Could this be the last ever annual general meeting for Twitter (TWTR)? A lot’s going on with the company – and shareholders will want to be heard while they still can.

Early on May 13, Tesla (TSLA) CEO Elon Musk’s tweeted that his plan to acquire the company was “on hold” until Twitter’s claim that spam accounts represent less than 5% of its total users is supported by evidence. Approximately three hours later, he backtracked, tweeting that he remains “committed” to purchasing the firm.

Apart from the will-he-won’t-he with Musk’s plans to buy the company, there’s the firing of executives, CEO Parag Agarwal’s compensation and remaining decisions to be made before the company goes private. Let’s talk about that last one for a minute – if the company ends up going private, it means the end of public annual general meetings, shareholder proposals and proxy voting. This might be the very last time for you, as a Twitter shareholder, to exercise your right to vote on issues that the board – and other shareholders – deem essential for unlocking shareholder value, and the sustainability of the company’s growth.

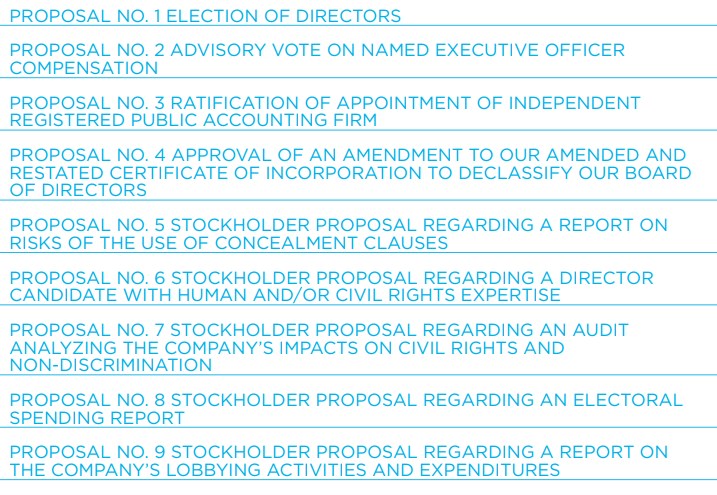

What’s on the ballot at Twitter’s 2022 AGM? According to the latest proxy statement, 9 proposals will be up for vote, including five shareholder proposals – all of which the board of directors ask that shareholders vote ‘Against’. The other four deal with executive compensation, the hiring of auditors, and the board of directors – which the board of directors ask shareholders to vote ‘For’.

Let’s look at the shareholder proposals in some detail, starting with the ones on civil rights.

Two Votes on Human Rights

There are two civil rights-related issues on the ballot – one from Arjuna Capital asking that a candidate with human rights and/or civil rights expertise be elected to the board of directors, and the other by the National Centre for Public Policy Research (NCPPR), asking that the company conduct an audit analyzing its impacts on civil rights and non-discrimination.

Arjuna Capital believes Twitter requires expert, board-level oversight of civil and human rights issues to assess risk and develop strategies to avoid causing or contributing to widespread violations of human or civil rights, such as voter suppression, disinformation and hate campaigns, or violence.

The NCPPR resolution says that while all agree that employee success should be fostered and that no employees should face discrimination, there is much disagreement about what non-discrimination means. “Concern stretches across the ideological spectrum. Some have pressured companies to adopt ‘‘anti-racism’’ programs that seek to establish ‘‘racial/social equity,’’ says the resolution, which appears to mean the distribution of pay and authority based on race, sex, orientation and ethnic categories rather than by merit. Where adopted, however, such programs raise significant objections, including concerns that, e.g., ‘‘anti-racist’’ programs are themselves deeply racist and otherwise discriminatory. It adds that if Twitter is, in the name of equity, diversity and inclusion, committing illegal or unconscionable discrimination against employees deemed ‘‘non-diverse,’’ then the Company will suffer in myriad ways - all of them both unforgivable and avoidable.

NCPPR has been identified as one of the players filing what we have been calling ‘anti-ESG’ shareholder proposals, which are disingenuously submitted proposals, usually by groups that oppose the work of ‘pro-ESG’ investors.

