Home may be where the heart is, but right now conditions in the U.S. housing industry are beginning to break many hearts.

Boom times during the past 10 years are now going bust, as the ultralow interest rates that benefited this rate-sensitive industry for so long have climbed sharply this year, a function of the Federal Reserve Board’s bid to rein in inflation.

Already in a slump, industry dynamics are seen worsening in the coming year and are expected to be a drag on already beaten-up housing-related stocks, particularly homebuilders.

“This is a house with a lot of smoke alarms and they are all going off,” says David Kelly, chief global strategist at J.P. Morgan Asset Management. “The problem with housing from an investment standpoint is that it takes a long time to clear the excesses and a long time to get to the bottom. Next year will be a tough year for housing.”

“We can’t escape 2023 with many positives,” says Brian Bernard, director of equity research at Morningstar, covering industrials and homebuilders.

Housing Will Get Worse Before Getting Better

“It won’t be another 2009,” says Bernard, referring to the global financial crisis of 2007-09, which was triggered by reckless mortgage underwriting, the use of nontraditional mortgages, and exotic leveraged investments tied to housing that led to the collapse of the housing sector. “But housing data gets worse before it gets better.”

As the excesses in the industry unwind, Bernard predicts challenging times through 2024. He’s now projecting housing starts will decline 18% in 2023 to 1.275 million from a prior forecast of 1.42 million. That’s in line with levels last seen in 2018-19, before the pandemic. Prices on new homes should drop by 15% and on existing homes by 5%, Bernard predicts.

Bernard expects mortgage rates eventually to decline to 4.5% in 2024 from the current 6.41%. The combination of lower rates and lower prices should eventually result in an industry rebound sometime in 2024, he says. But that’s a ways away.

Over at Fannie Mae, the government-sponsored mortgage lender, home prices are now forecast to rise by 9% in 2022, down from a previous forecast of 16% and the record 18.8% recorded in 2021. For 2023, Fannie Mae sees home prices declining 1.5% from a previous forecast of a rise of 4.4%. Coming into 2022, home prices have risen every year since 2012 by an average of nearly 8%.

Housing Stocks to Stay Under Pressure

Against this backdrop, expect the stocks of the major homebuilders to remain under pressure, says Bernard.

