Back to Earth

Each January, I write about a company that reflects the stock market’s zeitgeist. Two years ago, the firm was GameStop GME, meme stocks then being the rage. Last year’s topic was Digital World Acquisition Corp. DWAC, which was flying high thanks to its arranged marriage with Donald Trump’s new business venture, Trump Media. (As in a Julia Roberts film, that ceremony has since been twice postponed.)

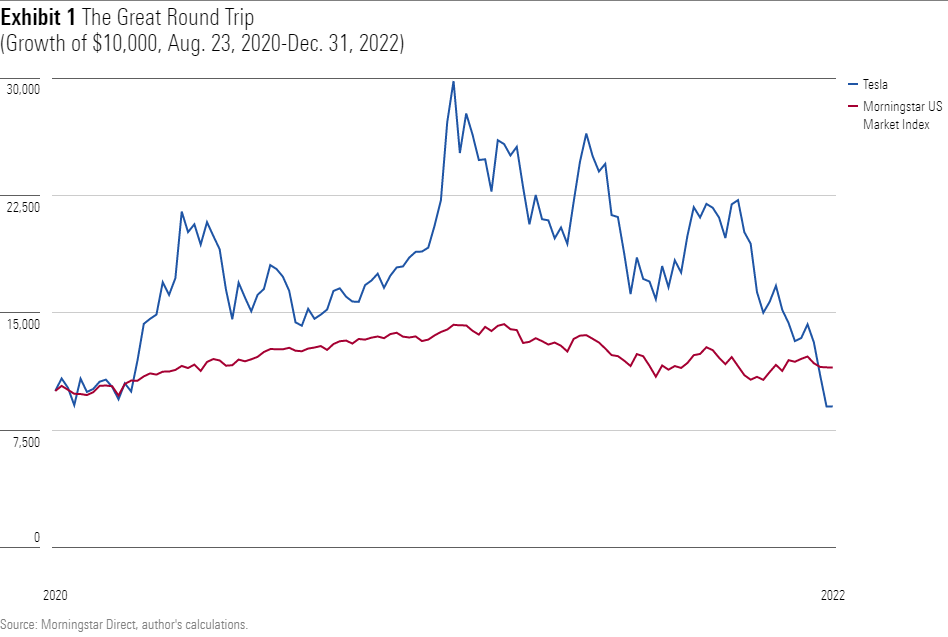

This year’s selection is, of course, Tesla TSLA. The company was not only among 2022′s two biggest stock market stories (along with Twitter, which is no longer publicly available), but it also neatly symbolizes the rise and fall of the previous bull market. In summer 2020 Tesla looked unbeatable—which, as shown by the following chart, it was over the next 12 months. During that time, Tesla’s stock price tripled.

Then pfft. Tesla retreated so sharply that it now trails the Morningstar US Market Index over the past 16 months. What’s more, the stock now trades below its August 2020 close.

