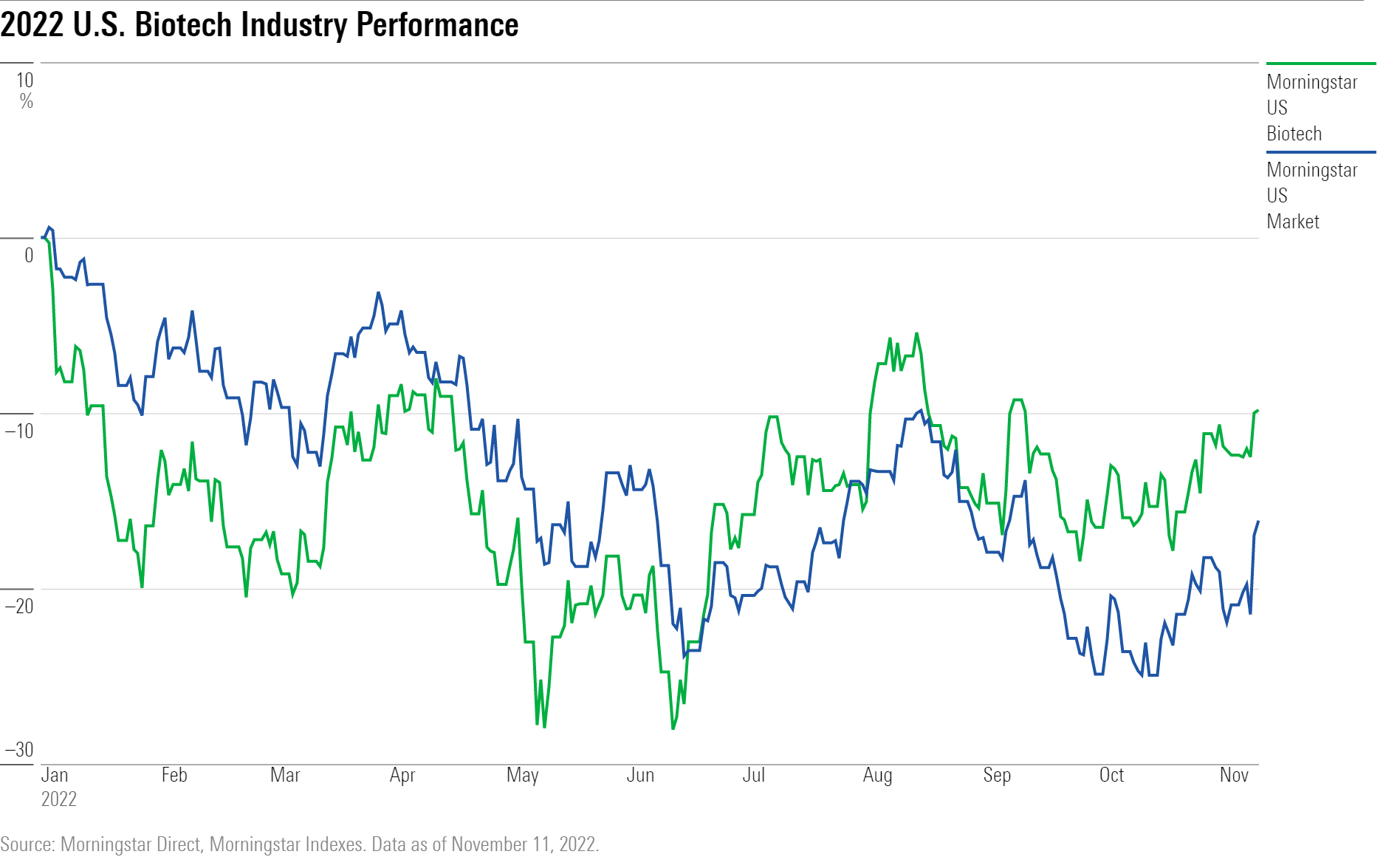

After a rough start to the year, biotech stocks have been on an upswing, standing out in a difficult market for high-growth stocks.

These notoriously volatile names have outperformed the broad market since June, thanks in part to their potential to ride out a recession as long as their pipelines of future drugs remain strong.

Since the end of June, the Morningstar US Biotechnology Index—which tracks biotechnology companies based in the United States—has gained 10.1% in the second half of the year through Nov. 14. That’s nearly double the Morningstar US Market Index’s gain of 5.5% for the same period.

The move higher in biotech stocks comes after a rough start in the first half of the year, when the biotech index lost 17.7%, more than it lost in the first six months of any year since 2016. Even with the recent bounce, those losses have led to a number of undervalued names in the space, according to Morningstar stock analysts.