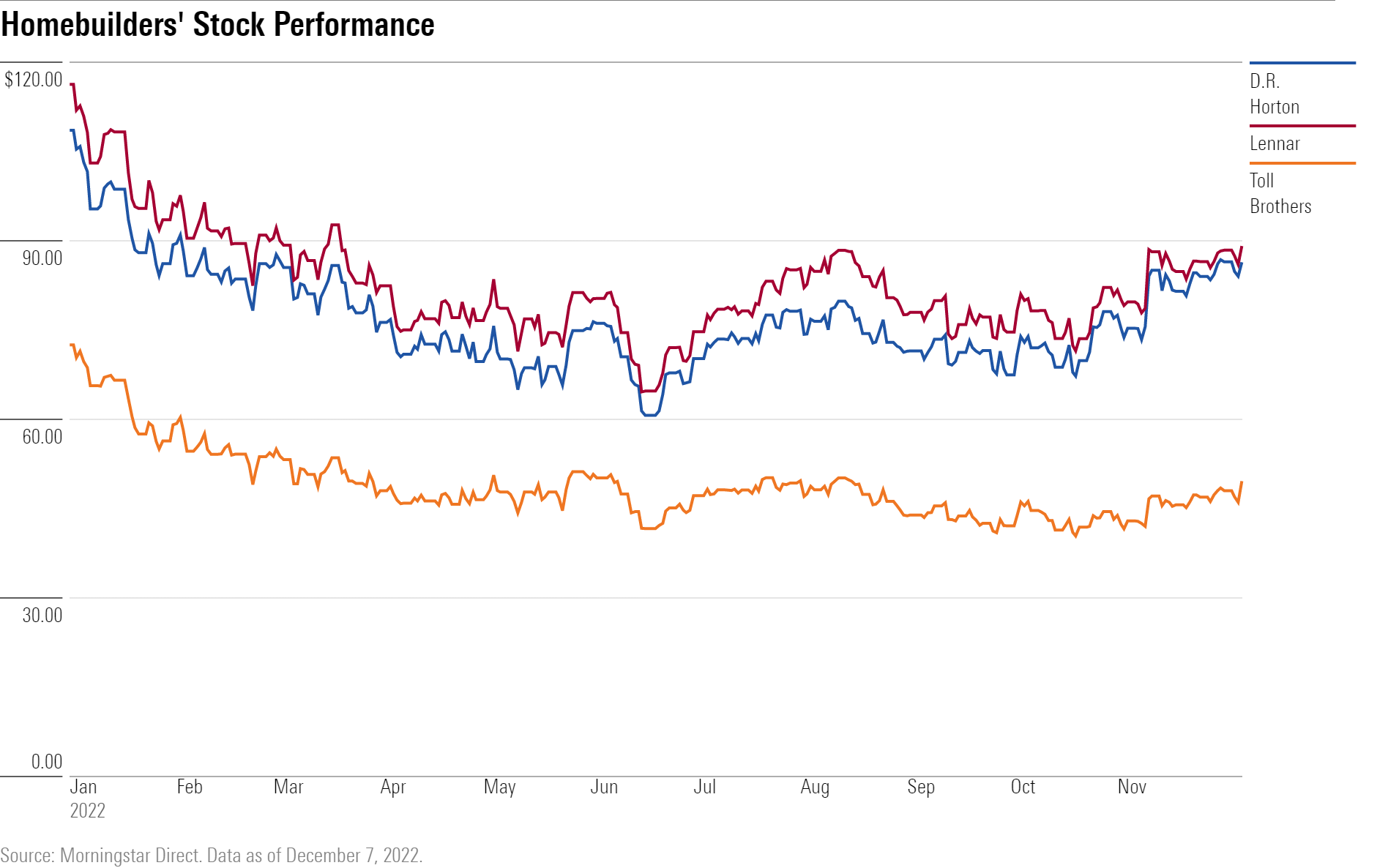

The industry leaders he follows, D.R. Horton (DHI), Lennar (LEN), and Toll Brothers (TOL) are off their mid-June lows when they were down by 40% or more, rallying in recent weeks on optimism the Fed will begin slowing the pace of its rate hikes. They also got a lift this week when luxury builder Toll reported record fiscal fourth-quarter 2022 earnings on the back of pricing strength based on its backlog of homes under contract, and said it was well-positioned for 2023 because of its backlog.

Still, Toll chair and chief executive Douglas Yearley Jr., in discussing the results, also noted that “the dramatic increase in mortgage rates since March presents a challenging market as we enter fiscal year 2023. Many homebuyers are on the sidelines, waiting for clarity on the direction of mortgage rates and the overall economy. Our net signed contracts were down 60% in units and 56% in dollars in the fourth quarter, with no discernible change nearly halfway through our first quarter.”

