Morningstar welcomes the opportunity to comment on the Ontario Capital Markets Modernization Taskforce’s consultation report dated July 9th, 2020.

Morningstar is a leading provider of independent investment research with a mission to create products that help investors reach their financial goals. Because we serve individual investors, professional financial advisors, and institutional clients, we benefit from a broad perspective on the proposal’s impact on the advice that investors receive. Through our partnerships and subsequent acquisitions of Fund Votes Research Ltd. and Sustainalytics Inc., we house appropriate expertise in the areas of proxy voting and ESG reporting.

Morningstar brings three different perspectives to the questions in the request for comment, including that of a:

- data aggregator with information on more than 50,000 equities worldwide,

- team of 100+ equity analysts globally who maintain qualitative ratings on 1500+ companies, and a

- public company and filer.

The consultation report is broad sweeping; Morningstar will comment only on areas where we have knowledge and expertise, numbered per the consultation report.

6. Streamlining the timing of disclosure, i.e., semi-annual reporting

To minimize regulatory burden, the Taskforce is considering changing the requirement for quarterly financial statements to allow for an option for issuers to file semi-annual reporting. What may be the concerns of such a proposal?

Robust quarterly disclosures in Canada are important for maintaining an efficient market and the high level of faith investors have in Canadian securities. A significant problem with earnings releases and quarterly filings today stem from earnings releases often coming out before filings and not containing critical pieces of information that analysts and investors need to assess a company’s fiscal health. Efforts to streamline the system should focus on these timing issues and on encouraging companies to report financial data in standardized, machine-readable formats such as XBRL and iXBRL.

In our view, while regular disclosures may encourage a certain amount of short-term thinking, they also provide important information on a company’s performance and financial health. Scaling back this information would hurt ordinary investors and impede analysts trying to understand a company’s financial condition throughout the year. At the same time, doing so could shake investors’ confidence in equity markets, particularly if reducing the cadence of disclosures leads to more cases of fraud or cases of industry insiders trading on that information. Although other jurisdictions have made moves toward requiring less frequent reporting, our experience is that it is more difficult for analysts and investors to understand how a company is doing in those jurisdictions, leading to worse investment decisions.

Further, moving to a six-month reporting cycle would not necessarily lessen the incentives for companies to focus on short-term profits. This would be particularly true for companies that continue to voluntarily report quarterly earnings and those that do not fall below a proposed size threshold who undoubtedly continue to be motivated to report positive short-term results. [SM1]

15. Expediting the SEDAR+ project

The Taskforce invites suggestions for further expansions or improvements in relation to SEDAR+ objectives.

Morningstar agrees with the task force that the expedition of the SEDAR+ project should be prioritized. We believe that the current system is seriously outdated. A modernized filing and reporting system would increase efficiencies in our markets. The proposed changes and enhancements to SEDAR seem to cover many of the sources of dissatisfaction of the current service including the outdated ‘directory’ of filings and the ability to quickly find a document in relation to a particular issuer.

Additionally, we believe that machine-readable filing formats should be mandated by the OSC and CSA. These formats make the analysis of financial statements far more efficient by enabling market participants to process vital information quickly and more accurately. The OSC’s direction in facilitating a more efficient flow of information would help market participants unlock new financial innovations currently bottlenecked by the manual splicing of .pdf documents. The adoption of structured data would help facilitate the organization, contextualization and analyses of financial data. At the time of this writing, a search on SEDAR over the last ten years showed that only 18 issuers posted using XBRL format, indicating that increased adoption of these modern file formats can benefit from further mandates from regulators.

Morningstar notes that in markets like the US, machine-readable tagging is being adopted rapidly. In Taiwan, all public companies have been required to adopt the Inline XBRL formats for financial reporting since the first quarter of 2019. Barring wide-spread adoption of machine-readable tagging standards like XBRL or iXBRL in Canada, a phased approach that allows for documents to be downloadable in a standardized plain text (.txt) format would still provide advantages to data processors over what is available via in .pdf format on SEDAR today.

