The opioid epidemic. The phrase itself has such a lyrical quality that it almost anesthetizes people to the devastating truth of this public-health crisis.

From 1999-2019, nearly half a million people died from an overdose involving any opioid, including both prescription and illicit opioids. And the number of opioid-related deaths rose during the coronavirus pandemic as people grappled with the devastating effects of social isolation, health insecurity, and economic hardship.

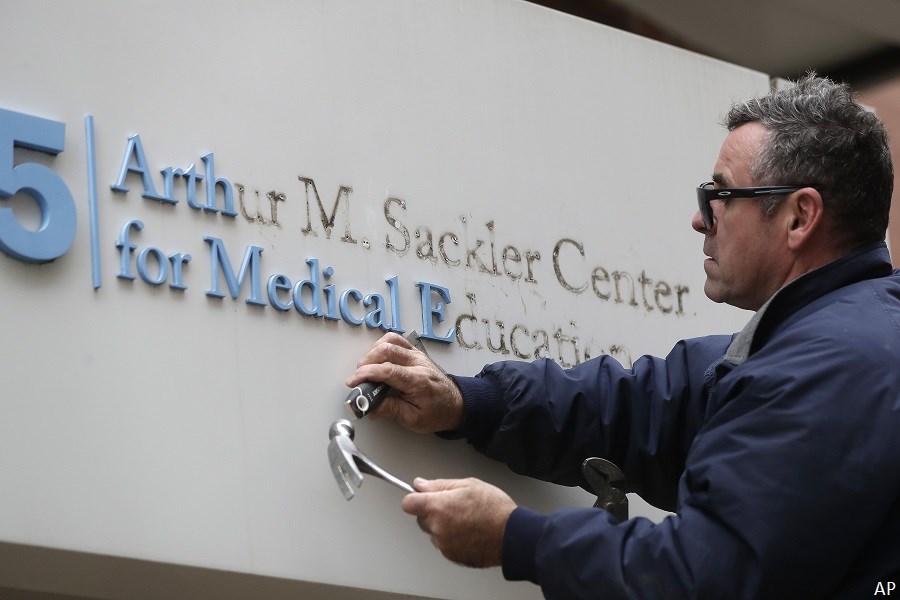

But unlike an epidemic caused by, say, a virus, many argue the continuing wave of opioid deaths is neither random nor inevitable. This timeline created by the Food and Drug Administration details significant events in the development of the opioid crisis: Beginning in the mid-1990s, dangerous opioids began flooding the market. These new formulations of narcotics were believed to be safer and have less potential for abuse and addiction because of their controlled-release formulations (marketed by now-dissolved Purdue Pharma as MS Contin and OxyContin).

But patients did become dependent on the drugs, which also carried severe side effects including respiratory depression and accidental death from overdose. And the potential for abuse was also understated: The time-release effect can be easily circumvented if the tablets are crushed, inhaled, dissolved, or injected. Prescriptions skyrocketed. Black market drug sales increased. The FDA added additional, stronger warnings to opioid labels, but by then, an entire industry was in place.

In his documentary The Crime of the Century, director Alex Gibney presents damning evidence of the organized network of players colluding to profit from the treatment of pain. To do so, he weaves together hours of interviews with pharmaceutical company executives; former salespeople; physicians; lawmakers; and political lobbyists. Gibney poses the question, how responsible for the public-health devastation are all the players along the chain?

Perhaps easier to measure, though, is how likely are different players along the chain to be held accountable, and what ongoing risks do they face? There are thousands of opioid-related lawsuits in courts across the country right now: On Sept. 4, pharmaceutical company Johnson & Johnson (JNJ) and the “big three” drug distributors--Cardinal Health (CAH), McKesson (MCK), and AmerisourceBergen (ABC), which have been accused of fueling the nation's opioid epidemic, said they would proceed with a US$26 billion multidistrict settlement to resolve over 3,000 claims.

