In yet another turn of events in the Rogers family (and company) drama, Edward Rogers called a meeting of the board of directors of Rogers Communications on Sunday and announced that he was Chair of the board.

This comes after he was removed as the chair late last week. However, he remained chair of the Rogers Control Trust, which is the controlling shareholder of Rogers Communication. Rogers Control Trust (along with the Rogers Family) owns 97% of the voting shares of the company.

Edward Rogers claimed that his position as the chairman of the Rogers Control Trust gives him the right to change directors – which he did at the Sunday meeting, where he replaced five independent directors. This new board then announced that Edward Rogers was chair.

In an issued statement, the board “…expressed disappointment that some within the Company have resisted recognizing the change of Directors that took effect on Friday morning in accordance with section 180 of the Business Corporations Act (British Columbia) and the articles of RCI.”

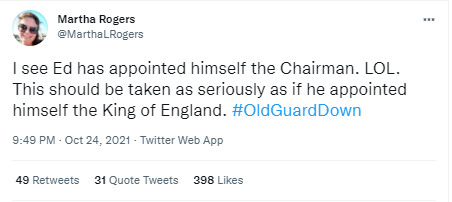

Edward Rogers also announced an intention to initiate proceedings in the British Columbia Supreme Court to confirm and implement the Shareholder Resolution, naming him chair. His family, including his sister Martha Rogers, is unimpressed. Late last night, Martha Rogers tweeted:

In another statement, members of the Rogers family, including Edward Rogers’ mother Loretta Rogers and two sisters Martha Rogers and Melinda Rogers-Hixon, said, “We unequivocally support Joe Natale as CEO and support his management team. We along with the Management continue to work tirelessly on behalf of all stakeholders including customers, employees, and shareholders. We remain as duly elected members of the Rogers Communications Inc. Board and represent the majority of the Board members of the company. No other group of individuals has any authority to purport to act as the Board of Directors of Rogers Communications.”

Martha Rogers continued to tweet, saying, among other things, that she would fight for the company’s employees and customers.

What Our Analyst Thinks

Morningstar Analyst Matthew Dolgin thinks things are not as bad as they seem.

In an updated analyst note, Dolgin noted that his view has been that this situation is an ordinary, if extreme, occurrence of board disagreement that was resolved as shareholders would have hoped: with each director taking the position that he or she feels is in the best interest of the company and letting the majority rule.

“We still adhere to that thought, but it’s not so simple or clear. Ed Rogers seems determined to continue fighting, and because he is chairman of the trust that controls the family’s shares (and votes), this is not over. Two items are key: it seems both sides want to complete the Shaw merger, so that should not be in doubt as long as it gets regulatory approval; and with both sides believing they are legally correct, a resolution in the courts could take months at least,” he noted.

He awards Rogers a narrow economic moat stemming from efficient scale and cost advantages in its wireless and wireline businesses, which accounted for 61% and 28% of total sales in 2020, respectively. On October 21st, he raised his fair value estimate to $68 per share implying a price/earnings multiple of 18 and enterprise value/EBITDA multiple of 9 based on his 2021 estimates.

“Ed Rogers is chairman of the family trust and exerts significant control over it… Deviating from best corporate governance practices has allowed a public, messy fight that may result in the company moving in a direction that the majority of board members and shareholders voted against,” Dolgin said.

According to local media reports, RBC Dominion Securities analyst Drew McReynolds lowered his recommendation for the company’s shares to “sector perform” from “outperform,” looking for “more timely and/or attractive entry points, saying, “In our view, functioning governance and family-Board-executive alignment absolutely do matter at this juncture for Rogers with respect to creating value for shareholders from current levels– not just in executing on day-to-day operations but on critical upcoming decisions with respect to proposed remedies on the Shaw transaction, transaction financing, crystallization of any non-telecom assets, a multi-year integration, and key 5G spectrum auctions.”