Finally, Morningstar points out that unlike the US Securities and Exchange Commission’s filing system, SEDAR does not grant free access for parties that seek information that should be free and publicly available. Moreover, the SEC encourages third parties to download data to analyze information through an aggregated indexed file, and regular bundling into a compressed feed which results in (1) reduced bandwidth usage for those seeking information, (2) fewer hits on the provider website and (3) ensures market participants receive this public information simultaneously and without delay. In principle, we believe that SEDAR should also encourage the widespread dissemination of publicly available information in a similar manner and without cost to those seeking information.

17. Increase access to the shelf system for independent products

The Taskforce proposes that closed product shelves/proprietary-only shelves should not be allowed in the bank-owned distribution channel and recommends a new requirement that all bank-owned dealers include independent products on their shelves if requested by an independent product manufacturer unless the bank-owned dealer has determined, on a reasonable basis, that a particular product is not suitable for their clients.

In our view, allowing investors access to the best possible suite of investment solutions regardless of provider is prudent to financial success. Decades of academic and practitioner investment research clearly supports the prudence of a diverse set of asset exposure in the overall health and risk management of client portfolios. As a market dominated by bank-owned distribution networks, it is imperative that in Canada both investors and those advising them are given freedom of choice in this regard.

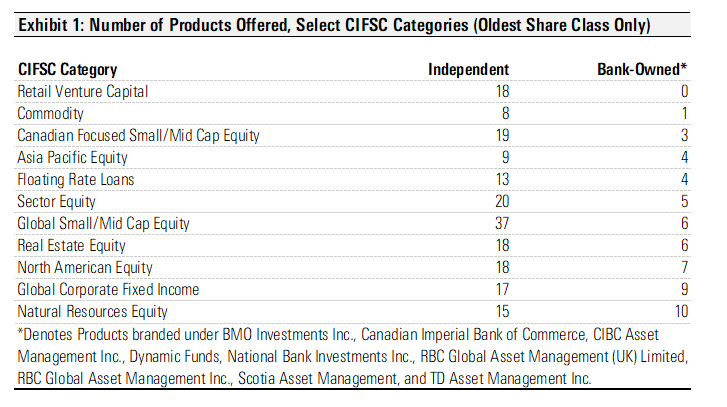

An argument in favour of the proposal is the lack of specific product types in the situation where only in-house funds are offered. The above table identifies CIFSC categories where there are fewer than 10 funds available through bank-owned asset managers (considering the oldest share class only). For example, six funds offer exposure to Global Small/Mid Cap equities from bank-owned asset managers, while there are 37 available from independent providers. Offering independent products in categories where few bank-owned funds exist would allow investors to gain exposure to asset classes through funds that may not be otherwise be presented as an option to the investor. Additionally, limiting investor choice to proprietary products stifles the flow of capital. To this end, we fully support the proposal to increase independent product shelf access.

Morningstar agrees that the requirement for a bank-owned dealer to report on why an independent product does not meet the requirements to exist on a product shelf would be a fair practice provided that part of this report includes an objective, independently verified reporting framework for evaluating a fund. Said objective framework might incorporate after fee risk-adjusted returns against a comparable share class of funds. Moreover, the risk metrics used should have a focus on downside risk in addition to traditional risk measures that consider both upside and downside risk equally. Through the CIFSC category system, it should be objectively shown that the independent product is truly inferior relative to a comparable share-class product offered through the bank if the product is to be denied shelf [SM3] space. This, in addition to a qualitative assessment by the platform owner on the funds’ adherence to clearly stated investment objectives, risk-control processes, and overall financial health of the fund company would be useful to be included in the report.

Should there be a review of redemptions from high performing third party funds into proprietary funds and report on those as well?

Regular publicly disclosed reporting of shelf composition from bank-owned distribution channels, inclusive of redemption of independent funds for inferior proprietary funds would be an effective way to monitor the effectiveness of this proposed rule change and help with sculpting future amendments if required.

Should there be a prohibition on charging a fee to gain access to a shelf, including no-advice channels?

