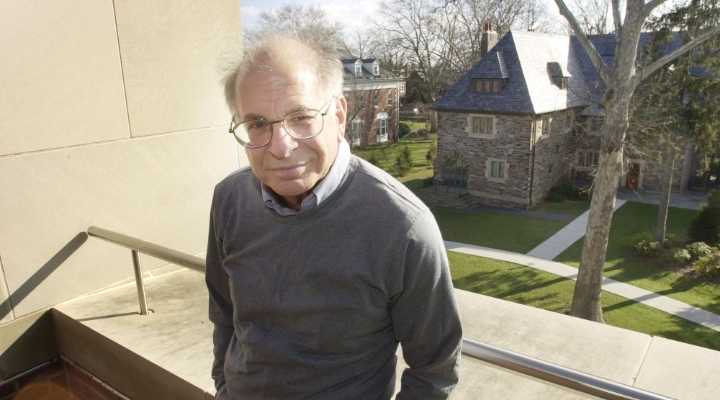

Nothing in his early life suggested that Daniel Kahneman, who died last week at the age of 90, would eventually win a Nobel Prize in economics.

To start, the 2002 Nobel laureate was trained in another subject. His PhD dissertation, in psychology, analysed a ratings scale called the semantic differential. That measure helps researchers, such as product marketers and sociologists, to better assess what respondents think about a subject. That would seem a long way from an economics prize, especially as Kahneman was an indifferent mathematician.

Also working against his candidacy was his personality. History chronicles many trailblazers who believed in themselves in the face of scepticism. Kahneman was just the opposite: wracked by self-doubt.

When asked about Kahneman's book Thinking, Fast and Slow his protégé Richard Thaler replied: "He quit writing this book at least a dozen times. And I had to convince him not to quit, n+1 times. He genuinely didn't think anybody would buy it. It was a biased forecast – he prides himself on being a pessimist."

Amos Tversky - A Lifelong Accomplice

Yet it was Kahneman's lack of self-belief that laid the groundwork for his success. The very introspection that made him so conscious of his failings underpinned his key insight: everybody was wrong. Not always, to be sure, but they made mistakes far more often than they liked to admit. People rushed to judgment by using mental shortcuts – heuristics, per Kahneman's terminology. They then sat on those opinions, rarely re-examining them even when the evidence strongly suggested that they should.

The study of errors became Kahneman's laboratory. His personality then provided him with a second gift. Because of his diffidence, he willingly accepted a partner. Those who are certain of themselves seek no assistance. In contrast, Kahneman was happy for the help. In 1969, he encountered the ideal associate. Amos Tversky was many things that Kahneman was not: confident, optimistic, and a keen mathematician. Upon meeting, the duo quickly challenged each other's beliefs and almost as quickly became lifelong accomplices.

Academic Papers by Daniel Kahneman

A series of groundbreaking papers followed:

1971: Belief in the Law of Small Numbers, which shows how people overestimate the knowledge that can be obtained from small sample sizes.

1972: Subjective Probability: A Judgment of Representativeness, which documents the related error of generalising about a broad group based on the characteristics of a few members.

1973: Availability: A Heuristic for Judging Frequency and Probability, which establishes how people frequently arrive at conclusions by comparing their current situation to a previous situation that is atop their minds (a sample size of one!).

1974: Judgment Under Uncertainty: Heuristics and Biases, a landmark paper that builds upon the previous works, while adding the process of "anchoring and adjustment." When people do change their views, their new outlooks are usually related to their previous beliefs. They are haunted by the past.

Kahneman's Useful Scepticism

Those articles were published in psychology reviews. However, economists soon found Kahneman and Tversky's work because it strongly appealed to those (such as Thaler) who doubted that investors invariably were of sound mind, as their discipline insisted.

In turn, Kahneman and Tversky obliged by beginning to consider economic issues. In 1979, they published their first paper about money: Prospect Theory: An Analysis of Decision Under Risk. It was also their first paper to appear in an economics journal.

As with most lauded scientists, Kahneman and Tversky occupied the right place at the right time. Economics had accomplished a great deal by modelling humans as strictly rational actors, but that assumption was overdue for hard scrutiny.

Along came Kahneman, with his innate scepticism and knowledge of how to conduct interviews, which was accompanied by Tversky's quantitative rigour. The pair invented a new science: behavioral economics, which evaluated how people actually made decisions.

(Tragically, Tversky died young and therefore did not receive a Nobel Prize. A great injustice, because if ever two scientists deserved to share the award, that duo was Kahneman and Tversky. Or, one could just as reasonably write, Tversky and Kahneman.)

Behavioural Economics Spreads

Kahneman and Tversky's insights spread rapidly. Behavioral economics introduced such now-common concepts as loss aversion, referring to the tendency for investors to suffer the pain of losses more keenly than they do the pleasure of equivalent gains (in the words of Larry Bird: "I hate to lose more than I like to win"); fairness, which explains why consumers dislike dynamic pricing; and the disposition effect, which encourages us to retain losers.

Their insights have extended well beyond economics. For example, rather than dispense wobbly "leadership principles," which I had both feared and expected, my MBA management course turned out to be a seminar on the work of Kahneman and Tversky. What a delight!

During this course, we spent 10 weeks making mistake after mistake, accompanied by lessons on how we could minimise (although of course not eliminate) such errors in the future. It was easily, by far, the most valuable class.

Entering the field as an outsider, while possessing far more questions than answers, enabled Kahneman to accomplish much more than if he had been a self-assured insider. His weaknesses were his greatest strength.

Economists ... Good at Explaining After the Event

I will close this article with five direct quotes from Kahneman:

1) My main work has concerned judgment and decision making. But I never felt I was studying the stupidity of mankind in the third person. I always felt I was studying my own mistakes.

2) Many people now say they knew a financial crisis was coming, but they didn't really. After a crisis, we tell ourselves we understand why it happened and maintain the illusion that the world is understandable. In fact, we should accept the world is incomprehensible much of the time.

3) Economists have a mystique among social scientists because they know mathematics. They are quite good at explaining what has happened after it has happened, but rarely before.

4) Confidence is not a very good indicator of accuracy.

5) A reliable way of making people believe in falsehoods is frequent repetition because familiarity is not easily distinguished from truth.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)