From the Investment Ashes

Few investors have profited over the past 21 months. From January 2021 through September 2022, nearly every fund category suffered negative total returns. The only exceptions were commodities, value stocks, and alternatives. Although those assets have performed well—the latter, I must confess, quite to my surprise—they have generally just cushioned the damage rather than prevented it.

The reason being that the major investments slumped. As shown by the chart below, blue-chip U.S. stocks have suffered only modest declines (albeit unpleasantly, with large 2021 gains followed by 2022′s sudden reversal). However, with bonds and foreign stocks faring even worse, mainstream portfolios have inevitably struggled, as all three of their investment legs have wobbled.

However, the outlook is brighter than dwindling portfolio balances suggest. If the current downturn does not indicate long-term troubles—and downturns rarely do; through investment history, that which has fallen almost always reverts to the mean—then today’s defeats likely foreshadow tomorrow’s victories. In such a case, not only would many investors fully recover their financial health but some would also find themselves even better off than they were before.

Situation #1: Retirees

Investment losses generally do not benefit retirees, because shrinking asset bases endanger portfolios that are being used for withdrawals. Bear markets that arrive during the early retirement years can cause those who spend fixed amounts from their portfolios to remove ever-larger percentages. Should that unfortunate trend continue, their portfolios can enter a death spiral, wherein their annual withdrawals exceed what retirees can earn, even during a market rally.

For this reason, retirees are best served by low-risk portfolios that deliver steady returns. (Better yet would be investments that time their performances to excel during the initial states of retirement, only to give back their excess gains later, after the portfolio has inflated its way to safety, but if such investments exist, I am not aware of where to purchase them.)

There is an exception: debt that will soon mature and is directly held. (The math gets more complicated for funds, which never mature.) For example, a retiree who invested $50,000 into newly minted five-year Treasuries in November 2017 currently receives $1,050 of annual yield. This week, when the government repays those securities, she will be able to reinvest the proceeds into five-year notes that pay $2,150 per year. A handsome raise indeed!

Overall, though, it would be inaccurate to claim that most retirees will profit from the recent stock and bond market slides.

Situation #2: Older Workers

The story is happier for workers who are approaching retirement. Presumably, they have not yet touched their portfolios, meaning that their deficits exist only on paper. Meanwhile, their future investment prospects have brightened. They therefore stand a good chance of regaining their lost ground.

