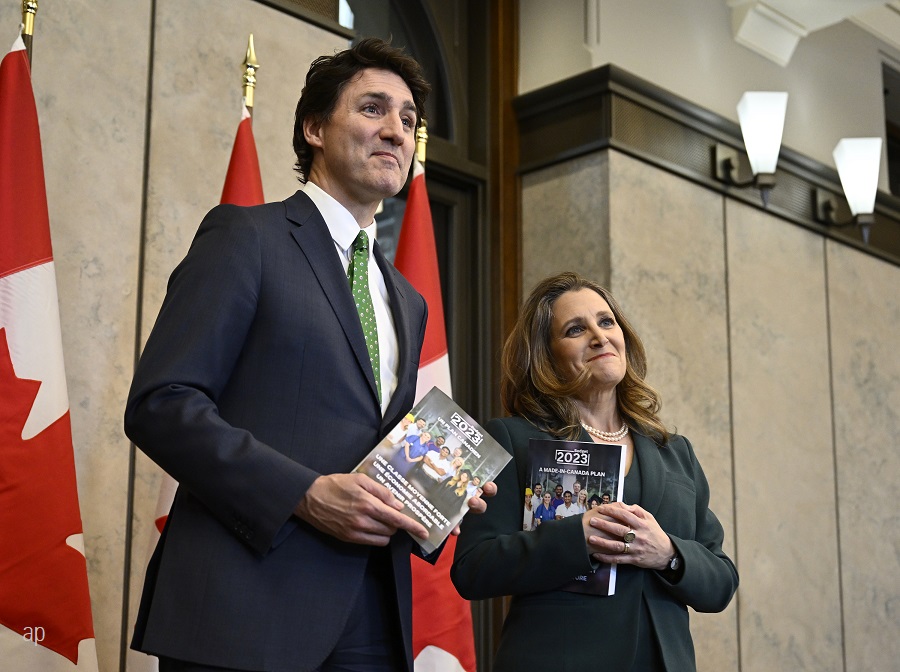

Despite the focus on affordability in the 2023 federal budget, it looks like house prices will stay higher – to the benefit of owners and perhaps the Canadian economy, although perhaps less so for new home buyers.

The federal government had been sprinkling housing affordability initiatives on the electorate in the lead-up to the budget, but today what caught the eye of Realosophy’s John Pasalis was the most recent move aimed squarely at interest rates and mortgage providers.

Banks on Notice to Give Existing Homeowners a Break

As mentioned in the budget, the Federal government, through the Financial Consumer Agency of Canada, is publishing a guideline for federally regulated institutions to take appropriate “relief measures” for homeowners in a bind. The measures for mortgage holders could include extending amortizations, adjusting payment schedules or authorizing lump-sum payments.

“This announcement will have a meaningful impact on the thousands of households who need to renew their mortgage during today's high interest rate environment,” says Pasalis, “It will give banks more flexibility when negotiating mortgage terms with homeowners that will effectively reduce the owner's mortgage payments to soften the payment shock due to today's high interest rates.”

Pasalis says the new policy for mortgage providers serves two purposes:

- First, it will mitigate the risk of homeowners defaulting on their mortgages or finding they are forced to sell when they cannot afford the roughly 40-50% increase in their payments, and

- Second, the Federal government is minimizing the risk that higher debt payments might lead to a significant decline in household spending which might push Canada's economy into a deep recession.

But what about those who don’t already have a home?

For Hopeful Home-Owners, There’s the First-Time Home Buyers Plan

The considerations for the wider Canadian economy, and those that aren’t currently homeowners, extend to offerings like the Tax-Free First-Time Home Buyers Plan (FHSA), a cornerstone Liberal campaign pledge for new buyers. But the response is mixed on its ability to address affordability.

On the one hand, the FHSA gives buyers a plan that allows $40,000 in tax deductions, as well as a tax-free withdrawal. On the other hand, to make the most of the plan, the new buyer had better start saving the moment they turn 18 to make the most of compounding before they need to buy a house.

“Where is all this money coming from, for the average person?” asks Ron Butler of Butler Mortgage. “If you start to add up all the money you’d have to have to save to max out [all these accounts], you’d need to have an income of $200,000 a year and dump a quarter of it into [savings].”

These Home-Focused Accounts are Theatre

For new home buyers in Canada, the limitations of the FHSA are in line with offerings that are mostly just for show, according to Butler.

“I think it’s a lot of theatre,” says Butler, “Because it doesn’t make sense. The Tax Free First-Time Home Buyers Plan is like an imitation Registered Retirement Savings Plan (RRSP). It does have the upside of tax deductibility when you deposit,” he says, “But here’s the truly wacky part. With an RRSP if you withdrew the money, you could actually keep the benefit of the RRSP. Your retirement savings allotment is intact.”

Not so with the FHSA – because you don’t get that tax-advantaged allotment back.

Instead of creating a new account which was costly for both taxpayers and banks, Butler remarks: “They could have just tweaked the RRSP account, but no, not enough theatre.”

What Does Canadian Housing Need?

Butler contends the solution to housing affordability in Canada is simple, (although perhaps politically difficult):

“The only hope we have is a legitimate stick,” says Butler. If a city has zoned and approved a new project, and the developer sits on a permit and doesn’t build or finish building it, there should be penalties.

Butler suggests the federal government could say to municipalities: “If you don’t tax them [the developers] into oblivion, we’re going to withhold federal transfers.”

In Ontario, for example, he notes that there are five families behind around 50% of the development activity in the province and can more comfortably sit on projects relative to publicly traded developers under shareholder pressure. The Feds need to force the issue that way, says Butler. Otherwise, it's left to the provinces who control the municipalities. “It’s a land game,” he adds.

How Are Canadians Affording Real Estate Now?

In the land game that remains in Canadian real estate after this budget, what’s the best bet for first-time home buyers?

“If they don’t have parents with money, they have to move to Alberta [from Ontario],” says Butler.

Currently, he sees most real estate sales in units under a million dollars. Above that, “the [interest] rates don’t make sense,” says Butler.

Canadian Real Estate Demand Should Stay Strong – But Not from Investors

Monetary policy has already taken the froth off the market, especially among investors says Butler, “The purchase volume is down. And you can’t ‘buy the rent’ anymore. That died with interest rates,” he says, adding that “The price is too high and still, the rents are too high”

While investors may be out of the picture, average home buyers should remain on the scene.

“There is a profound desire in this country to own homes. If you give them [new homebuyers] an opportunity today to buy a home, they’ll buy,” he says.