Morningstar understands that there are technological and administrative costs associated with adding new funds (proprietary or independent) to a distribution platform. We do not agree that costs as a result of independent products being listed should be absorbed by the bank-owned distribution platform but rather should be considered the cost of doing business for the independent fund manufacturer. That said, having an explicit listing fee may lead to unintended consequences. We draw parallels between listing fees to the 12b-1 fee in the US which we’ve scrutinized for not living up to purpose which was originally to lower the cost to investors as the fund reached economies of scale. Unfortunately, providers and distribution platforms did not change these fees as assets grew, hence defeating its original purpose. From this perspective, we recognize the motivation of the Task Force’s proposal to ban fees.

Whatever the implementation path is, the costs will ultimately be borne by the retail investor. It is important that fees for in-house and independent products be displayed to retail investors on a comparable basis. Furthermore, investors would be served well if additional rules are in place to ensure advisors are not compensated differently for selling proprietary products over independent products on this comparable basis.

19. Improve corporate board diversity

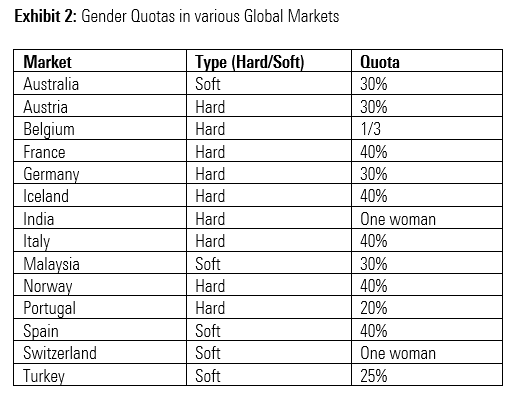

A growing number of legislative frameworks impose either hard or soft numerical gender quotas for corporate boards. Examples of markets are outlined in the below exhibit where “type” would indicate whether the quotas are accompanied by enforceable penalties (“hard”) or broad guidance (“soft”).

Some legislative frameworks take the alternate approach of requiring companies to establish goals for increasing board diversity and to report back on the implementation of these goals. Such markets include South Africa, Denmark and large EU financial services firms (that are subject to the relevant EU directives). For example, HSBC aspires to meet diversity targets recommended by the Hampton-Alexander Review and Parker Review of 33% female share of Board Directors by 20201. Typically, there are no penalties for failing to achieve these self-set targets.

At least one US state, namely California with its Bill SB 826, imposes fines for non-compliance with targets for board gender diversity.

Set targets and provide data on the representation of women, black people, indigenous people, and people of colour (BIPOC) on boards and in executive officer positions.

While board gender quotas are increasingly common from an international perspective, quotas on BIPOC (or equivalent) representation have not been widely deployed outside of North America.

Taking them in order, the suggested 40 percent women and 20 percent BIPOC board representation would likely present challenges in identifying sufficient suitable candidates, especially in markets where the lack of diversity at the board level is a reflection of wider structural inequalities i.e. a lack of women or BIPOC candidates at senior levels throughout the industry. Furthermore, hard targets may ignore the specific circumstances of location and industry.

We, therefore, suggest that the Taskforce recommend that companies set their own reasonable targets, disclose their progress towards these targets and, where applicable, explain why they have been unable to achieve targets. For gender representation, where targets are lower than 40% for either male or female representation, the company must explain specific reasons for this. For BIPOC representation, we encourage the Taskforce to provide more concrete guidance on diversity with reference to the groups identified under the Canada Business Corporations Act (CBCA) and the grounds for establishing discrimination under the Ontario Human Rights Code.

A written policy for identifying women and BIPOC candidates in the director nomination process.

We support improved diversity disclosure, not only with respect to board and senior management composition but also with respect to intentional approaches for improving board and senior management diversity. Existing disclosure requirements for written policies describing the process for identification and nomination of women candidates should be extended to cover BIPOC candidates.

Timeline and compliance for implementation of diversity targets.

With regard to what constitutes appropriate targets, the timeline for achieving these and measures to promote compliance, there is no standard approach. However, we consider up to five years to be a reasonable time period over which to expect companies to meet their own realistic targets for board diversity and would allow boards sufficient time to factor the changes into their succession planning.

With regard to mechanisms to enhance compliance, we take the view that active shareholders that recognize the importance and benefits of a diverse board is an effective mechanism for change.

However, we acknowledge strong empirical evidence that countries with hardboard gender representation quotas have a higher number of female board directors.