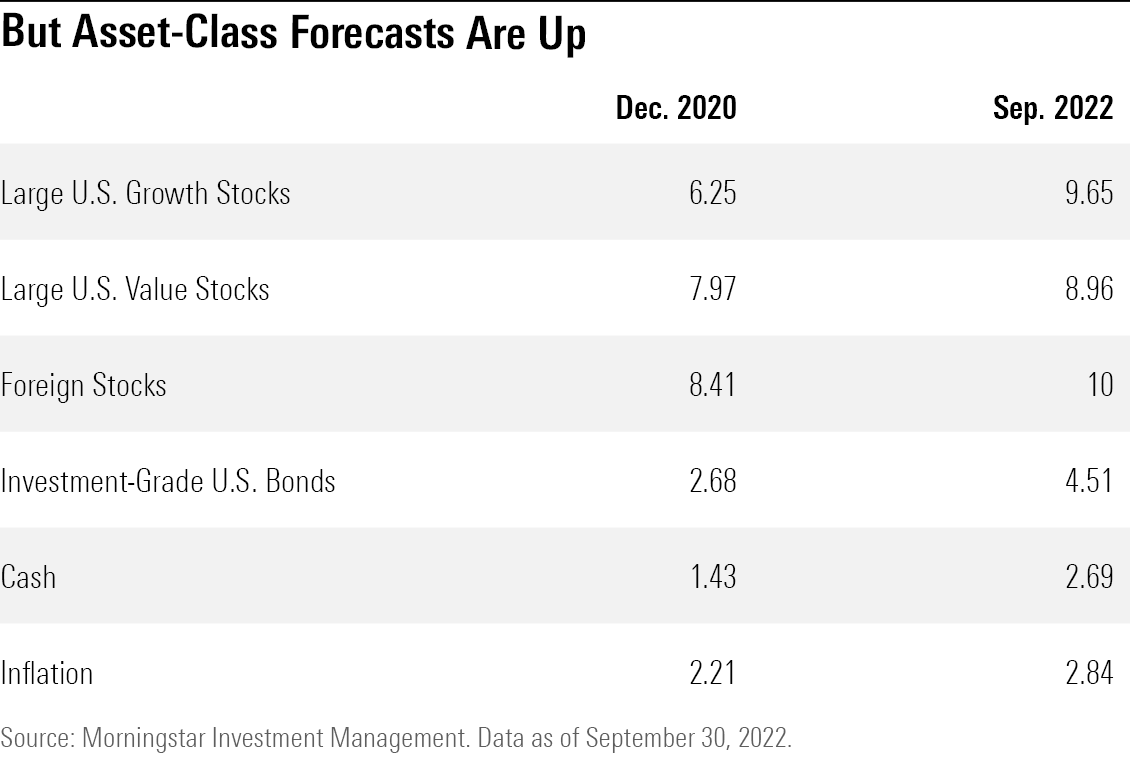

The following table illustrates how the combination of lower stock market prices, higher bond yields, and continued corporate-profit growth has boosted asset-class expectations. In January 2021, the mood at Morningstar Investment Management, the group responsible for the company’s asset-class forecasts, was glum. Annual equity returns over the next 30 years were estimated to be from 6% to 8%, with bonds at 2.7%. Today, MIM’s stock forecast exceeds 9%, while bonds have increased to 4.5%. True, its inflation estimate is also higher, but even when expressed in real terms, the group’s market projections are significantly higher.

