It is in our nature to try to forecast what the future might hold, but it is not a wise move as an investor. That’s one of the lessons from Morningstar’s Investment Outlook for 2023.

What are we supposed to do then? Dan Kemp, Morningstar Investment Management's global chief investment officer, is joining us for a chat about how you as an investor can set yourself up for success in this challenging market climate. A full transcript is below.

***

Johanna Englundh: Morningstar has just released an investment outlook for 2023. And Morningstar's Global Chief Investment Officer, Dan Kemp, is here to give us a heads up of what to keep in mind when we try to navigate the market in the new year.

Dan, from this 2023 outlook, is there anything that stands out from previous years?

Dan Kemp: Well, Johanna, I think the first thing that stands out is that we think about outlooks a little bit differently from other people. We believe that the future is uncertain and therefore unpredictable. And so, we don't spend our time trying to forecast what's going to happen in the year ahead. Instead, we think about the investor and how they navigate whatever 2023 has ahead for us. And so, we always start thinking about investment from the investor perspective. We've done that with this outlook as well that it's geared around the challenges that investors face as they think about 2023, the challenges posed by markets and even the challenges posed by different life stages in terms of their investments. So, this is far more an outlook for the investor than it is an outlook for the markets. The other thing that's changed, of course, is the investment landscape as we enter '23 is different from that which we entered in '22. And so, that marks a change as well.

JE: Okay. So, it's more up to the investor to not forecast the future but rather to construct a solid portfolio really to help us reach our long-term goals. But I do however think that a lot of investors might have been a bit disappointed with some classic portfolio structures like the 60-40 during 2022. Do you think that these older theories of diversification will still hold in the future?

DK: That's a really, really good question. And as we think about '22, you're absolutely right that it was a real surprise for a lot of people, because not only did we have share prices falling – and that happens frequently, particularly when we have big global macroeconomic shocks like the war in Ukraine – but also, bond prices fell as well. And people typically rely on the price movements of bonds to offset that of shares because they normally move in opposite directions. And so, if you hold both shares and bonds in your portfolio, then one is designed to offset the other, and that may give you a smoother ride as an investor. That didn't happen in '22. But it usually does happen. If you own high-quality bonds, then typically, that's the best insurance policy if you want to protect the portfolio against these periods of market volatility.

Now, there's been times in the past where it hasn't happened as well. So, there was an event called the taper tantrum in 2013, there was a period in 1994, and then there was a period in the early 70s when again we had this synchronised downturn in equities and bonds. But the fact that we can highlight those three areas in the last 50 years is a real reminder that normally bonds do their job. And there's no reason to expect that bonds won't do their job in the future. So, the key is to understand the value of these assets that when prices are really high, then they're less likely to be supportive of future returns. The benefit for investors as we enter '23 is that prices are lower than they were as we came into '22.

JE: Okay. So, diversification is not out of fashion then. But for those investors that might still feel a bit worried about this ever so quickly market and all these changes, what advice would you like to give to them?

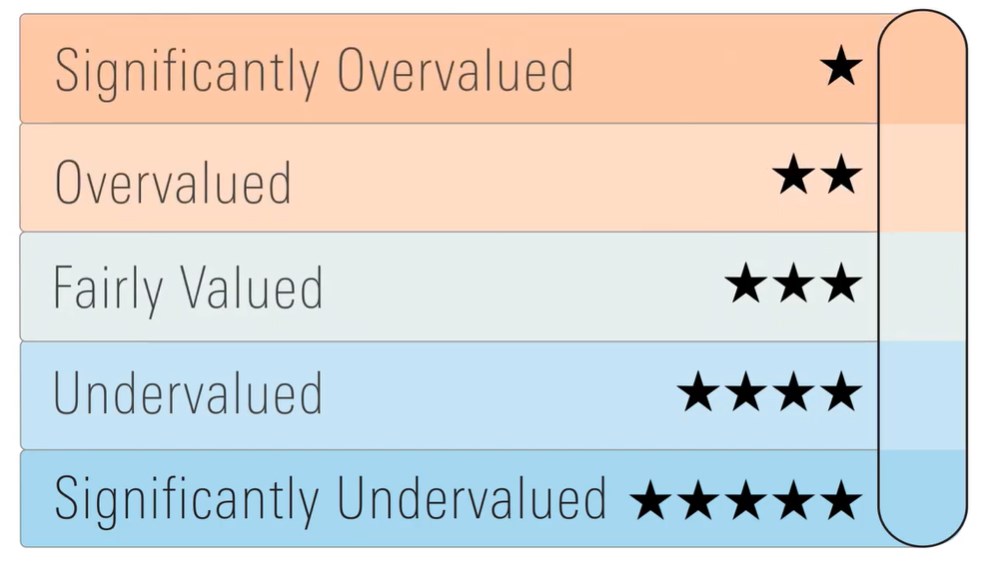

DK: Yes. So, the first thing to remember, and as I mentioned it at the beginning of our conversation, that the future is uncertain. And the definition of uncertainty is that we not only don't know what the outcome will be, but we don't know the range of possible outcomes. So, uncertainty is different from risk. When we think about risk, we can think of that like rolling the dice. You don't know what number will come up when you roll the dice, but you know it will be somewhere between one and six, and you can work out the probability. Whereas when we're thinking about the future, when we're thinking about investment, then the future is uncertain. And we all feel really uncomfortable about that uncertainty. And so, the danger is that we transform that uncertainty into stories, into narratives that then drive our behaviour. And when we try and create narratives about the future, then we normally make mistakes. So, we could become too aggressive in our investing when prices are high and too defensive, too depressed about the investing conditions when prices are really low, and that tends to be supported by the news flow that we see around us and the announcements and the positive and negative sentiment of other investors. So, the most important thing as an investor is to try and protect yourself, insulate yourself from all of that news and noise around us and remember that when prices are low, that's a better time to invest.

JE: On that note, thank you so much, Dan, for sharing your thoughts. And until next time, I'm Johanna Englundh for Morningstar.