:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

With much of the rally in stocks being driven by a handful of mega-sized companies, some market watchers have been sounding the alarm about the durability of the bull market. But one strategist isn’t concerned; in fact, she thinks the hype is warranted.

BlackRock global chief investment strategist Wei Li points to exceptionally strong earnings across most of the stocks known as the Magnificent Seven, especially with the exponential growth of artificial intelligence technology. “As I look ahead to this year, I’m reasonably comfortable and confident that the earnings picture is going to stay quite strong, supported by tech and the Magnificent Seven,” she says.

The Morningstar US Market Index is up 7.2% for the year and 25.5% since its October 2023 low. These gains have come despite the prospect of the U.S. Federal Reserve making fewer interest rate cuts this year than expected, thanks to strong inflation and historically high valuations.

Markets Soar on High Earnings, AI Hopes

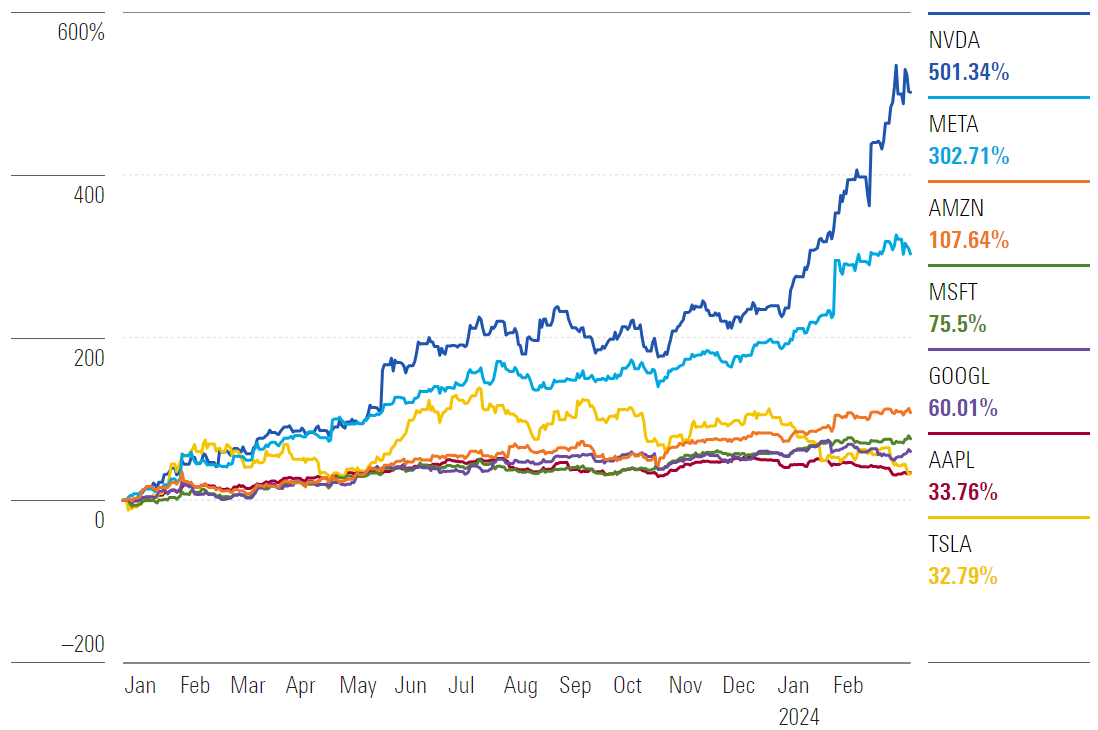

Much of the returns in the broad market have come from the stocks known as the Magnificent Seven: Nvidia NVDA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, Alphabet GOOGL, and Tesla TSLA. Over the past year, the group has been responsible for 33% of the market’s rally. Since the beginning of 2024, Nvidia, Microsoft, Meta, and Amazon account for just over 50% of the US Market Index’s return, according to data from Morningstar Direct.

Magnificent Seven Stock Performance

Data as of Mar 15, 2024 Source: Morningstar Direct, Morningstar Indexes.

Given the narrowness of the rally, along with the less supportive economic backdrop, why aren’t markets freaking out?

Strong earnings from the Magnificent Seven mean Li isn’t concerned about the concentration risk that’s had many watchers wringing their hands. For investors, “The missing piece is earnings,” she explains. “Earnings are coming through very, very strong.” She points out that in the fourth quarter of 2023, earning growth for U.S. stocks was more than double analysts’ expectations.

The results are even more dramatic among the individual stocks of the Magnificent Seven. For instance, Nvidia’s earnings per share were an eyewatering 765% higher than in the year-ago period. Many analysts, including at Morningstar, say this growth can continue because the firm’s underlying fundamentals can support it.

A Broad Rally Isn’t Always a Good Thing

Li has an answer for investors and pundits who worry about the dominance of a relatively small group of stocks. In the period before the covid-19 pandemic, the Fed’s quantitative easing policy (wherein it pumped money into financial markets through bond purchases) bolstered investor confidence after the chaos of the financial crisis.

That infusion of liquidity and the attendant long period of low interest rates meant money was cheap and stocks soared. “A rising tide was lifting all boats,” Li says, including smaller firms whose fundamentals weren’t strong enough to justify those gains. “That was a broad-based rally,” she says. “Does that make you more secure and comfortable that everything was going up, including companies that maybe shouldn’t be going up and maybe shouldn’t exist? I’d rather the market be supported by good fundamentals, and if these fundamentals are concentrated in a few names compared to a broad-based rally, that’s fine.”

Li is confident that the forces driving a few stocks higher today—like artificial intelligence in tech and GLP1s in healthcare—have long runways. If investors can feel comfortable with that too, she says, “then the concentration is a feature, not a bug.”

Today’s Market Is No Dot-Com Bubble

In recent months, some analysts have sounded the alarm over similarities between the enthusiasm for AI and the dot-com bubble of the early 2000s, which sent stocks plummeting when it burst. Li says this comparison isn’t apt. AI stocks are rising quickly, but so are earnings expectations and (most critically) realized earnings. In other words, AI companies like Nvidia and Microsoft are living up to the hype. “It’s very, very different from back then,” she says.

Not to mention that AI is in its early stages. “We think advances from here are likely to be exponential as innovation snowballs,” BlackRock strategists wrote in their 2024 outlook. “We see the tech sector’s earnings resilience persisting and expect it to be a big driver of overall U.S. profit growth in 2024.”

Inflation Could Threaten Earnings

Li says interest rate shocks could be one of the biggest risks to market sentiment. While she believes markets may be pleasantly surprised by inflation that falls more quickly than expected in the coming months, they could stumble if the path downward continues to be bumpy.

Bumpy inflation could also threaten the robust earnings that have underpinned the market’s seemingly unstoppable rally. Li says she’ll be looking for early indicators of margins contracting as a sign that softer numbers might appear in quarterly earnings reports. “How margin develops will be key.”

The author or authors do not own shares in any securities mentioned in this article.

.jpg)