No one likes to be dumped. And in financial planning, a client breaking up with you isn’t just unpleasant—it’s costly.

When a client leaves, you’ve lost out on their business; you’re out the costs you’ve already put into the client; and you’re losing any business you might have earned from their referrals. And with the megaphone of online reviews, a particularly disgruntled former client can cost your business even more.

But even if an unhappy client chooses to stay, they can still cost you a pretty penny. Research has shown that clients often won’t outright end a relationship with an advisor, decreasing their assets with them instead. That means you could have people taking up space in your practice who would rather not be there.

When a client leaves, it can be tempting to offload the blame on poor returns, but this stance is problematic for two reasons. First, the fact is clients do not tend to leave advisors just because of bad returns—consider research from the global financial crisis that showed clients largely stuck with their advisors even amid a bad market. Second, lackluster returns are going to happen sometimes, so pinning the blame on them puts you in a powerless position when it comes to retaining clients.

In our latest work, we examined why clients left their advisors, to learn what you can do about it.

Top Reasons Clients Fire Their Advisors

We gathered data from 184 investors who have previously fired their financial advisor and asked them, “Why did you choose to stop working with [an] advisor?”

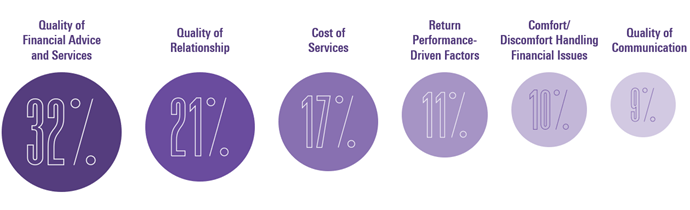

We found six common reasons why clients fired their advisors. The most common reasons were:

- Quality of financial advice/services (32% of responses)

- Quality of relationship with an advisor (21%)

- Cost of services (17%)

Clients also mentioned they fired their advisors because they were unhappy with returns (11%), felt comfortable handling their own finances (10%), and felt they were missing quality communication (9%).

Our results show the decision to fire an advisor is more complicated than being unhappy with returns—that only told 11% of the story. Still, there are a lot of financial issues motivating clients to fire their advisors, which may drive some to despair, but we still think there is a lot an advisor can do to anticipate and remedy these issues.

How to Not Get Fired

Having identified the main issues, let’s talk about how to resolve them before your relationship with a client goes south.

1. Issues regarding the quality of advice and relationship can be addressed by better understanding each client and their specific financial needs and goals.

Clients don’t want an advisor who makes them feel like a number, so take the time to show that you see them as a person. A goal-setting exercise, like this master list, can help you and your clients delve deeper into what they want and need. But this isn’t where the work ends. Clients will struggle to understand the value of your advice if they cannot see how it connects back to the goals they are working toward, so revisit these goals and how they align with their financial plan in your ongoing conversations.

2. Issues regarding the cost of services, comfort handling finances, and communication can be addressed by effectively communicating your value.

Intentionally communicating with your clients about how you are meeting their personal needs can help resolve issues that ultimately stem from clients misunderstanding your role as a financial advisor. Research from our team shows clients and advisors tend to have a mismatch between what they think the value of a financial advisor is. You should be able to communicate to clients not only how you provide the value they are looking for but also provide the value they may not even be aware of.

3. Issues regarding return performance can be addressed by setting expectations for the relationship early on.

Clients rank the ability to “maximize my returns” as the fourth most important value financial advisors bring to the table. Ultimately, this stems from a misunderstanding of investing and financial advisors. When establishing a relationship with a new client, clarify the value of taking the long view when investing. Some clients may benefit from reminders about the value of keeping their expectations on returns in check, but if you are consistently finding a client is only interested in immediate returns, remember it is OK to consider releasing them as a client.