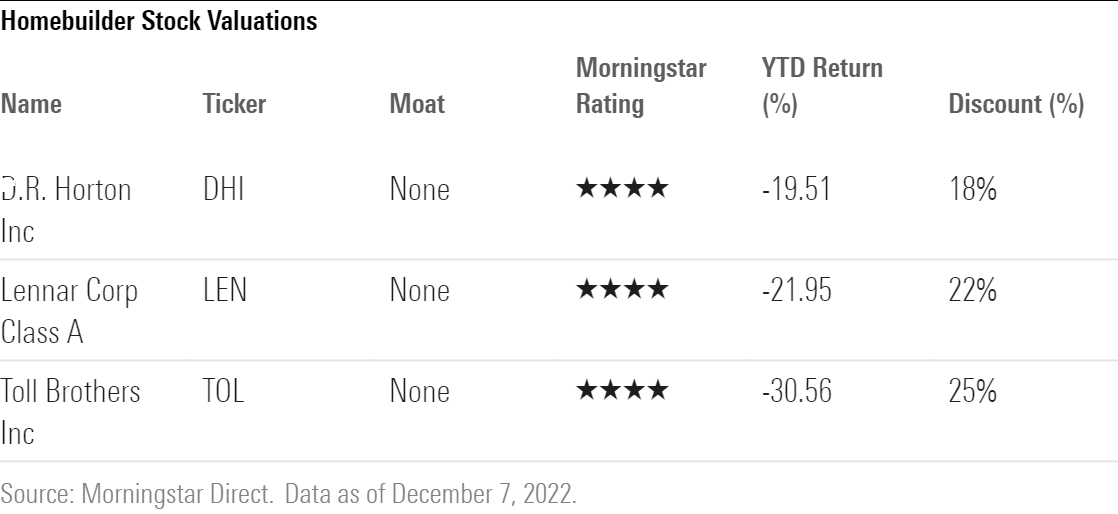

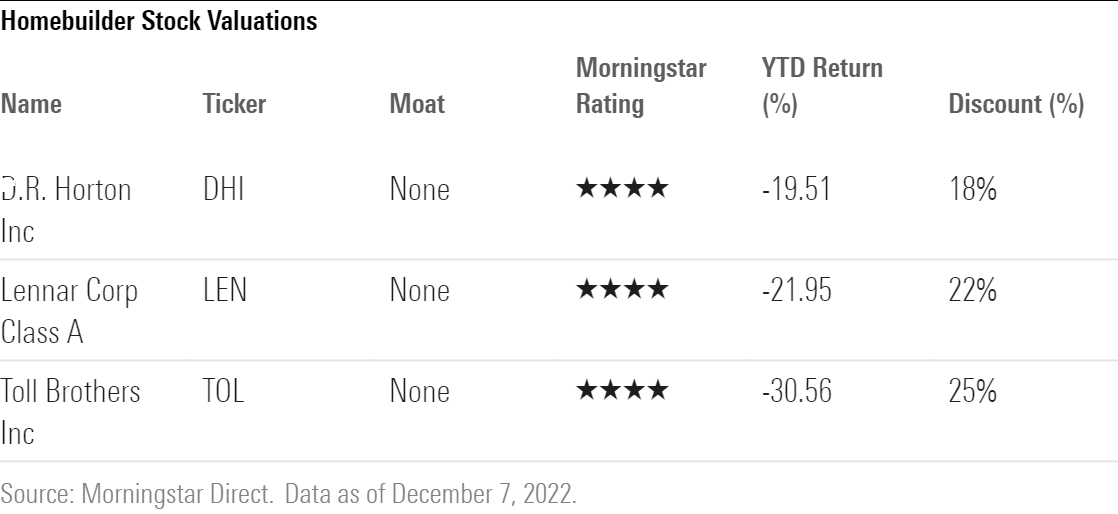

Each of the homebuilding stocks Morningstar’s Bernard covers carries a 4-star rating, indicating good value, but he warns there’s considerable risk they will get even cheaper.

Toll is a custom luxury homebuilder, says Bernard, whose homes take 13 months on average to build, and that most of these deliveries are under contract. That’s helped support prices and margins in 2022. “That won’t be the case on new orders that will begin delivering in 2024,” he says. Other builders build faster and build more on speculation, he explains, so the impact of fewer orders and lower prices and margins on those orders will be felt sooner.

Throughout this year, Adrian Helfert, chief investment officer for multi-asset strategies at Westwood Holdings Group (WHG), has pared his position in Toll significantly, anticipating more difficult and volatile conditions ahead in housing.

The homebuilders are “extraordinarily cheap,” trading at mid-single-digit price/earnings ratios, but he says “there’ll be a better entry point” once home prices and mortgage rates begin to fall.

The stocks have gotten crushed this year and are underperforming the nearly 19% drop in the Morningstar US Market Index. Toll’s 32% drop is almost double that of the market’s. At a recent price of US$49.49, it trades 25% below Morningstar’s fair value estimate of US$66 a share. Toll stock sports a P/E ratio of 4.54, suggesting investors are antsy about overpaying at a time when the outlook is darkening for residential construction.

D.R. Horton, down about 20.5% this year, trades at an 18% discount to Morningstar’s fair value estimate of US$105 a share. Its shares closed at a recent price of $86.27 a share putting its P/E ratio at 5.22 times earnings.

