There’s a silver lining to the recent painful three-day selloff in the stock market: Dozens of stocks dropped into undervalued territory and are now trading at sometimes-meaningful discounts to their Morningstar fair value estimates.

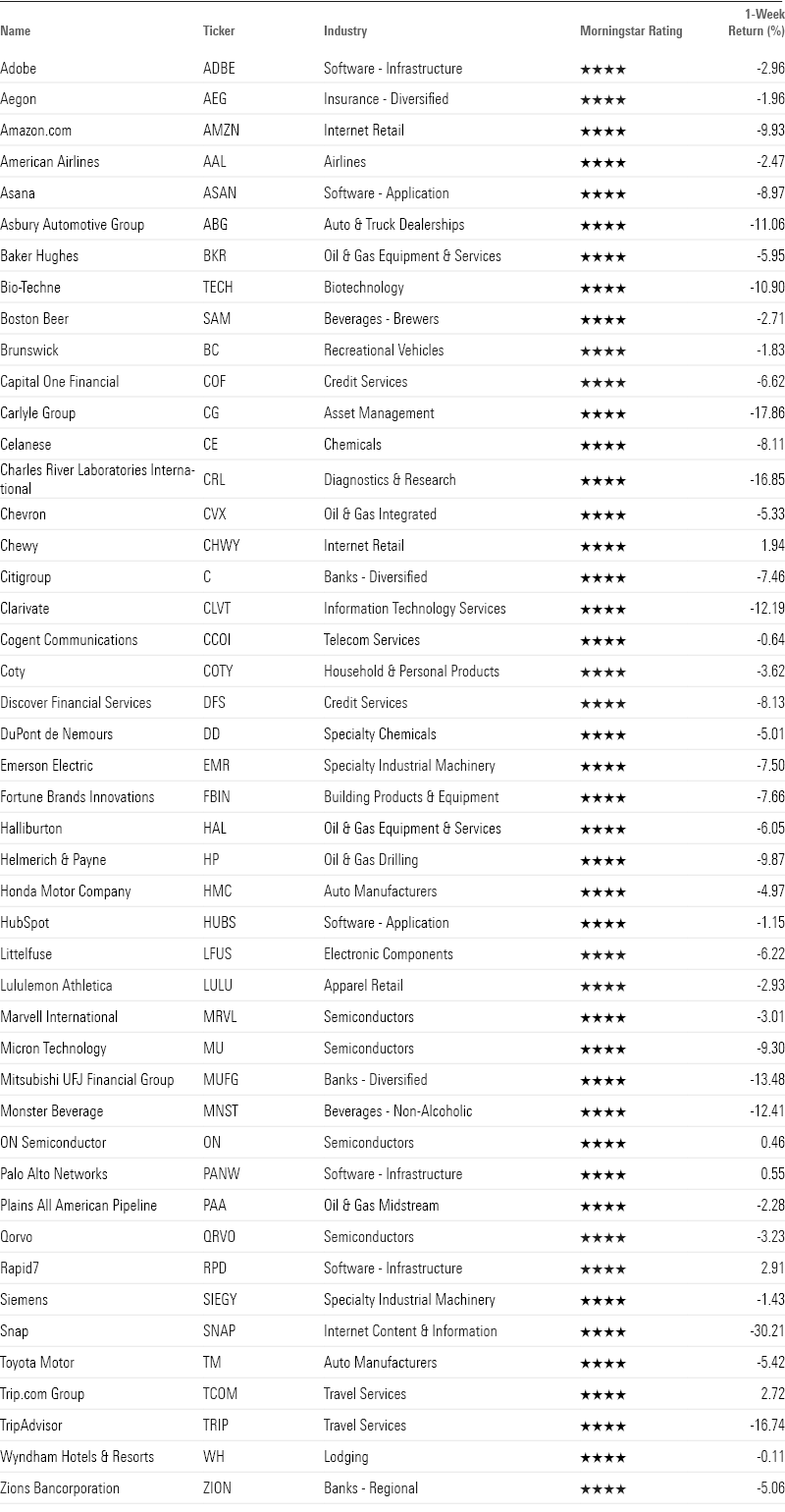

From Aug. 1 through Aug. 8, 46 stocks saw their Morningstar Ratings go from 3 to 4 stars. Stocks rated 4 or 5 stars are considered undervalued, those rated 3 stars are considered fairly valued, and those rated 1 or 2 stars are considered overvalued.

The 10 newly undervalued stocks with the largest market capitalization are:

- Amazon.com AMZN

- Chevron CVX

- Adobe ADBE

- Toyota Motor TM

- Siemens SIEGY

- Mitsubishi UFJ Financial Group MUFG

- Citigroup C

- Palo Alto Networks PANW

- Micron Technology MU

- Emerson Electric EMR

Another 11 stocks dropped from 4 stars to 5, meaning Morningstar analysts now view them as significantly undervalued:

- British American Tobacco BTI

- Diageo DEO

- STMicroelectronics STM

- Fresenius Medical Care FMS

- Wayfair W

- Western Union WU

- New Fortress Energy NFE

- Scor SCRYY

- Park Hotels and Resorts PK

- Evotec EVO

- Compass Minerals International CMP

Market Overview After the Selloff

The Morningstar US Market Index plummeted 6.28% in the first three days of trading in August. It has since made up some of the losses, leaving the overall US stock market roughly fairly valued, hovering at a 1% premium to its fair value estimate on a cap-weighted basis.