Business Fundamentals

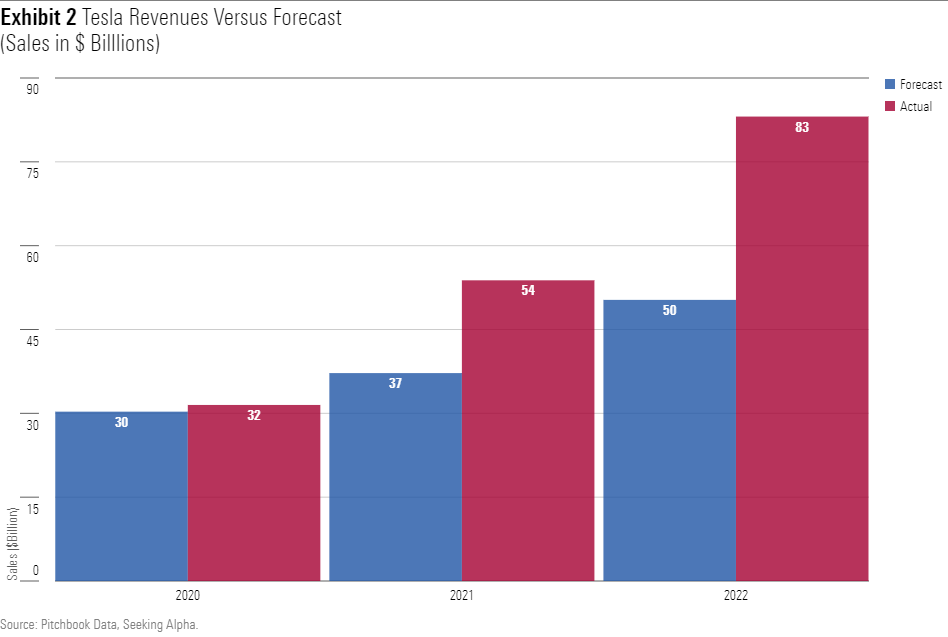

The logical explanation for Tesla’s stock market troubles is that its operations have disappointed. Not so. While it is difficult to find historic Wall Street predictions for Tesla’s revenue, I did locate this January 2020 analysis. Because the report’s authors recommended Tesla’s stock, we can safely assume that their sales forecast was not unduly pessimistic. More likely, it was relatively optimistic.

And boy was it wrong! Tesla has since eclipsed the authors’ fondest hopes. After accurately predicting 2020′s revenue—admittedly, not a terribly challenging task, as the fiscal year had already begun by the time that article was published—the report understated Tesla’s 2021 sales growth by more than 200% (!). They expected the company to increase its revenue by US$7 billion; however, the actual amount was US$22 billion. Their undercount deepened in 2020.

To put the matter another way, those relatively bullish analysts estimated that in the seven years from 2020 to 2028, Tesla’s revenue would grow from US$30 billion to US$80 billion. In fact, the company’s sales will have already surpassed the US$80 billion mark when its fourth-quarter 2022 financials are released. Looking out further, the current Wall Street estimate for Tesla’s 2025 revenue is $195 billion. Clearly, Tesla has fared far better over the past three years than most observers anticipated.

True, some of this positive fundamental news had already affected Tesla’s stock price by August 2020, when this column’s initial chart began. But not all future reports had been anticipated. By and large, the company has continued to exceed expectations, both for sales and profits. Yet its stock price has languished.

The Problems

Perhaps the biggest trouble has been the overall performance of glamour stocks. In 2022, the Morningstar US Growth Stock Index lost 36.7%. Given that Tesla was not just a growth stock, but rather the growth stock, carrying steep price multiples even by that group’s inflated standards, it might have been expected to decline by a greater amount, say 50%. However, Tesla fell another 30% further than that, suggesting that its shares were afflicted by more than merely a general malady.

Another issue has been business hiccups. The company’s fourth-quarter 2020 sales trailed Wall Street expectations; its decision to offer sales discounts sparked worries that customer demand was slowing; and it suffers from production and logistical glitches. All legitimate fears—but also all par for Tesla’s particular course. In 2015 Tesla faced concerns, and in 2016, and in 2017, and in 2018, and in 2019, and in 2020. (The news does seem to have been steadily positive in 2021!) With Tesla, the wolf has often been sighted, but it has yet to appear.

The bigger effect, it seems, has been the public’s re-evaluation of Elon Musk’s value. When I wrote about Tesla in September 2020, I received several emails chiding me for discussing only the company’s current offerings, thereby ignoring its future business lines. (This article provides a flavor of those arguments.) At that time, Tesla’s stock price included a large “Musk premium.” If Tesla’s CEO could not turn water into wine, he could make box wine taste bottled.

That mystique, obviously, has largely disappeared. Over the past year, Musk has shown considerably more interest in battling perceived enemies than in creating new business opportunities. This places Tesla where it should always have been—a company that trades largely on its tangible business prospects, rather than on the dreams of what its CEO might eventually accomplish.

Summary

Unlike its previous two January installments, this column is guardedly optimistic. Whereas GameStop’s January 2021 gains exemplified retail investors’ greed, and DWAC’s surge demonstrated their gullibility, Tesla’s share-price losses seem both useful and rational. Since Tesla’s stock began its 16-month round trip, the company’s quarterly revenue have more than doubled. Meanwhile, its share price has slightly declined. That makes for two steps in the right direction.

Whether that makes Tesla a bargain is less clear. The company is still much more expensive than other automobile manufacturers, enjoying twice the stock market capitalization of its closest rival, Toyota TM. Then again, its revenue growth rate has been, and will be for the foreseeable future, far above that of its rivals. Whether the one justifies the other is open for debate. Unlike during Tesla’s headiest days, though, there is at least a debate.

The same may be said about prospects for the overall stock market. Whether equities are poised to rebound depends on the economic news; either higher rates or a sharp recession would likely cause further damage. But at least the marketplace’s excesses have largely been purged. Tesla’s plight bears witness to that.