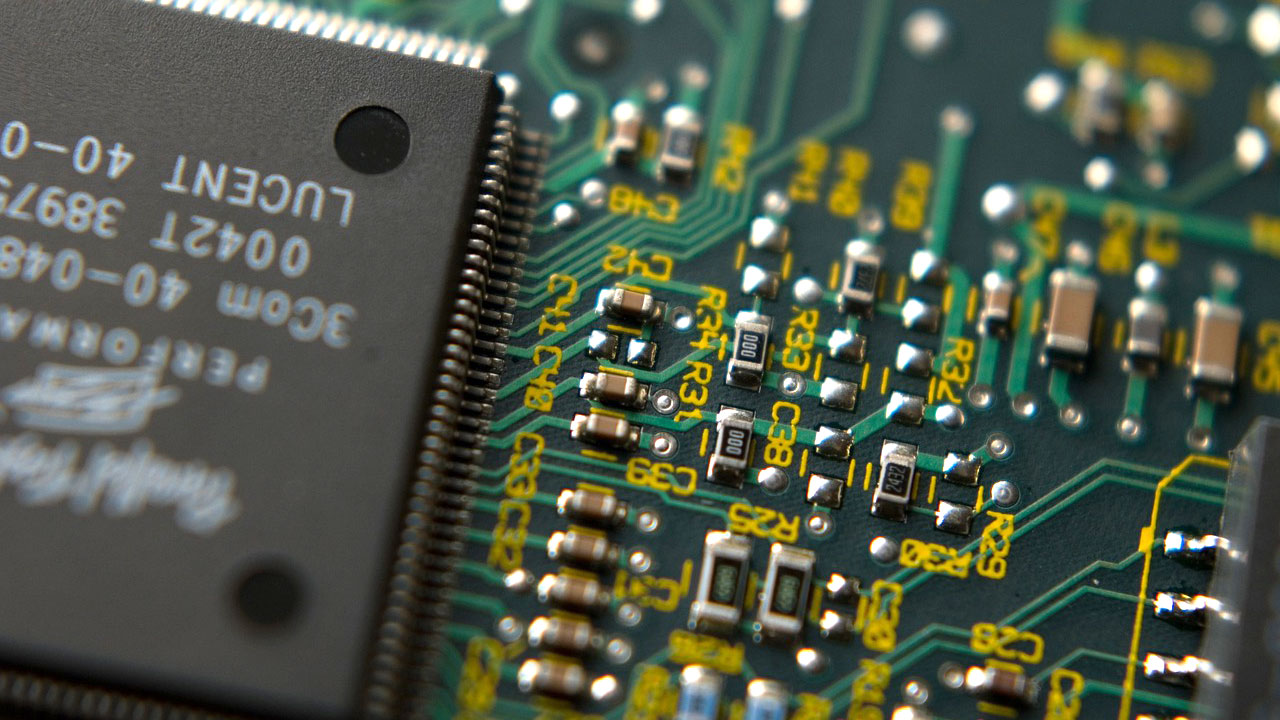

He says technology, powered by semiconductors, will accelerate the pace of change during the next decade. China is benefitting from the rising education and wealth of its population, as well as the centralized government’s extraordinary ability to organize and execute plans. The country is producing a new generation of entrepreneurs creating successful business giants.

‘Fierce’ Chinese Founders

“China has surpassed all expectations in terms of the ferocity of its entrepreneurs, and now has some of the biggest companies in the world,” Thomas says. “With the massive size of its population, the runway is tremendous. It’s well suited to benefit from technology disruption. Many businesses are simply not burdened by old or outdated infrastructure, and they can leapfrog ahead.”

For example, the physical bricks-and-mortar infrastructure for retail shopping simply never existed in most second-tier Chinese cities that were slower to modernize. Comfortable with using smartphones, the Chinese people are going straight to the Internet for such activities as ordering meals, buying consumer goods and paying for these things electronically.

A potential risk is whether the growing dominance of Chinese companies will lead to friction with other world powers and pushback on their ability to make global inroads, Thomas says.

“Many Chinese companies have the scale and technology to expand across Asia and worldwide, but we’ll see how far they will be allowed to reach and dominate,” Thomas says.

Desjardins Overseas Equity Growth’s mandate is to invest in companies primarily outside of North America, including emerging markets. However, the team will invest in exceptional U.S. companies when equivalents cannot be found elsewhere.

Essential Electrics

For example, the fund has a holding in U.S.-based electric carmaker, Tesla Motors Inc. (TSLA). Along the same theme, it also holds NIO Inc. (NIO), a smaller electric car maker based in China, Nidec Corp. (NNDNF), a Japanese manufacturer of electric motors, and Umicore NV (UMICF), a Belgian company involved in the recycling of electric batteries.

Geographically, the fund’s top holdings are based in the Netherlands, Germany, China, the U.S. and Japan, although many companies are exposed to growth in Asia and other emerging markets no matter where their head office is.

Prior to the COVID pandemic, the fund was already invested in the digital disruption theme and was therefore well-positioned to benefit from the boost these companies received as people gravitated to the Internet for work and leisure activities to avoid physical contact.

“We were already in the right place, but when COVID hit, our 10-year view was accelerated, and what we thought would take several years happened in one year,” Thomas says.

The fund’s performance shows the positive effects of being in the right stocks. Ranked gold by Morningstar, Desjardins Overseas Equity Growth F Series showed a one-year gain at June 30 of 40.1%, more than 20 percentage points ahead of Morningstar’s International Equity Category average and almost 19 points better than its benchmark index. For the longer five-year period, the fund had an average annual compound gain of 25.5%, handily beating the category and benchmark.

Some Disruptors Still Getting Started

Thomas says the full potential of technological disruption is not yet fully recognized. Areas such as renewable energy and health care are demonstrating impressive rates of progress that won’t be stopped by economic cycles, he says, and capturing one or two big companies that could become world dominators could be hugely rewarding.

The largest sector weighting in the fund is technology, followed by consumer goods, consumer services and health care.

The portfolio is relatively concentrated, typically holding 50 to 60 stocks. The largest holding is currently ASML Holding NV (ASML) of the Netherlands, the global leader in the manufacture of lithography machines used to make semiconductor chips.

Thomas also likes a handful of luxury goods companies that are profiting from strong brand loyalty, rising incomes in Asia and a growing appetite for prestige items such as leather goods, clothing, jewelry, eyewear and cars. Among the fund’s holdings are Italian sports car maker, Ferrari S.p.A. (RACE), and Kering SA (PPRUF), a French company that owns brands such as Gucci, Saint Laurent, Balenciaga, and Alexander McQueen.