In this article, we will take a look at how Morningstar and Sustainalytics assess the ongoing opioid-related risks for the four companies involved in the multibillion-dollar settlement. Specifically, we’ll take a closer look at how Sustainalytics rates each of these companies’ controversies (on a scale from 1 to 5, with 5 being the worst). This includes a discussion of the potential financial impact each controversy could have on the business; what steps have been/are being taken to manage and mitigate the risks; and our outlook on the controversy over a two-year period.

In terms of overall impact on the four companies' valuations, however, healthcare equity research director Damien Conover says the litigations pose a manageable headwind relative to the companies' total profits. This is reflected in the companies' current 3- and 4-star Morningstar Ratings, which mean our analysts believe the companies are fairly valued and undervalued, respectively.

"Litigation costs for the large drug companies over the past five years in aggregate have averaged approximately 3% of normalized income. This looks manageable, particularly given average net margins in the 20s to 30s for the large-cap drug and biotechnology companies." (For more, read "What Litigation Risk Means for Big Pharma and Biotech Valuations.").

A Closer Look at the Multibillion-Dollar Settlement

The Centers for Disease Control and Prevention estimate the total economic burden of the opioid crisis in the United States to be US$78.5 billion each year. These costs arise from medical care for opioid-addicted or opioid overdose patients; treatment for infants born with opioid-related conditions; rehabilitation services; social services; law enforcement; and lost productivity of citizens.

Over the past several years, several states’ attorneys general have been negotiating a multibillion-dollar settlement with Johnson & Johnson and drug distributors Cardinal Health, McKesson, and AmerisourceBergen to settle claims that they fueled the opioid crisis.

Plaintiffs alleged that the opioid manufacturers grossly misrepresented the risks of long-term opioid use in people with nonmalignant pain and distributors failed to properly monitor suspicious orders of opioids, allowing these addictive painkillers to be diverted to illegal channels. The companies have denied the allegations.

Currently, the multidistrict litigation, or MDL, consolidates over 3,000 lawsuits. The three drug distributors are expected to pay US$21 billion to settle claims, while Johnson & Johnson would pay US$5 billion. The money from the distributors will be paid out over the next 18 years. Johnson & Johnson will pay over nine years, with up to US$3.7 billion paid during the first three years.

On Sept. 4, the companies said that enough U.S. states had signed onto the agreement to proceed. In the next stage, the 42 participating states will give cities and counties until Jan. 2, 2022, to agree to the deal. The settlement uses a complex compensation formula with US$10.7 billion dependent on how many localities participate.

As part of the national opioid MDL, Johnson & Johnson has been accused of knowingly understating the risks of its opioid products. The company disclosed in February 2020 that it has reached an agreement in principle to pay US$4 billion to settle the majority of remaining opioid-related litigation. In October 2020, this amount was increased to US$5 billion.

Johnson & Johnson has a history of alleged marketing violations, most notably involving its opioid products (fentanyl patch Duragesic and Tapentadol pills Nucynta and Nucynta ER, which it no longer sells) but also with its ASR hip replacement system and its antipsychotic medication Risperdal. These have resulted in significant fines and penalties.

Among non-opioid-related claims also contributing to the High event rating, in November 2013, Johnson & Johnson agreed to pay US$2.2 billion in penalties to resolve criminal and civil investigations into its promotion of powerful psychiatric drugs, including Risperdal, for unapproved use to children, seniors, and disabled patients. In July 2014, the company paid US$4 million to the state of Oregon to settle allegations of withholding information on the proper functioning of its ASR hip replacement system, which was widely recalled in 2010.

Sustainalytics assesses this event as High risk because of the very high impact on patients and society and the corresponding risks to the company. Johnson & Johnson’s criminal penalty and US$2.2 billion in liabilities related to Risperdal in 2013 are exceptional within the industry. More recently, Johnson & Johnson has been accused of fueling the opioid crisis by aggressively marketing opioids as safe for everyday pain and lobbying state government to include its products on approved prescription lists.