Changing hands at US$84.93 a share, Lennar stock represents a 22% discount to Morningstar’s fair value estimate of US$114. It trades at 5.9 times earnings.

On the plus side, homebuilders are in far better shape in every which way than was the case in the last housing downturn. They have stronger balance sheets and have lowered their net debt/capital ratios significantly in the past two years. They are managing their inventory well by cutting prices, offering incentives, and even revising contracts, a practice they rarely engage in, says Morningstar’s Bernard. Their land management strategies are more flexible. And they’ve begun to rent the single-family houses that aren’t selling.

There’s growing concern that the ongoing pressures in the housing market could complicate the Fed’s delicate dance of bringing down inflation without causing a full-blown recession, especially if unemployment rises and consumers come under greater stress. Residential housing represents a small portion of the overall economy, about 4.3%, but developments in the industry can have far-reaching impacts on consumer spending that spread beyond the homebuilding and construction industries to a score of other segments, ranging from consumer durables—that is, the furniture and appliances to outfit homes—as well as home-improvement retailers, mortgage lenders, real estate brokers, and moving services.

“We estimate the decline in home sales and homebuilding will directly reduce real GDP (gross domestic product) by 0.6% at year-end 2022 and by 0.2% the following year,” says Kelly of J.P. Morgan. He’s fearful that stresses in the housing industry, combined with a slowdown in manufacturing and weakness in exports, “could help tip the economy into recession in 2023.”

