Key Takeaways From Our Third-Quarter Stock Market Outlook

- U.S. stock market is trading at a 5% discount to composite of our fair value estimates.

- It’s time to move to underweight in the growth-stock category, especially the technology sector.

- The stock market rally is unusually concentrated: Only seven stocks account for approximately three-quarters of this year’s gains.

- Federal Reserve rate increases are coming to an end, but rate cuts won’t start until next year.

From its October lows, the U.S. stock market has risen 22% through June 26, breaching the technical indicator of a bull market.

Many market commentators are saying this rally marks the start of a new bull market and investors should jump into equities to ride this wave. But others argue it’s a bull trap in an ongoing bear market and investors should get out of stocks while the getting is good.

As detailed in our third-quarter Stock Market Outlook, the question for investors isn’t whether to raise the sails and ride the tailwind of a new bull market, or to batten down the hatches in preparation for a near-term squall, but rather how to best position their portfolios based on today’s valuations.

In the wake of the first half’s rally, we are seeing several opportunities for investors to reallocate their portfolios to take profits where the market has overextended itself and reinvest those gains in undervalued areas that have been left behind.

Third Quarter 2023 U.S. Stock Market Outlook

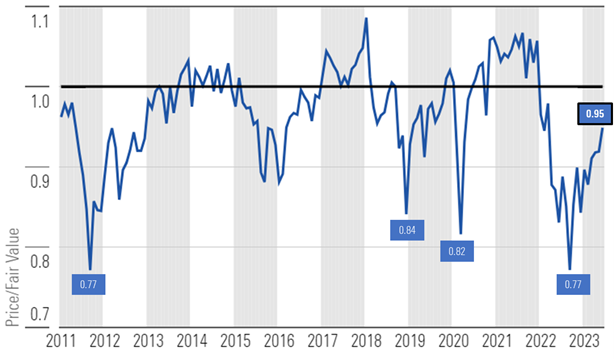

In October 2022, the market was trading at a 23% discount to a composite of our intrinsic stock valuations. Since 2010, such a discount has only occurred one other time, in 2011.

According to a composite of the more than 700 stocks we cover that trade on U.S. exchanges, as of June 26, 2023, the U.S. equity market was trading at a price/fair value ratio of 0.95, representing a 5% discount to our fair value estimates.

Growth stocks as measured by the Morningstar US Growth Index have risen 23.4% this year through June 26, outperforming the 13.2% increase in the Morningstar US Market Index. As such, the growth category is now trading near fair value, whereas it was the most undervalued category at the beginning of the year. At this point, on a relative value basis, investors would be best positioned by overweighting value stocks and underweighting core and growth stocks, both of which are trading near fair value.

Large-cap stocks have also outperformed this year, with the Morningstar Large Cap Index rising 16.0%, and are now trading slightly closer to fair value than the broader market. Mid-cap and small-cap stocks both remain at much greater discounts to fair value.

Looking ahead, we forecast that the rate of economic growth will slow sequentially in the third and fourth quarters, then bottom out in the first quarter of 2024. While we continue to view the broad market as undervalued, between slowing economic growth, tight monetary policy, and reduced credit availability, we suspect the rate of market gains will be limited over the next few quarters.

Morningstar Equity Research Price to Fair Value by Style Box

Stocks Remain Undervalued but With Less Margin of Safety

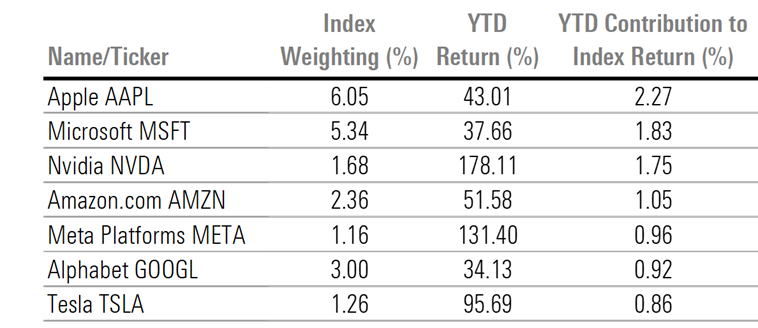

The U.S. stock market continued its march higher in the second quarter, as stronger-than-expected economic growth and excitement regarding the long-term potential for artificial intelligence to spur earnings growth lifted market sentiment. This year’s market rally has been unusually concentrated, as an attribution analysis reveals that the returns on only seven companies are responsible for approximately three-quarters of the overall gains.