Oklahoma’s attorney general presented evidence to argue that Johnson & Johnson specifically marketed all opioids, not just the company’s branded opioids, as safe for everyday pain while downplaying the risk of addiction for more than 15 years. Johnson & Johnson contends that it manufactured and sold a relatively low proportion of the prescription opioids that fueled the opioid crisis (less than 1% in Oklahoma). However, Oklahoma’s attorney general presented evidence that Johnson & Johnson created a mutant strain of poppy in 1994 that allowed the company to supply more than 60% of all active ingredients for opioids manufactured and sold in the U.S. for several years.

Opioid litigation, particularly the MDL, represents a significant legal risk for Johnson & Johnson. To satisfy the terms of the proposed MDL settlement, Johnson & Johnson said it will pay $5 billion over the next nine years, with up to $3.7 billion paid during the first three years (accounting for greater than 1% of its market cap, as of Sept. 8, 2021). If the proposed settlement is finalized, the company’s legal risks would substantially decrease.

Rating Outlook: Positive

Sustainalytics analysts have a positive outlook on this controversy for Johnson & Johnson. Importantly, the company’s exposure to opioids has decreased significantly, and its management of this controversy is considered moderate:

- Johnson & Johnson no longer produces or markets its branded opioid products and sold its opium-poppy-processing business in 2016.

- The marketing tactics outlined in evidence presented by Oklahoma’s attorney general, such as media outreach to children and adolescents, indicate an inadequate response to previous marketing incidents. In particular, Johnson & Johnson already pleaded guilty to criminal charges of off-label marketing of Risperdal to children and seniors in 2013.

- At the same time, Johnson & Johnson has not been accused of significant marketing violations in the past few years, and patient claims have trended downward.

- The company’s drug promotion standards are considered adequate.

Sustainalytics would consider a positive reassessment if the company resolves related pending legal proceedings and experiences a lack of new related allegations. A positive reassessment would be considered if the tentative settlement proposed by the three drug distributors and Johnson & Johnson, which has been accepted by the vast majority of the U.S. states, is finalized, as this would substantially decrease the company’s legal risks.

Sustainalytics would consider a negative reassessment if the investigation conducted by the Department of Justice’s Prescription Interdiction & Litigation task force develops into a criminal one against Johnson & Johnson. A negative reassessment would also be considered if the company is implicated in additional ethical marketing issues (related to other products) or if the tentative global settlement is not finalized, as this would likely increase liability risks for the company.

As part of the national opioid MDL, Cardinal Health (along with other healthcare distributors McKesson and AmerisourceBergen) has been accused of failing to report suspiciously high orders of opioid drugs for at least five years, and it is currently under investigation by the U.S. Department of Justice.

In November 2020, Cardinal Health, together with AmerisourceBergen and McKesson, proposed a tentative $21 billion deal to resolve all MDL lawsuits. In July 2021, the settlement agreement was sent out to several U.S. states and their municipalities for formal approval. In September 2021, the companies said the tentative settlement has been accepted by the vast majority of U.S. states and will move forward. If the settlement is finalized, the company’s legal risks would decrease.

The rating for Quality and Safety is assessed at Category 3, based on the significant impact that Cardinal Health’s failure to monitor and report suspicious orders of opioid drugs has had on stakeholders and the significant legal risks that the company is facing.

Cardinal Health is facing an increasing number of government lawsuits and investigations for allegedly failing to prevent and report the high number of distributed opioid drugs, and this has raised its legal risks. The impact on patients is high, as opioids are highly addictive painkillers with dangerous side effects.

Cardinal Health is one of the three main U.S. opioid distributors that accounted for around 85% of the market, indicating that the company’s involvement is significant. In addition, despite the settlements related to misconduct that occurred until 2012, Cardinal is still facing lawsuits for failing to report suspicious orders until at least 2015. This raises questions about the corrective actions that the company has implemented.

To satisfy the terms of the proposed MDL settlement, Cardinal Health would need to pay US$6.4 billion over the next 18 years, which would be approximately US$350 million a year (accounting for 2% of its market cap, as of Sept. 8, 2021).

Rating Outlook: Negative

Sustainalytics would consider a rating or outlook downgrade if the DOJ’s PIL task force investigation develops into a criminal one against the company as well as if the company faces restrictions to distribute its drugs). A negative reassessment would also be considered if the tentative global settlement of US$21 billion proposed by McKesson, AmerisourceBergen, and Cardinal Health is not finalized, as this would likely increase liability risks for the company.