In its comments on this proposal, Morningstar Sustainalytics’ ESG Voting Policy Overlay finds some of the assertions and suggestions in NCPPR’s supporting statement to be concerning because it is not clear from the statements how the requested report will address the issues raised. While opposing the resolution, Morningstar Sustainalytics recognizes that investors have become increasingly aware of the need to advance racial equity, as evidenced by strong shareholder support for proposals requesting third-party racial equity and civil rights audits.

Questions Arise on Electoral Spending and Lobbying Activities

The New York State Common Retirement Fund and the Administrative Head of the New York State and Local Retirement System ask that Twitter provide a report, updated semiannually, disclosing the Company's spending on elections, and disclose both monetary and non-monetary contributions, including the identity of the recipient as well as the amount paid to each, and who within Twitter is making these decisions.

The National Legal and Policy Center wants Twitter to provide full, detailed disclosure of its direct and indirect lobbying activities and expenditures to assess whether our lobbying is consistent with Company's expressed goals and in shareholders' best interests.

Morningstar Sustainalytics recommends a vote ‘For’ both of these proposals, saying that in both cases, increased transparency around political activities and expenditure, particularly regarding trade associations and other tax-exempt groups, will help shareholders better understand the risks to which the company is exposed.

Addressing Risks Around the Use of Concealment Clauses

The last shareholder proposal has been filed by Whistle Stop Capital, and asks that the Board of Directors prepare a public report assessing the potential risks to the company associated with its use of concealment clauses in the context of harassment, discrimination and other unlawful acts.

Concealment clauses are any employment or post-employment agreement, such as arbitration, non-disclosure or non-disparagement agreements, that Twitter asks employees or contractors to sign which would limit their ability to discuss unlawful acts in the workplace, including harassment and discrimination.

“Twitter wisely uses concealment clauses in employment agreements to protect corporate information, such as trade secrets. However, harassment and discrimination are not trade secrets, nor are they core to Twitter’s operations or needed for competitive reasons. Yet, Twitter's employment agreements may prohibit their workers from speaking openly on these topics,” the filing says.

What About the Twitter Stock?

Should you buy Twitter right now? As Morningstar’s U.S. market strategist Dave Sekera points out, trading around deals like Musk’s proposed buyout of Twitter falls under the umbrella of merger arbitrage, generally the domain of professional traders such as hedge funds.

“Merger arbitrage can be a risky investment approach as it usually involves large downside risk with only a few percent of upside potential. In this case, considering the size of the transaction and current deal spread for Twitter is so wide, the risk/reward dynamics in this situation may attract more investors than usual,” he says.

The Morningstar base case scenario is that the deal closes as advertised. But until then, there are regulatory hurdles to clear, political pressures, and questions around Musk’s own determination to stick with the buyout.

In Morningstar analyst Ali Moghrabi’s view, Musk will have difficulties exiting the deal even if Twitter cannot support its claim about the proportion of spam users. The firm’s statement regarding the risk of miscalculating spam users has consistently been in the risk factors section of its annual and quarterly SEC filings, which any buyer should be aware of. In his view, Musk cannot claim that this news was surprising.

“If Musk decides to abandon this deal, he is likely to face lengthy legal battles with the firm and its shareholders, which could add significant costs to the US$1 billion breakup fee for which he will be responsible. In addition, the market’s reaction could rid Musk of a large amount of his unrealized profit made on investing in Twitter in the low to mid-US$30s. Musk may also get into legal fights with holders of Tesla, who have seen their shares decline 25% since the April 20 filing in which it was revealed that possible financing of the Twitter deal included a margin loan against his Tesla shares,” he said. Since then, there have been reports that Musk is trying to raise equity and preferred financing to avoid the margin loan.

“On the bright side, the stock’s reaction may have created an opportunity for institutional investors to get into the name or increase their stake as Musk’s action has created merger arbitrage opportunities with significant upside—but also with a lot of risks. We are maintaining our US$54.20 fair value estimate, which is the price at which Musk committed to acquire Twitter,” Moghrabi added.