We, therefore, recommend that the issue of board diversity quotas, and their enforcement approach, be revisited by a subsequent review in light of progress made up to that point.

Director tenure and board renewal.

With regard to director tenure limits, there are a variety of market practices including maximum tenures for independent directors and specific requirements regarding independence. Note, however, that actual tenure caps are relatively rare, with most jurisdictions opting to simply reclassify long-tenured directors as non-independent. Some examples are set out in the table below. Note that, in some markets, the board or nominating committee may choose to classify a director as independent despite having exceeded the relevant tenure limit.

Within this context, a 10-year maximum tenure limit for directors, with an allowance that 10 percent of the board can exceed the 10-year maximum for up to two years appears to be in line with good market practice. However, to leave boards with some degree of flexibility in applying this limit, we recommend that, where a director’s tenure exceeds 10 years, the director is considered non-independent. Should the board disagree, it is required to provide an explanation.

As a final thought, we would remind the Taskforce of why companies should consider diversity. In our view it is to promote a variety of opinions thereby supporting robust and wide-ranging discussions, thus reducing the risk of ‘group think’ and improving the probability of the directors fulfilling their collective responsibilities to the shareholder. Whilst a balance of genders and ethnicities may promote diversity, they do not necessarily promote diversity of opinion, for example, if the directors all have similar backgrounds in terms of education and profession. In short, it is important to note that meeting diversity targets does not necessarily mean diversity is achieved and that the best interests of the shareholder are served. Boards should be encouraged to explain how the diversity of opinion is achieved and any strategies that are undertaken for identifying candidates beyond the traditional pool of candidates.

20. Introduce a regulatory framework for proxy advisory firms (PAFs) to provide issuers with a right to “rebut” PAF reports

The right of rebuttal is unnecessary

No evidence supports the need for an issuer right of rebuttal. While issuers may regularly disagree with a recommended vote against management, factual and analytical errors in PAF reports have been found to be extremely low, and there is no evidence that errors, where they have been found, are instrumental in swaying investors’ votes as investors often consider multiple inputs to voting a proxy ballot.

PAFs already provide issuers with an opportunity to provide feedback on reports. As an additional service, Glass Lewis now offers a Report Feedback Statement service to all issuers and shareholder proponents, allowing for the inclusion of unedited comments on PAF voting advice within 7 days of the publication of the report and notification of clients of the inclusion of new comments, where applicable.

No right of rebuttal rule exists in other jurisdictions. Even the SEC’s highly contested new rules for offering proxy voting advice in the U.S. market don’t go so far as to require issuer review prior to release of reports to clients and inclusion of management’s rebuttal in the report itself.

The right of rebuttal could create additional problems for investors

Extending the right of rebuttal before reports go out to clients would delay their release. As it is, investors are voting proxies on a very tight timeline between the filing of proxy circulars and when investors get information and advice from PAFs. At the height of the proxy season, this could be detrimental to investors being able to cast informed votes.

Proposed rules could have anticompetitive effects by raising the costs of producing reports and the complexity of communications with issuers and clients. The market for proxy advisory services is already highly concentrated. Any rule that imposes additional costs and complexity will create barriers to new entrants and likely make it more difficult for smaller providers to compete.

Furthermore, the additional costs of proxy advice will ultimately be borne by purchasers of services and passed on to pension fund beneficiaries and fund investors in the form of higher fees. Monitoring and enforcement will add a layer of bureaucracy to market oversight and the costs will be borne by taxpayers.

We view additional competition in the market for proxy advisory services to be the strongest assurance of good quality research. This proposal would have the opposite effect in aiming to solve a problem that purchasers of PAF reports do not perceive.

22. Adopt quarterly filing requirements for institutional investors of Canadian companies

We agree with the proposal for quarterly disclosure of holdings for institutions. As it relates to proxy voting, we concur that this added layer of transparency would benefit issuers and increase their ability to address shareholder issues.

Would the proposal provide useful information to issuers and other market participants?

