Editor's Note: This article was originally written for a U.S. audience

With stock and bond prices declining simultaneously and inflation coming on strong in 2022, new retirees have run headlong into what retirement researchers call “sequence risk.” In a nutshell, that’s the risk of encountering difficult market conditions early on in retirement, thereby imperiling the portfolio’s ability to last over the whole of a typical retirement spending horizon, often 25 or 30 years or even longer. Exacerbating sequence risk this time around is the fact that inflation has risen, potentially forcing retirees to take higher withdrawals from their reduced portfolios. (We’ll explore sequence risk in-depth in upcoming articles.)

Yet there’s a silver lining for people who are about to retire, as we explore in our newly released research, “The State of Retirement Income 2022.” (We produced the paper along with Jeff Ptak, chief ratings officer for Morningstar Research Services.)

Because equity valuations have declined and cash and bond yields have increased, the forward-looking prospects for portfolios—and in turn the amounts that new retirees can safely withdraw from those portfolios over a 30-year horizon—have enjoyed a nice lift since we explored the topic last year. Whereas last year’s research suggested that a 3.3% withdrawal rate was a safe starting point for new retirees with balanced portfolios over a 30-year horizon, this year’s research points to 3.8% as a safe starting withdrawal percentage, with annual inflation adjustments to those withdrawals thereafter.

Retirees who are willing to employ more-flexible strategies or make other modifications to a fixed real withdrawal system can enjoy even higher starting withdrawals, assuming they’re willing to accept other trade-offs, such as fluctuating year-to-year real cash flows and the possibility of fewer leftover assets at the end of a 30-year period.

Digging Into the Research: An Analysis of Safe Withdrawal Rates

As in last year’s study, we employed a “base case” to test safe starting withdrawal rates. Specifically, we assumed a new retiree with a 50% stock/50% bond portfolio and a 30-year anticipated time horizon who would like to secure a 90% probability of not outliving his or her money. We assumed the retiree was using a fixed real withdrawal system—setting the starting withdrawal amount and then taking inflation adjustments to that dollar amount each year thereafter.

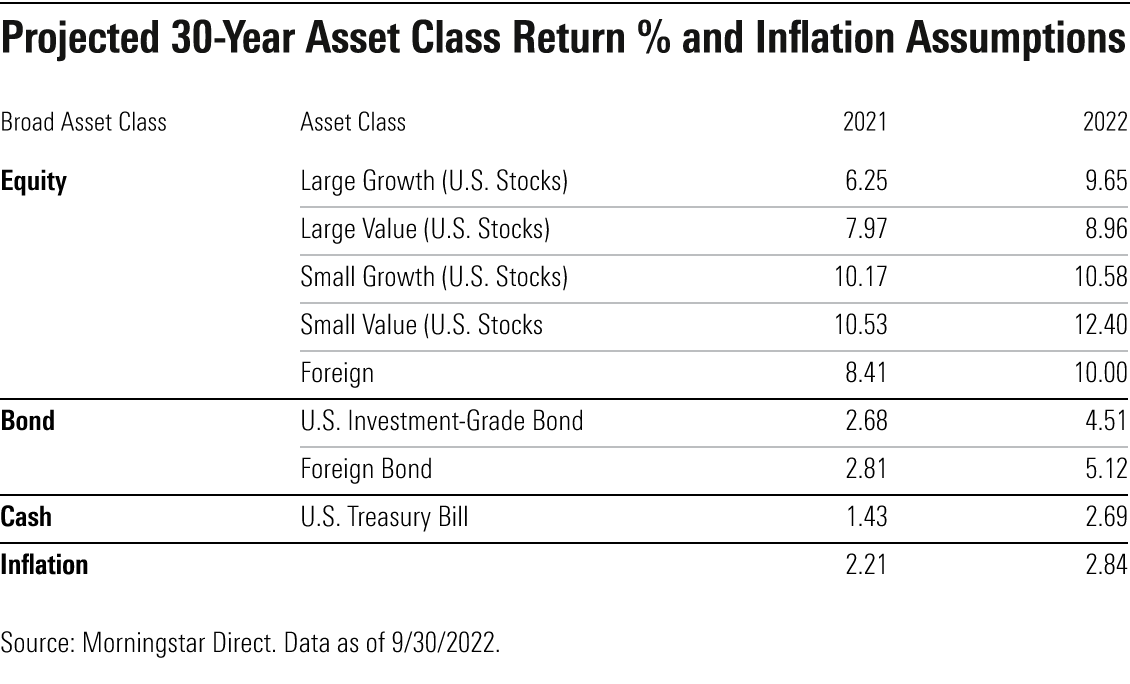

We held all of those inputs steady from last year, but our expected returns for stock and bonds rose, informed by the capital markets assumptions put together by our colleagues in Morningstar Investment Management. Whereas anticipated 30-year stock returns came in between 6% and 11% in our 2021 research, for example, the 30-year outlook for various stock categories ranged from 9% to 12% in this year’s research. Expected bond returns also got a lift, jumping from 3% to 5%, reflecting the much higher yields available today. Unfortunately, higher inflation gobbles up some of those return increases: MIM’s 30-year inflation expectation jumped from 2.2% in 2021 to 2.8% in this year’s study.