Of the 881 US-listed stocks covered by Morningstar analysts:

- 40% are undervalued, 42% are fairly valued, and 18% are overvalued

- 46 are undervalued after the selloff

- Four are now overvalued

- 11 moved from a 4-star rating to a 5-star rating

- One moved from a 5-star rating to a 4-star rating

- 14 are no longer undervalued

Of the 46 newly undervalued stocks, 11 came from the technology sector and 10 from consumer cyclicals. These two sectors were hit especially hard in the selloff; the Morningstar US Technology Index dropped 8.99% and the Morningstar US Consumer Cyclical Index fell 8.21%. Over the past month, tech stocks are down 10.76%, consumer cyclical stocks are down 6.83%, and the overall market is down 4.13%.

Metrics for the Largest Newly Undervalued Stocks

Amazon

- Morningstar Rating: 4 stars

- Return during selloff: -13.88%

Internet retail company Amazon is down 11.81% over the past three months and up 18.48% over the past year. Amidst the selloff, Amazon’s fair value estimate rose to $195 per share from $193 after reporting earnings on August 1. The stock trades at a 15% discount to its new fair value estimate, with a Medium Uncertainty Rating. The large-growth stock has a wide economic moat.

Chevron

- Morningstar Rating: 4 stars

- Return during selloff: -9.85%

Oil and gas firm Chevron has dropped 10.21% over the past three months and 5.75% over the past year. The stock is trading at an 18% discount to its fair value estimate of $176, with a High Uncertainty Rating. Chevron is a large-value company with a narrow economic moat.

Adobe

- Morningstar Rating: 4 stars

- Return during selloff: -7.67%

Software infrastructure firm Adobe is up 8.63% over the past three months and 1.85% over the past year. The stock’s price is 16% below its fair value estimate of $635, with a High Uncertainty Rating. The large-growth stock has a wide economic moat.

Toyota

- Morningstar Rating: 4 stars

- Return during selloff: -13.02%

Auto manufacturer Toyota has lost 26.93% over the past three months and gained 0.55% over the past year. After reporting earnings on Aug. 1, Toyota’s fair value estimate rose to $217 from $204. The no-moat stock trades at a 22% discount to its new fair value estimate, with a High Uncertainty Rating.

Siemens

- Morningstar Rating: 4 stars

- Return during selloff: -7.09%

Specialty industrial machinery firm Siemens is down 10.80% over the past three months and up 11.54% over the past year. The stock’s price is 12% below its fair value estimate of $99, with a Medium Uncertainty Rating. The large-core stock has a wide economic moat.

Metrics for the Largest Newly 5-Star Rated Stocks

British American Tobacco

- Morningstar Rating: 5 stars

- Return during selloff: -1.80%

British American Tobacco is up 21.83% over the past three months and 20.75% over the past year. British American Tobacco’s fair value estimate rose to $50 from $49 last week, after the company reported earnings on July 25. The stock trades at a 28% discount to its new fair value estimate, with a Medium Uncertainty Rating. The large-value stock has a wide economic moat.

Diageo

- Morningstar Rating: 5 stars

- Return during selloff: -3.79%

Alcoholic beverages company Diageo has dropped 12.82% over the past three months and 26.34% over the past year. The stock is trading at a 22% discount to its fair value estimate of $157, with a Low Uncertainty Rating. Diageo is a large-core company with a wide economic moat.

STMicroelectronics

- Morningstar Rating: 5 stars

- Return during selloff: -12.94%

Semiconductor company STMicroelectronics has lost 26.94% over the past three months and 39.63% over the past year. The large-core stock has a narrow economic moat. It’s trading at a 43% discount to its fair value estimate of $52, with a High Uncertainty Rating.

Fresenius Medical Care

- Morningstar Rating: 5 stars

- Return during selloff: -2.70%

Medical care facilities firm Fresenius Medical has dropped 9.17% over the past three months and 27.61% over the past year. The stock trades at a 43% discount to its fair value estimate of $32, with a High Uncertainty Rating. Fresenius Medical is a mid-value company with a narrow economic moat.

Wayfair

- Morningstar Rating: 5 stars

- Return during selloff: -18.46%

Internet retail company Wayfair is down 39.73% over the past three months and 49.72% over the past year. After reporting earnings on August 1, Wayfair’s fair value estimate was cut to $91.00 from $96.0. The stock trades at a 55% discount to its new fair value estimate, with a Very High Uncertainty Rating. The small-value stock has no economic moat.