What’s Driving the Housing Slowdown

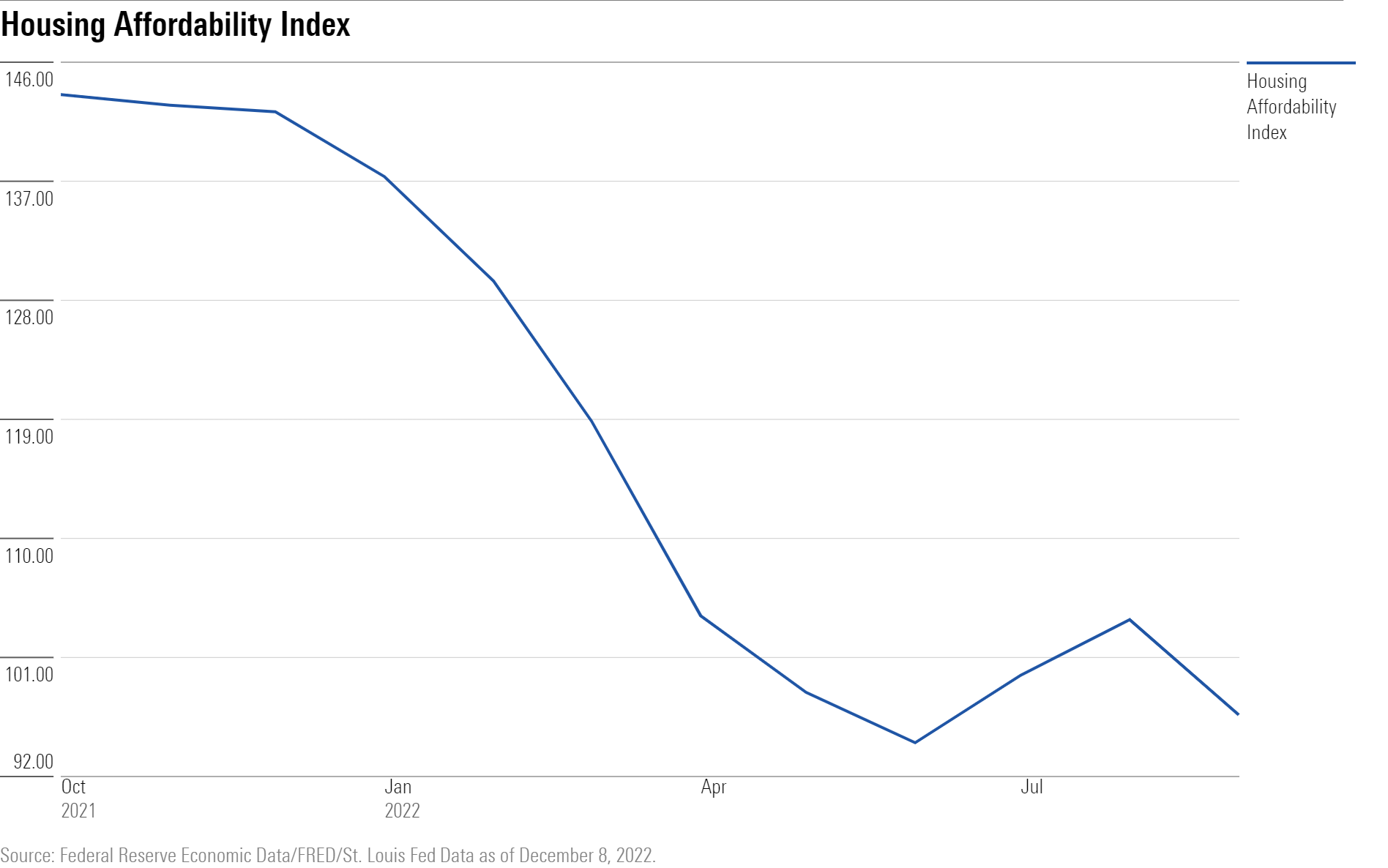

Mortgage rates are at the highest levels since 2008 and more than double the level of a year ago. House prices remain elevated despite decelerating this year and retreating from the record 18.8% gains of 2021.

That’s increasingly putting homeownership out of reach for many, particularly first-time homebuyers. In September, the Housing Affordability Index, a gauge used by the National Association of Realtors, fell below 100 for the fourth time since April, indicating that a typical family making the median income had less than the income required to buy a median-priced home.

It has also slammed the brakes on new and existing home sales and housing starts.

Mortgage refinancing applications, an important tool for homeowners to tap into their home equity to lower their monthly payments to free up cash for other purposes, such as paying down debt or making renovations, has fallen to 20-year lows as rates have risen. The dollar volume of refinancing applications fell 86% year-over-year through last week, according to the Mortgage Bankers Association.

Mortgage applications to buy a new home fell 3% for the week ended Dec. 2, and were 40% lower than the same week one year ago.

Spooked by the largest year-over-year mortgage rate increases in 40 years, buyers backed out of deals and pushed pending home sales in October down by 32%, according to Redfin (RDFN), a publicly-held residential real estate brokerage based in Seattle. The national median monthly mortgage payment in October rose 3.7% to US$2,012 from $US1,941 in September, according to the Mortgage Bankers Association, representing a 45.5% year-over-year increase.

Forced to put their homeownership dreams on hold, potential homeowners continue to rent, pressuring rental prices higher and eating into incomes and making it harder for new buyers to save for down payments.

Multifamily a Bright Spot

That has led to a bright spot in the industry: Multifamily construction remains strong. Lennar expects to spin off its Quarterra Multifamily unit later this year under the parent company Quarterra Group.

Yet, even with the sharp drops in housing sales and starts throughout the course of this year, the supply of houses remains below demand, and that’s helping to keep prices elevated. At the same time, would-be sellers are taking their homes off the market, handcuffed by mortgage rates that are lower than what is now available, and that’s led to supplies shrinking further. Roughly, 85% of mortgage holders have a fixed-rate mortgage lower than 5%, says Morningstar’s Bernard.

Mortgage Rates Have Likely Peaked

While most market watchers think mortgage rates peaked at the 7% level in early November, “it will take a while to get to 5s and 4s again,” says Kelly.

He’s looking to the second half of 2024 for any meaningful recovery, assuming the Fed first cuts rates in December 2023 followed by “multiple cuts in 2024.”

House prices appreciated 94.5% in the past decade, according to Enrique Martinez-Garcia, senior research economist at the Federal Reserve Bank of Dallas. Much of the increases occurred during the early years of the COVID-19 pandemic when prices rose 40% between the first quarter of 2020 and the second quarter of 2022. He estimates housing wealth increased by US$9 trillion in that time frame, almost completely due to price gains.

The Fed will need to pivot and ease before housing stabilizes, says Kelly of J.P. Morgan.

.jpg)