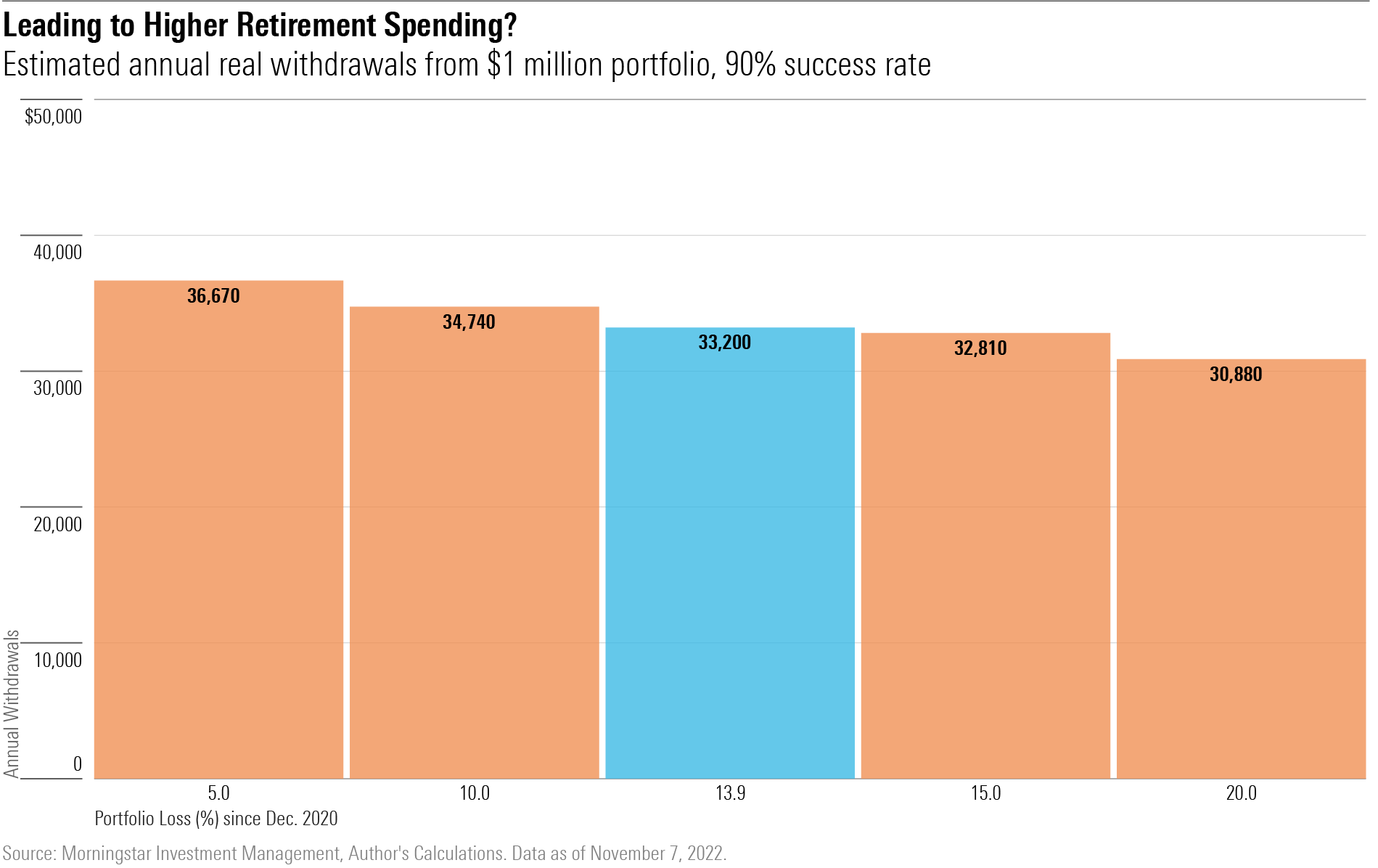

The next chart takes some explanation. It shows a model’s recommendation for after-inflation annual retirement spending for a $1 million portfolio that is invested 50% in equities and 50% in bonds, assuming a 30-year time horizon. (Forget the level of the numbers; we can argue elsewhere if the assumptions are too conservative. What matters are the differences between the figures.)

The blue bar depicts the result for Morningstar Investment Management’s December 2020 forecast. At that time, the model suggested a $33,200 initial withdrawal. The orange bars show the model’s current recommendation, adjusted for the portfolio’s subsequent performance. For example, the bar on the far left indicates that the model suggests a $36,670 spending rate for portfolios that lost 5% of their value between January 2021 and September 2022. That rate is well above the $33,200 amount from December’s forecast.

So … are older investors who have suffered only modest portfolio losses better off today than they were entering 2021? Well, not necessarily. After considering the effect of inflation, the contest is pretty much a wash. But the point remains. At least to a certain extent, and sometimes completely, the disadvantage of lower portfolio values for upcoming retirees who suffer market losses are offset by the advantage of higher expected portfolio returns.

Situation #3: Younger Investors

This one is easy. Young investors benefit from early bear markets and later bull markets. Because they contribute to their investment accounts throughout their working careers, they have more money in their portfolios as they approach their retirement dates. That is the time when they derive the greatest gain from bull markets—and the greatest harm from the bears.

That logic holds even if today’s high inflation rates are much more than just a temporary scare. Should inflation rage for the next 15 years, as I did from the late ‘60s through the early ‘80s, younger investors will still face few worries. Even if their portfolios deteriorate from, say, age 30 through 45, that gives them roughly 20 years with which to ride what almost certainly would be strong investment performance, as stocks and bonds rebound from their hibernation.

Summary

Investors typically regard investment declines as an unmitigated woe. But the truth is more nuanced. Lower stock and bond prices create opportunity, just as soaring prices pose dangers. Admittedly, it can be difficult for those who are already retired to profit from the opportunity, because they may be spending from their portfolios, thereby limiting their flexibility. But for those who have not yet retired, time may be on their side—particularly if they are younger workers.