Canadians Prefer Global Balanced Funds

The latest Morningstar Balanced Fund Landscape for Canadian Investors reveals that local funds close to make way for global options.

Morningstar's 2023 Balanced Fund Landscape for Canadian Investors shows that Canadians continue to prefer global exposure in their balanced funds. While global balanced funds (those holding more than 70% of assets outside of Canada) grew substantially, Canadian balanced funds (those holding more than 70% of assets within Canada) lost ground. You can read the whole report here.

The report's authors, Morningstar's associate manager research analyst Michael Dobson and director of manager research Danielle LeClair estimated that from the start of 2012 through the first quarter of 2023, 683 balanced funds opened and 456 closed. Most of those that closed were Canadian strategies.

"Canadian investors wanted more globally oriented portfolios, and the fund companies responded by creating more global balanced funds and shuttering more Canadian balanced funds," Dobson said.

According to the report, “As of the end of March 2023, retail assets in balanced funds totaled over $740 billion. This represents a growth—through flows and capital appreciation—of roughly $140 billion over the five years ended March 31, 2023."

How Did Balanced Funds Perform?

A volatile 2022—in which rising interest rates pressured both bonds and stocks—called the traditional 60/40 portfolio approach into question. In fact, the authors say that 2022 was only the second calendar year since 2007 that all six Morningstar Canada allocation benchmarks recorded a loss; the other year was 2008.

“Every Morningstar Canada balanced benchmark lost money in 2022 for the first time since 2008 as rising interest rates pressured all asset classes and increased correlations," the authors wrote. "Longer time frames still show a strong case for the diversification benefit of balanced funds. Despite these short-term setbacks, patient investors were rewarded if they held their funds. The last 15 years saw the benchmarks produce an annualized return between 4.0% and 6.6%."

Still, the authors found that investors pulled out of balanced funds during the recent market turbulence, with net outflows of $26 billion from the start of 2022 through March 2023.

ETFs Have Contributed Heavily to the Growth of Balanced Funds

In 2018, Vanguard launched its suite of all-in-one exchange-traded funds. It launched three funds at a fourth of the cost of the average fund at the time. Other ETF providers followed suit.

"Balanced exchange-traded funds have taken off, especially after Vanguard entered the market," Dobson and LeClair wrote. "The number of balanced ETFs more than doubled to 58 from 24, and their assets sextupled to $12 billion from $2 billion over the five years ended March 31, 2023."

The authors argued that the increased competition from these low-cost entrants contributed to the trend of lower fees for all balanced funds—a trend that is certainly to investors' benefit.

"Fees for balanced funds have declined over 15% over the past 10 years. Balanced ETFs and fee-based share classes have declined the most, with reductions of 28% and 17%, respectively," they found.

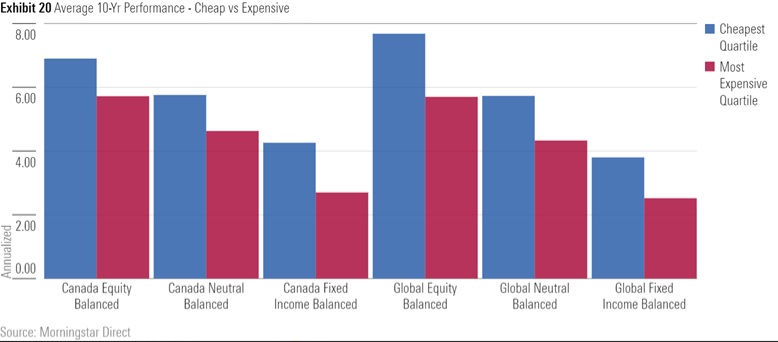

Fees Matter – Cheaper Funds Outperform Expensive Ones

Morningstar has always held the view that fees matter. Morningstar director of investment research Ian Tam found that after 10 years, the impact of a 2% fee results in a difference of 18% less wealth when compared with no fees. "After 20 years, that gap balloons to 33%," Tam said. "So, you need to be diligent in monitoring the fees you're being charged because the fees you pay are detrimental to the amount of wealth you will end up with."

Balanced funds are no different.

Over the past 10 years, cheaper funds typically outperformed their expensive counterparts,” wrote Dobson and LeClair, adding that times are changing for balanced funds in Canada. "This reinforces the importance of fees as the most reliable predictor of performance over time. If investors continue to seek out cheaper and robust portfolios, the change will be for the better."