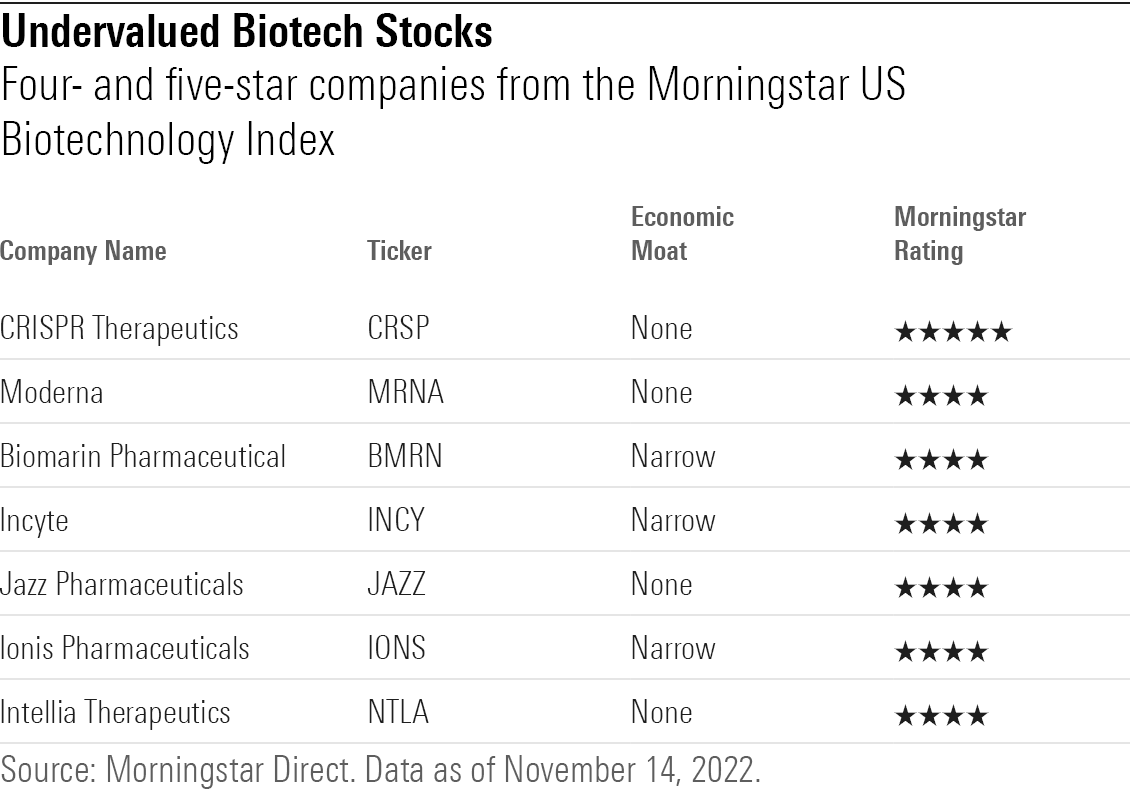

7 Most-Undervalued Biotech Stocks

1. CRISPR Therapeutics CRSP

2. Moderna MRNA

3. BioMarin Pharmaceutical BMRN

4. Incyte INCY

5. Jazz Pharmaceuticals JAZZ

6. Ionis Pharmaceuticals IONS

7. Intellia Therapeutics NTLA

Why Are Biotech Stocks Rallying?

Several catalysts are fueling the recent outperformance of biotech stocks, according to Karen Andersen, equity sector strategist for healthcare at Morningstar.

Biotech companies—and their potential for success—tend to be highly idiosyncratic. That’s because biotech share prices generally depend on the success of clinical trials, acquisition- or partnership-related deals, as well as a company’s ability to commercialize a new treatment.

“These companies are not as vulnerable to the economic issues that have been hitting companies hard with inflation,” Andersen says. “People need healthcare regardless of what the economy is doing.”

And while that’s a plus for the big pharmaceutical companies and healthcare providers, biotech firms provide the opportunity for growth through their development of new medical treatments. “Innovation—and demand for innovation—in healthcare is always going to be strong,” Andersen says.

When it comes to innovation, one of the most important has been the adoption of new genetic technologies such as mRNA vaccines, which were central to the development of coronavirus vaccines. While the ideas behind mRNA have been around for decades, “We’re starting to see some real potential in these newer technologies,” Andersen says.

Another reason for the improved returns among biotech companies is the potential for acquisitions.

Biotechs are “seen as acquisition targets for larger drug firms, so investors might buy biotech stocks hoping for a big acquisition premium,” she says. “And there are several big drug firms that have plenty of cash and need to build pipelines to defend against sales declines as major drugs reach patent expiration.”

At the same time, Morningstar analysts urge investors to exercise caution. “Biotech is very speculative,” says Rachel Elfman, healthcare equity analyst at Morningstar. While successful drugs can bring in billions in revenue, that’s far from guaranteed. “A lot of times, these kinds of companies invest heavily in the R&D process for early-development treatment candidates that may not come to fruition,” Elfman says.