For the rally to continue in the second half of this year, it will need to spread out into the value category as well as mid-cap and small-cap stocks. The U.S. stock market continues to trade at a discount to our fair valuations, but now at a much smaller margin of safety.

Historical Morningstar US Equity Research Coverage Price to Fair Value

Magnificent Seven Responsible for Almost Three-Quarters of Market Gains

According to an attribution analysis of the Morningstar US Market Index, the returns from only seven stocks account for almost three-quarters of the total market return thus far this year.

The excitement surrounding artificial intelligence—specifically natural language processing tools such as ChatGPT—drove the stocks of any companies that may stand to benefit from the future implementation of this technology significantly higher.

Magnificent Seven Responsible for Almost Three-Quarters of Market Gains

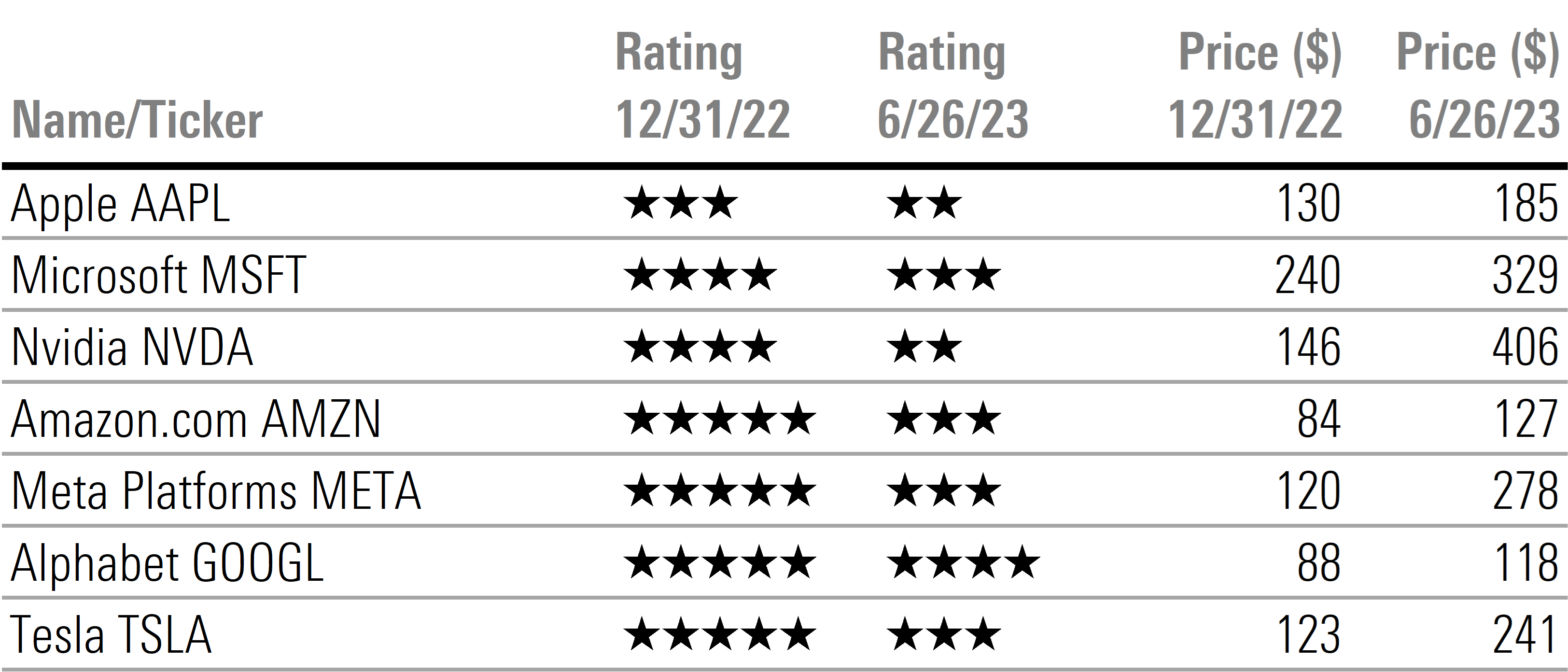

From a valuation standpoint, it appears the main driver of the 2023 rally has run out of steam. While six of these seven stocks were rated either 4 or 5 stars at the beginning of the year, only one remains at 4 stars, while four are now rated 3 stars and two are rated 2 stars.

Star Rating and Price Changes for Magnificent Seven Through June 26

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/22DGCGOHMJC7HHQIF2CERYV4JM.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KEGKFRO24VF67PWV7V2ADNG37U.png)