A rating or outlook upgrade would be considered if most of the lawsuits and investigations into Cardinal Health are settled or concluded without a negative ruling for the company or if Cardinal Health significantly improves its measures to ensure that its sales strategy is in line with federal and state guidelines for opioid distribution. A positive reassessment also would be considered if the tentative settlement proposed by the three drug distributors is finalized, which would lessen the company’s legal risks.

The largest drug distributor in the U.S., McKesson is facing several lawsuits and government inquiries regarding its role in the distribution of opioid drugs in the United States. In 2016, McKesson finalized a USD 150 million settlement with the U.S. Department of Justice for failing to enforce a system to detect and report a high number of orders for opioid drugs. In October 2018, the FDA issued a warning letter, noting that the company still lacks such a system. Following the company’s inadequate response, the FDA issued another warning letter in February 2019, which alleged that the company failed to identify, investigate, and report tampering with its opioid shipments. McKesson is accused of failing to detect that a large number of opioid shipments had been tampered with or removed and, therefore, delivered counterfeit products to pharmacies.

As part of the national opioid MDL, McKesson, (along with other healthcare distributors Cardinal Health and AmerisourceBergen) has been accused of failing to report suspiciously high orders of opioid drugs for at least five years, and it is currently under investigation by the U.S. Department of Justice.

In November 2020, McKesson, together with AmerisourceBergen and Cardinal Health, proposed a tentative US$21 billion deal to resolve all MDL lawsuits. In July 2021, the settlement agreement was sent out to several U.S. states and their municipalities for formal approval. In September, the companies said tentative settlement has been accepted by the vast majority of U.S. states and will move forward. If the settlement is finalized, the company’s legal risks would decrease.

Sustainalytics assesses this controversy as Category 4 based on the high legal, regulatory, and reputational risks that the company faces as well as the high impact on patients and society. McKesson is accused of failing to prevent and report the high number of opioids distributed since at least 2012, and this has allegedly contributed to the severity of the opioid crisis. The impact on patients is exceptionally high, as opioids are highly addictive painkillers with dangerous side effects.

McKesson faces an exceptionally high number of lawsuits related to its distribution of opioids since at least 2012. To satisfy the terms of the proposed MDL settlement, McKesson would need to pay US$7.9 billion over the next 18 years, which would be approximately US$400 million per year (accounting for 1.3% of the company’s market cap, as of Sept. 8, 2021).

Rating Outlook: Neutral

Sustainalytics would consider a positive reassessment if the company takes measures to ensure that its operational processes are in line with federal and state guidelines for opioid distribution, if it resolves related pending legal proceedings, or if it experiences a lack of new related allegations. A positive reassessment also would be considered if the US$21 billion tentative MDL settlement proposed by the three drug distributors is finalized, which would lessen the company’s legal risks.

Sustainalytics would consider a negative reassessment if the company faces additional selling restrictions by the U.S. government to distribute its opioid medications, the investigation conducted by the DOJ’s PIL task force develops into a criminal one against McKesson, McKesson receives a financially material fine or settlement, McKesson is implicated in additional quality and safety issues (related to other products), or McKesson loses its license to distribute for failing to comply with the corrective actions required in the FDA warning letters. A negative reassessment would also be considered if the tentative MDL settlement is not finalized, as this would increase liability risks for the company.

AmerisourceBergen, along with McKesson and Cardinal Health, controls 96% of the opioid drug distribution market (as of fiscal-year 2019). AmerisourceBergen is the second-largest U.S. drug distributor, accounting for 34% market share.

As part of the national opioid MDL, AmerisourceBergen (along with other healthcare distributors Cardinal Health and McKesson) has been accused of failing to report suspiciously high orders of opioid drugs for at least five years, and it is currently under investigation by the U.S. Department of Justice.