Why mRNA Matters for Biotech

It’s the mRNA potential that has Andersen excited about the space, even though as the COVID-19 pandemic has faded, investor interest has ebbed from the frenzy seen in the wake of the pandemic.

At that outset, investor interest in biotech skyrocketed in anticipation of—and following—the development of new vaccines. “There was a very strong desire to get in on the ground floor with this new technology that could become the basis of some new type of drug—with multibillion-dollar earnings potential—that could be used for a variety of different businesses.”

The Morningstar US Biotechnology Index reached an all-time high in September 2021 after spending the better part of a year well ahead of the wider market.

Interest in the space has since fallen, leaving some undervalued biotech stocks up for grabs. “The mRNA technology seems underappreciated right now,” Andersen says. “The mRNA vaccines for COVID-19 were a huge advancement in biotechnology. There are still a lot of other types of gene-based treatments in testing that show a lot of potential. The innovation is still there.”

Andersen currently sees Moderna, an American pharmaceutical and biotechnology company and a major developer of the mRNA COVID-19 vaccine, as undervalued.

“Moderna and [Germany-based] peer BioNTech BNTX have both had investors start to shy away as the demand for COVID-19 vaccines has fallen. But there’s not enough credit given for how this technology could be applied to other areas.” Andersen highlights the late-stage developments of a new mRNA vaccine for respiratory syncytial virus, or RSV, which is currently causing an epidemic among young children. She also points to treatments for cancer and other rare diseases that make use of new gene-based technology.

“People are going to be hearing a lot more about new vaccine programs in the foreseeable future, starting in the coming months for Moderna, and a little after for others.” Still, she cautions that investors need to see biotech stocks as long-term investments, and to hold realistic timelines for biotech advances.

Which Biotech Stocks Are Undervalued Right Now?

A screen of the Morningstar US Biotechnology Index highlights stocks currently trading at the biggest discounts to their analyst-assessed fair value estimates.

CRISPR Therapeutics

- CRSP

- Market Cap: US$4.7 Billion

- Price/Fair Value: 0.50

“We think the company’s proprietary technology has the potential to build blockbusters in rare diseases, such as CTX001 for the treatment of sickle-cell disease and transfusion-dependent beta-thalassemia … Although the company currently operates without an economic moat, we believe potential success through regulatory approvals for its therapies may push us to consider a narrow moat in the future.” — Rachel Elfman, analyst

Moderna

- MRNA

- Market Cap: US$68.8 Billion

- Price/Fair Value: 0.77

“Given Moderna’s strong positioning for diversification beyond COVID-19, we think shares remain significantly undervalued. That said, we think the firm is still in the process of building a moat around its innovative mRNA technology.” — Karen Andersen, sector strategist

BioMarin Pharmaceutical

- BMRN

- Market Cap: US$15.7 Billion

- Price/Fair Value: 0.80

“Commercialization and research and development expenses have kept BioMarin in the red, but we’re confident in the profit-generating power of its rare-disease treatments, and BioMarin’s turn to profitability looks maintainable. With a deep in-house pipeline and the ability to supplement growth with strategic acquisitions, BioMarin is in a strong position.” — Karen Andersen, sector strategist

Incyte

- INCY

- Market Cap: US$17.1 Billion

- Price/Fair Value: 0.80

“We think Incyte has a robust late-stage pipeline focusing primarily on oncology and other autoimmune indications, which provides attractive long-term growth opportunities for the firm.” — Karen Andersen, sector strategist

Jazz Pharmaceuticals

- JAZZ

- Market Cap: US$9.3 Billion

- Price/Fair Value: 0.79

“Management has been focused to diversify its portfolio, with the new drug approvals of Zepzelca (for metastatic small cell lung cancer), Rylaze (for acute lymphoblastic leukemia), and Xywav (for the treatment of cataplexy, EDS, and idiopathic hypersomnia). Strong launches and commercialization efforts for these drugs will be crucial for Jazz to successfully diversify its portfolio.” — Rachel Elfman, analyst

Ionis Pharmaceuticals

- IONS

- Market Cap: US$6.3 Billion

- Price/Fair Value: 0.71

“Ionis has several wholly owned neurology and rare-disease programs, and partnered programs in neurology (with Biogen BIIB) and cardiology (with Novartis NVS and Pfizer PFE) are in late-stage development, putting Ionis in a position to see key phase 3 data in 2023-25.” — Karen Andersen, sector strategist

Intellia Therapeutics

- NTLA

- Market Cap: US$4.2 Billion

- Price/Fair Value: 0.63

“As a precommercial biotechnology company with no marketed drugs, Intellia does not possess an economic moat. However, Intellia merits a positive moat trend due to its developing pipeline spanning many rare diseases, which we view as possessing strengthening intangible assets.” — Rachel Elfman, analyst