As an aggregator of fund holdings information for the majority of retail open-ended products in Canada, Morningstar holds a unique insight to this proposed requirement. Though our existing holdings database provides us with a competitive advantage as a research firm, as an advocate for investors we believe that holdings transparency would be a benefit to investors regardless of whether received through Morningstar, another data aggregator, or through a company’s filings. Although no such filing exists today in Canada, it is noted that several large asset managers and institutions provide 13-F filings to the SEC at present. Having a similar filing in place for Canada would add transparency to the market from the investors’ perspective and allow data aggregators like Morningstar and others to use the information and further derive valuable insights for an issuer.

23. Require TSX-listed issuers to have an annual advisory shareholders’ vote on the board’s approach to executive compensation

We support the Taskforce’s proposal to adopt mandatory annual advisory votes on executive compensation, also known as ‘say-on-pay’, for all TSX-listed companies.

Say on Pay gives investors a stronger voice on corporate governance

Canadian investors have been advocating for a say on pay vote for a number of years via engagements and shareholder resolutions. In the absence of a mandatory requirement, up to 70% of TSX composite companies now extend a say on pay vote to their shareholders. However, voluntary adoption has stalled in recent years.

Investors advocating for say-on-pay have repeatedly emphasized that, as a non-binding measure, it is not onerous on issuers to extend this voting right, yet it gives investors a stronger voice on corporate governance.

Rules applying to all TSX companies would harmonize with recent amendments to the CBCA requiring mandatory say on pay votes for companies incorporated under the Act.

Say-on-pay is now seen as an important voting right for shareholders in most developed markets since first mandated in the UK in 2002. The 2008-2009 Financial crisis was blamed at least in part on excessive risk-taking resulting from poor pay practices. Say-on-pay was mandated under the Dodd-Frank Wall Street Reform and Consumer Protection Act, 2010, as a way of giving shareholders a stronger voice in senior executive pay practices.

Say on Pay Provides Valuable Feedback to Boards

Morningstar data on say-on-pay vote outcomes at US companies shows that only around 40-70 of nearly 3,000 say on pay votes held each year fail to achieve majority support. The lowest decile achieved the support of no more than 75% of shares voted in 2020, with the overall average vote outcome across all US companies at around 90% support.

Given the wides pread in say-on-pay vote outcomes, this signal conveys important information about investor sentiment on pay practices and has resulted in a sharp decline in shareholder resolutions on executive pay practices since the early 2000s.

While offering a general signal of shareholder sentiment on pay practices and, by extension, the quality of board oversight of incentive senior executive incentive structures, say-on-pay vote outcomes are also responsive to specific practices, such as large payouts to departing or new CEOs and excessive executive pension payments.

Investors have used say-on-pay votes to express dissatisfaction where there is a disconnect between company performance and amounts paid to executives. For example, CVS Health’s say-on-pay resolution earned only 24% support from shareholders in May 2020 as the company faces ongoing opioid litigation and the CEO, Larry J. Merlo, earned more than $36m in 2019.

Finally, the right to cast an advisory vote on executive pay practices encourages companies to put in place proactive engagement strategies in order to avoid strong investor dissent.

Say on Pay Advances Greater Transparency Around Pay Practices

Informed voting on executive compensation practices requires additional transparency on senior executive performance metrics and goals. Say on pay has driven more transparency around pay practices in US company proxies over the past 10 years.

Linking executive pay to sustainability metrics is increasingly viewed as good governance practice (shareholder resolutions, pharmaceutical companies and opioid crisis). Investors can use say-on-pay votes to put pressure on boards to adopt pay practices that align with ESG risks and opportunities.

Greater investor scrutiny of pay practices can be expected as a consequence of the differential impacts of the COVID pandemic on the earnings of ordinary workers compared with senior executives, particularly where pay practices have shifted to stock-based compensation.

We strongly support adopting an annual, advisory (non-binding), retrospective vote on executive pay practices for all TSX-listed companies.

24. Empower the OSC to provide its views to an issuer with respect to the exclusion by an issuer of shareholder proposals in the issuer’s proxy materials (no-action letter)

We oppose empowering the OSC to offer views on the excludability of shareholder resolutions from issuer’s proxy materials for the following reasons:

1. While this is the approach taken in the U.S. under the SEC’s regulatory oversight of the proxy process, there are ways in which the proxy process functions differently in Canada with respect to shareholder resolutions.