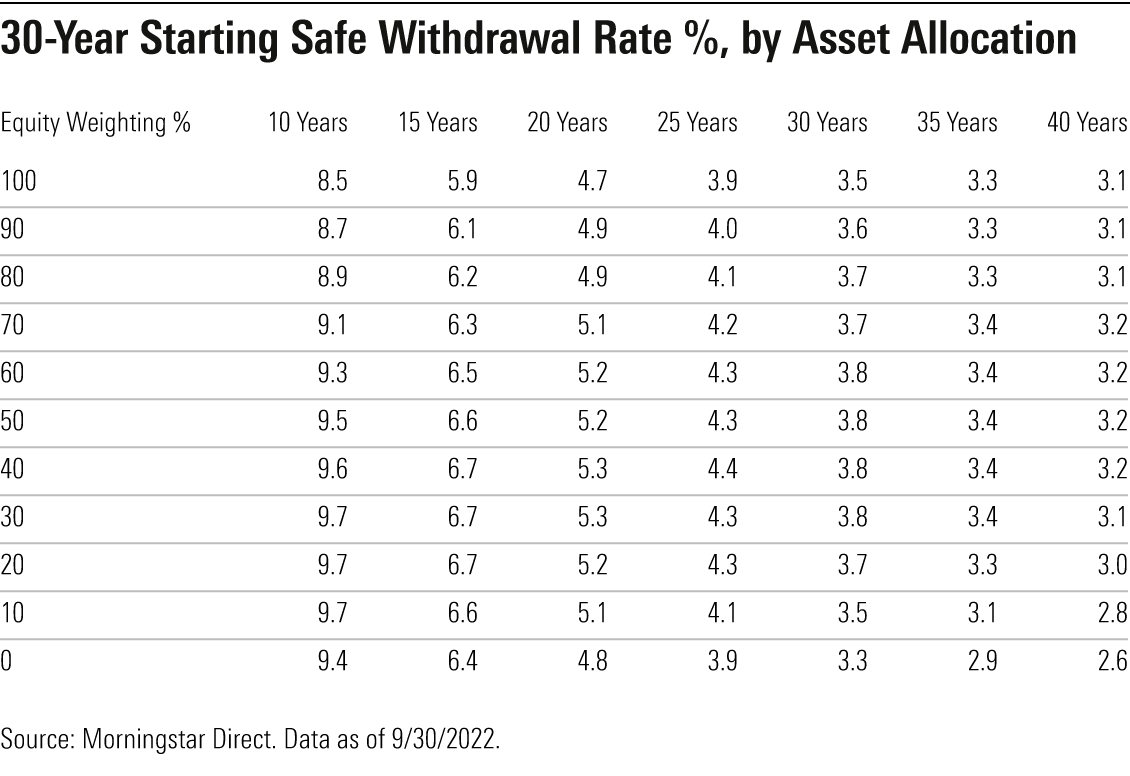

Even factoring in those higher inflation adjustments, however, our research suggests that retirees embarking on retirement today can reasonably use a higher starting withdrawal rate than indicated last year. Moreover, our research suggests that new retirees don’t need to stick their necks out with higher equity weightings in order to obtain higher starting paydays.

While with our base case we concluded that a 50% stock/50% bond portfolio was likely to sustain itself over a 30-year time horizon with a 3.8% starting withdrawal, we found that a retiree could dial equity exposure all the way down to 30% and still employ that same starting withdrawal percentage of 3.8%.

For retirees with time horizons of 10 to 15 years, portfolios with equity weightings of less than 40% generally supported higher withdrawal rates than more aggressively positioned portfolios would. The reason is that not only have bond-return expectations improved markedly thanks to higher yields, but bond returns are much less variable than equity returns.

How Alternative Withdrawal Systems Can Help

Those findings come with significant caveats. For one thing, portfolio values have declined, so the higher safe starting withdrawal percentage in our 2022 research doesn’t necessarily translate into a higher payday for people embarking on retirement today versus those starting retirement a year ago, when balances were higher.

Moreover, it’s important to note that the assumptions in our base case are pretty conservative. Many retirees don’t have a 30-year time horizon in retirement, and our 90% success rate target is high. Retirees could dial down their desired success rates even a small amount and achieve a meaningful lift in starting safe withdrawal rates.

Perhaps the most significant caveat is that our base case spending system may not reflect the way that many retirees actually spend. A fixed real withdrawal system, whereby the retiree withdraws X% of his or her portfolio in Year 1 and then inflation-adjusts the dollar amount thereafter, provides a steady “paycheck equivalent” over the whole retirement time horizon. Yet actual retiree spending shows a different pattern. Specifically, research from David Blanchett, formerly of Morningstar and now at PGIM, demonstrated that retirees often spend the most in the early years of retirement, then gradually reduce spending over their retirement years. They might elevate spending again in the later years of retirement to fund higher healthcare outlays, especially long-term care.