In November 2020, AmerisourceBergen, together with McKesson and Cardinal Health, has proposed a tentative US$21 billion deal to resolve all MDL lawsuits. In July 2021, the settlement agreement was sent out to several U.S. states and their municipalities for formal approval. In September, the companies said tentative settlement has been accepted by the vast majority of U.S. states and will move forward. If the settlement is finalized, the company’s legal risks would decrease.

The rating for Quality and Safety is assessed at Category 3, based on the significant legal, regulatory, and reputational risks that the company faces as well as significant negative impact on patients and society. AmerisourceBergen is accused of failing to prevent and report the high number of opioids distributed since at least 2012, and this has allegedly contributed to the severity of the opioid crisis. The impact on patients is exceptionally high, as opioids are highly addictive painkillers with dangerous side effects.

To satisfy the terms of the proposed MDL settlement, AmerisourceBergen would need to pay US$6.4 billion over the next 18 years, which would be approximately US$350 million a year (accounting for 1.4% of the company’s market cap, as of Sept. 8, 2021).

Rating Outlook: Negative

Sustainalytics would consider a positive reassessment if the company resolves related pending legal proceedings and experiences a lack of new related allegations. A positive reassessment also would be considered if the US$21 billion tentative MDL settlement proposed by the three drug distributors is finalized, which would lessen the company’s legal risks.

Sustainalytics would consider a negative reassessment if AmerisourceBergen faces selling restrictions by the U.S. government to distribute its opioid medications, the company receives a warning latter by the FDA related to its opioid shipments, the investigation conducted by the DOJ’s PIL task force develops into a criminal one against AmerisourceBergen, AmerisourceBergen receives a financially material fine or settlement, or AmerisourceBergen is implicated in additional quality and safety issues (related to other products). A negative reassessment would also be considered if the tentative MDL settlement is not finalized, as this would likely increase liability risks for the company.

AmerisourceBergen, along with McKesson and Cardinal Health, controls 96% of the opioid drug distribution market (as of fiscal-year 2019). AmerisourceBergen is the second-largest U.S. drug distributor, accounting for 34% market share.

As part of the national opioid MDL, AmerisourceBergen (along with other healthcare distributors Cardinal Health and McKesson) has been accused of failing to report suspiciously high orders of opioid drugs for at least five years, and it is currently under investigation by the U.S. Department of Justice.

In November 2020, AmerisourceBergen, together with McKesson and Cardinal Health, has proposed a tentative USD 21 billion deal to resolve all MDL lawsuits. In July 2021, the settlement agreement was sent out to several U.S. states and their municipalities for formal approval. In September, the companies said tentative settlement has been accepted by the vast majority of U.S. states and will move forward. If the settlement is finalized, the company’s legal risks would decrease.

The rating for Quality and Safety is assessed at Category 3, based on the significant legal, regulatory, and reputational risks that the company faces as well as significant negative impact on patients and society. AmerisourceBergen is accused of failing to prevent and report the high number of opioids distributed since at least 2012, and this has allegedly contributed to the severity of the opioid crisis. The impact on patients is exceptionally high, as opioids are highly addictive painkillers with dangerous side effects.

To satisfy the terms of the proposed MDL settlement, AmerisourceBergen would need to pay $6.4 billion over the next 18 years, which would be approximately USD 350 million a year (accounting for 1.4% of the company’s market cap, as of Sept. 8, 2021).

Rating Outlook: Negative

Sustainalytics would consider a positive reassessment if the company resolves related pending legal proceedings and experiences a lack of new related allegations. A positive reassessment also would be considered if the $21 billion tentative MDL settlement proposed by the three drug distributors is finalized, which would lessen the company’s legal risks.

Sustainalytics would consider a negative reassessment if AmerisourceBergen faces selling restrictions by the U.S. government to distribute its opioid medications, the company receives a warning latter by the FDA related to its opioid shipments, the investigation conducted by the DOJ’s PIL task force develops into a criminal one against AmerisourceBergen, AmerisourceBergen receives a financially material fine or settlement, or AmerisourceBergen is implicated in additional quality and safety issues (related to other products). A negative reassessment would also be considered if the tentative MDL settlement is not finalized, as this would likely increase liability risks for the company.