2. There is no evidence to support the reasons stated in the consultation report: a no-action letter petition process would add complexity, costs and delays in place of a system that presently results in few if any immaterial proposals and disputes.

The rules around shareholder proposal eligibility under the CBCA, the Business Corporations Act (Ontario) and the Bank Act are similar to those that presently apply under SEC Rule 14a-8 (as at the time of this writing). However, Canada has a smaller securities market to that of the U.S., with different norms and practices around engagement making a no-action process seem like overkill.

Each year, more than 1,000 shareholder resolutions are filed at U.S. companies and around 500 appear on corporate proxy ballots. In 2020, the SEC adjudicated at least 230 no action appeals made by issuers. Forty-two were subsequently withdrawn. One hundred and thirty-two of the remainder, or 69%, resulted in a decision favourable to the issuer. In Canada, by contrast, around 75 shareholder resolutions are filed at Canadian companies each year and around 30 come to vote. The majority of the others are withdrawn following some level of engagement between issuer and proponent or an agreement on the part of the issuer to accept part, or all, of the recommendations contained in the shareholder resolution. This can be taken as evidence of a far less confrontational approach to investor engagement than that which prevails in the U.S.

In addition, we observe in recent years that the SEC no-action letter process has become increasingly politicized. Many are concerned that the SEC’s own judgements have been inconsistent and have become somewhat more restrictive on issues such as climate risk disclosure, reflecting a broader political conservativism. We believe this is dangerous for the well-functioning of the securities market. The SEC has proposed, and may soon promulgate, amendments to shareholder resolution filing rules that would make it more difficult for shareholders to put forward ballot initiatives. These stricter rules would effectively be enforced via the no-action letter process. We have registered our strong opposition to these proposed amendments.

The reasons offered in the Taskforce’s Consultation Report are that a no-action process would:

- provide an efficient means of addressing shareholder proposal disputes while reducing litigation in court and

- allow for greater streamlining of the shareholder proposal process and screening of immaterial proposals.

Introducing a no-action process entails an additional administrative layer in the proxy process, with a cost burden and a predictable delay in the engagement process that typically follows resolution filing. Some U.S. issuers routinely appeal for a no-action judgement following the receipt of a shareholder resolution. If this were the result of a similar process in Canada, constructive engagement in the shadow of a shareholder vote would likely be delayed pending no-action appeals, limiting what could be achieved via investor-issuer dialogue.

Furthermore, in the U.S., this layer of adjudication frequently involves supporting letters from lawyers for both the issuer and the filer, thereby increasing the legal costs all around. We are not aware of any recent cases where shareholders have needed to appeal to the courts to settle a dispute over inclusion of a shareholder proposal in an issuer’s proxy materials in Canada.

Finally, we note that shareholder proposal eligibility is governed by corporate law in Canada. Apart from small differences, the rules around shareholder resolution filing are consistent across provincial and federal statutes, including the Bank Act. It is not clear that any changes to Ontario’s Securities Act to enshrine a no-action letter process would supersede existing corporate law statutes. And any changes to the Business Corporations Act (Ontario) would apply only to a handful of shareholder proposals each year.

We recommend that this issue is revisited in future reviews but that there is no evidence to support the need for a new OSC-administered no-action process in the Canadian securities market at this point in time.

25. Require enhanced disclosure of material environmental, social and governance (ESG) information, including forward-looking information, for TSX issuers

What specific material ESG information is needed beyond what is currently captured by existing disclosure requirements?

As evidence of this rapid growth, the Responsible Investment Association Canada noted in its most recent Trends Report that assets in Canada being managed using one or more responsible investing strategies increased from $1.5 trillion at the end of 2015 to $2.1 trillion as of December 31, 2017. This growth represents a 41.6 percent increase in responsible investing assets over a two-year period. Clearly, this growth serves as a solid proof point that more Canadian investors than ever are leveraging ESG information as a part of their investment decision-making processes. Yet, while demand for high-quality ESG information continues to increase, our collective experience highlights that corporate disclosure practices remain inconsistent and incomplete.