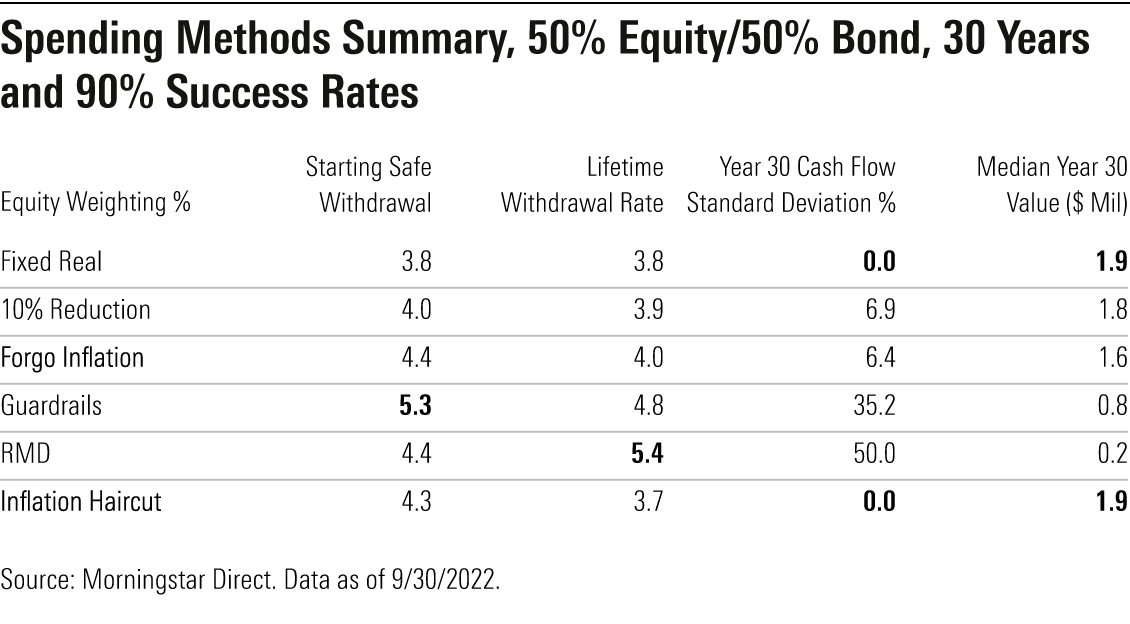

The net effect of that pattern, Blanchett found, is that retirees don’t spend in line with inflation—they increase their spending roughly 1 percentage point less per year than the inflation rate, on average. Thus, in this year’s research, we decided to model an alternate scenario with an inflation adjustment of 1.8% annually (versus 2.8% in our base case). The net effect of that ongoing haircut to real withdrawals, predictably, is that the starting safe withdrawal rate jumped to 4.3% for a balanced portfolio over a 30-year time horizon with a 90% success rate. The trade-off, however, is that lifetime withdrawal rates decreased relative to a fixed real withdrawal system—not surprisingly given the reduction we gave to inflation adjustments.

In-Depth on Dynamic Withdrawal Systems

As in last year’s paper, we tested a variety of additional flexible withdrawal systems. These ranged from ultrasimple adjustments—such as forgoing inflation adjustments after the portfolio lost value in the preceding year—to more-dynamic systems such as the “guardrails” approach pioneered by financial planner Jonathan Guyton and computer scientist William Klinger. Our research found that all of these systems elevated starting and lifetime withdrawal rates (the average portfolio withdrawal rate over a 30-year time horizon) relative to the fixed real spending system we used as our base case.

Yet our research also pointed to trade-offs associated with these dynamic strategies. The most obvious one is that they subject retirees to more variability in their real cash flows. Those cash flow variations, as reflected in the Year 30 Cash Flow Standard Deviation percentages above, ranged from modest to more dramatic. Two strategies that we tested—forgoing inflation increases and taking a 10% income reduction following a portfolio loss—elevated cash flow variability just a bit relative to the base case, because the adjustments were applied only after portfolio losses. Meanwhile, the guardrails strategy and taking withdrawals in line with required minimum distributions gave a big boost to starting safe and especially lifetime withdrawal rates, but they resulted in much more variability in portfolio cash flows from year to year. That’s because both strategies effectively give retirees a raise in good markets and a paycheck cut in bad ones.

Another dimension that we explored was “leftover assets”—an important consideration for bequest-minded older adults. Fixed real withdrawal systems (our base case) and modest tweaks thereto (such as taking an inflation adjustment less than the actual inflation rate) tended to result in the highest remaining balances in Year 30. Thus, such methods would tend to be most appropriate for retirees who aim to leave legacies for family or charity. At the opposite extreme, the guardrails method and especially the RMD method actively encourage retirees to consume by providing upward income adjustments in good markets. They’re therefore most appropriate for retirees who are interested in maximizing consumption during their own lifetimes.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own

.jpg)