We could provide many examples of material ESG issues for which there is widespread inadequate corporate disclosure, but we will limit our response to four:

- Of the 71 Canadian oil and gas and mining companies that Sustainalytics covers, over 50 percent of these companies have either weak disclosures or weak performance related to risk management programs to measure and address the regulatory, market and reputational risks posed by climate change.

- Nearly 80% of the 41 Canadian mining companies we cover have none or limited disclosures or weak programs related to risk management of the physical risks posed by climate change, which includes extreme weather conditions such as floods.

- Roughly 52 percent and 60 percent of mining and oil and gas companies, respectively, have none or limited disclosures on community involvement programs in areas potentially affected by their operations.

- 83% of the 65 Canadian oil and gas and mining companies we cover have limited disclosures on policies regarding indigenous people and land rights.

As the examples above demonstrate, company disclosures on ESG issues are disparate and insufficient. This, in turn, can hinder investors from making well-informed investment decisions on the risks facing their portfolio companies.

Morningstar and Sustainalytics believe that corporate reporting and disclosure will continue to be incomplete and inconsistent until there is a regulatory requirement to enhance ESG disclosures. The market would benefit from having an ESG reporting and disclosure structure in place that adheres to the same principles as applied to financial accounting, e.g. IFRS oversight. With clearer oversight measures in place, companies could provide more relevant and comparable data to capital market participants. Market trends are likely to drive further growth in sustainable investing, and as such more investors will need comprehensive, high-quality ESG information. This demand necessitates that corporations provide more meaningful enhanced disclosures on ESG information to strengthen our capital markets in Canada.

Should there be a phased approach to implementation, including a comply-or-explain model?While we have a strong perspective on what ESG issues are material for companies, it is not a simple answer as every (sub)industry is exposed to different ESG issues. A such, we find it difficult to generalize. That said, we would be happy to participate in a subsequent consultation on what information should be included under regulatory requirements. In terms of implementation, we have seen successful rollouts of similar disclosure requirements in other markets that have taken a phased approach. Companies will need and should be given time to comply with any new requirements. That said, there is an urgency to meaningfully improve ESG disclosure practices as soon as is possible.

Fund Companies

Though the Taskforce has focused its proposal on TSX-listed issuers, we encourage the OSC to also formalize reporting requirements for fund companies as the growth of sustainable investments continues to accelerate in Canada. As most Canadian retail investors invest through mutual funds, having standardized reporting requirements outside of descriptors within the prospectus documents would greatly aide investors in making the appropriate choices, and reduce the effects of greenwashing. By our calculations, the size of the retail sustainable investment universe in Canada is roughly CAD 8.8 billion at the end of Q2 2020, 13 percent larger than it was at the end of 2019. Though still just a small fraction of the market, the growth rate of assets invested through sustainable investments justifies the attention paid to reporting requirements. To this end, we refer the OSC to our comment letter to the Joint Committee of the European Supervisory Authorities (ESAs) dated September 1st, 2020 in reference to Joint Consultation Paper JC 2020 16 ESG Disclosures.

As a voting member of the CIFSC, Morningstar is involved in the development of a Canada-wide identification for sustainable funds. Through roundtable discussions and analysis of data, we’ve observed that the lack of a standardized reporting structure for sustainable or responsible funds is a hindrance to the identification of said funds. Fund providers each have a unique process which can be difficult to ascertain strictly through prospectus language. Though an objective third-party assessment of a fund’s holdings can add some much-needed transparency, additional disclosures like those proposed by the ESAs would provide a far greater level of detail and will ultimately allow investors to make more thoughtful choices. Morningstar would welcome the opportunity to collaborate further with regulators around this topic.

Note: Aron Szapiro, Director of Policy Research for Morningstar, Jackie Cook, Director of Manager Research, Investor Stewardship and Proxy Voting Research at Morningstar Research Services, Christine Ha Kong, Senior Associate, Technology Media & Telecommunications Research at Morningstar Sustainalytics, Martin Wennerström, Associate Analyst, Corporate Governance at Morningstar Sustainalytics, Simon McMahon, Executive Vice President of Research Products at Morningstar Sustainalytics and Henry Hofman, Associate Director of Corporate Governance at Morningstar Sustainalytics also contributed to this letter